Question: Please provide clear and detailed steps without using a scientific calculator (5-25) Maturity Risk Premiums: Assume that the real risk free rate, r*, is 3

Please provide clear and detailed steps without using a scientific calculator

Please provide clear and detailed steps without using a scientific calculator

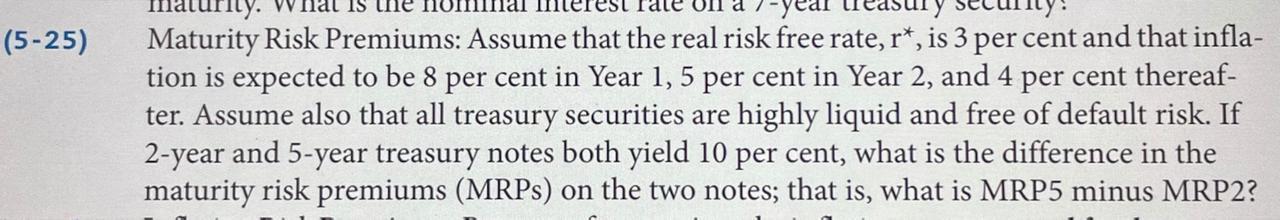

(5-25) Maturity Risk Premiums: Assume that the real risk free rate, r*, is 3 per cent and that infla- tion is expected to be 8 per cent in Year 1, 5 per cent in Year 2, and 4 per cent thereaf- ter. Assume also that all treasury securities are highly liquid and free of default risk. If 2-year and 5-year treasury notes both yield 10 per cent, what is the difference in the maturity risk premiums (MRPs) on the two notes; that is, what is MRP5 minus MRP2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts