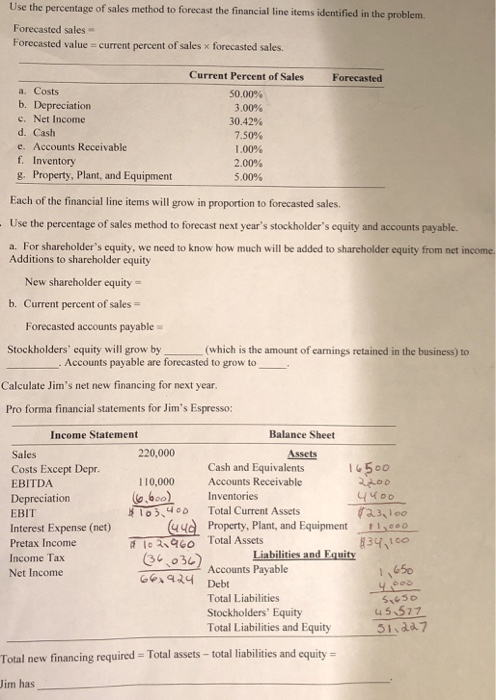

Question: *Please provide complete correct answers with detailed work shown * Use the percentage of sales method to forecast the financial line items identified in the

Use the percentage of sales method to forecast the financial line items identified in the probl Forecasted sales Forecasted value = current percent of sales x forecasted sales. Current Percent of Sales 50.00% 3,00% 30.42% 7.50% 1.00% 2.00% 5.00% Forecasted a. Costs b. Depreciation c. Net Income d. Cash e. Accounts Receivable f. Inventory g. Property, Plant, and Equipment Each of the financial line items will grow in proportion to forecasted sales. Use the percentage of sales method to forecast next year's stockholder's equity and accounts payable. a. For shareholder's equity, we need to know how much will be added to shareholder equity from net income. Additions to shareholder equity New shareholder equity- b. Current percent of sales Forecasted accounts payable Stockholders' equity will grow by (which is the amount of carnings retained in the business) to Accounts payable are forecasted to grow to Calculate Jim's net new financing for next year. Pro forma financial statements for Jim's Espresso: Income Statement Balance Sheet Assets Sales Costs Except Depr. EBITDA Depreciation EBIT Interest Expense (net) Pretax Income Income Tax Net Income 220,000 110,000 d To34:0 Cash and Equivalents 500 Accounts Receivable Inventories Total Current Assets 4 Property, Plant, and Equipment11,ceo le 396o Total Assets Liabilities and Equity Accounts Payable 650 Gera Debt Total Liabilities Stockholders Equity Total Liabilities and Equity u 5.577 5lda7 Total new financing required Total assets- total liabilities and equity Jim has Use the percentage of sales method to forecast the financial line items identified in the probl Forecasted sales Forecasted value = current percent of sales x forecasted sales. Current Percent of Sales 50.00% 3,00% 30.42% 7.50% 1.00% 2.00% 5.00% Forecasted a. Costs b. Depreciation c. Net Income d. Cash e. Accounts Receivable f. Inventory g. Property, Plant, and Equipment Each of the financial line items will grow in proportion to forecasted sales. Use the percentage of sales method to forecast next year's stockholder's equity and accounts payable. a. For shareholder's equity, we need to know how much will be added to shareholder equity from net income. Additions to shareholder equity New shareholder equity- b. Current percent of sales Forecasted accounts payable Stockholders' equity will grow by (which is the amount of carnings retained in the business) to Accounts payable are forecasted to grow to Calculate Jim's net new financing for next year. Pro forma financial statements for Jim's Espresso: Income Statement Balance Sheet Assets Sales Costs Except Depr. EBITDA Depreciation EBIT Interest Expense (net) Pretax Income Income Tax Net Income 220,000 110,000 d To34:0 Cash and Equivalents 500 Accounts Receivable Inventories Total Current Assets 4 Property, Plant, and Equipment11,ceo le 396o Total Assets Liabilities and Equity Accounts Payable 650 Gera Debt Total Liabilities Stockholders Equity Total Liabilities and Equity u 5.577 5lda7 Total new financing required Total assets- total liabilities and equity Jim has

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts