Question: Please provide compelte solution, show full calculations, explanations and proofs to the following question: 4. The Capital Asset Pricing Model (CAPM): The CAPN may be

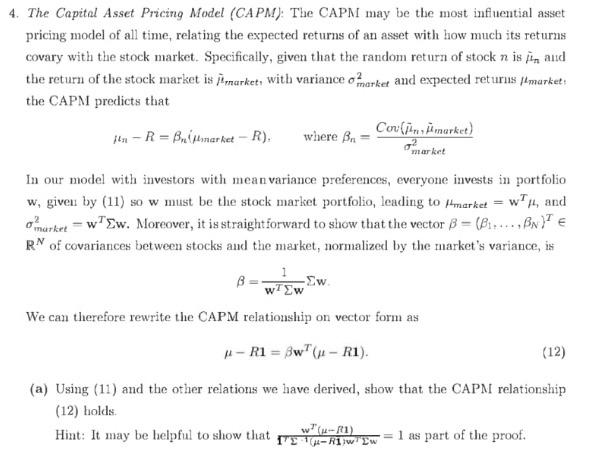

4. The Capital Asset Pricing Model (CAPM): The CAPN may be the most influential asset pricing model of all time, relating the expected returns of an asset with how much its returns covary with the stock market. Specifically, given that the random return of stock n is in and the return of the stock market is market, with variance of market and expected returns markets the CAPM predicts that ita - R= Bulmarket - R). where Bin Cor (market) market In our model with investors with mean variance preferences, everyone invests in portfolio w, given by (11) so w must be the stock market portfolio, leading to market = w'), and o market - wEw. Moreover, it is straightforward to show that the vector B = (Burs--- Ba] RM of covariances between stocks and the market, normalized by the market's variance, is -Sw ww We can therefore rewrite the CAPM relationship on vector form as -R1 = Bw"(- RI) (12) (a) Using (11) and the other relations we have derived, show that the CAPM relationship (12) holds Hint: It may be helpful to show that the RW Ew = 1 as part of the proof. 4. The Capital Asset Pricing Model (CAPM): The CAPN may be the most influential asset pricing model of all time, relating the expected returns of an asset with how much its returns covary with the stock market. Specifically, given that the random return of stock n is in and the return of the stock market is market, with variance of market and expected returns markets the CAPM predicts that ita - R= Bulmarket - R). where Bin Cor (market) market In our model with investors with mean variance preferences, everyone invests in portfolio w, given by (11) so w must be the stock market portfolio, leading to market = w'), and o market - wEw. Moreover, it is straightforward to show that the vector B = (Burs--- Ba] RM of covariances between stocks and the market, normalized by the market's variance, is -Sw ww We can therefore rewrite the CAPM relationship on vector form as -R1 = Bw"(- RI) (12) (a) Using (11) and the other relations we have derived, show that the CAPM relationship (12) holds Hint: It may be helpful to show that the RW Ew = 1 as part of the proof

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts