Question: Please provide correct answer for all, want good mark. QUESTION 1 Royal Blue has decided to issue long term debt (Bond) with a maturity date

Please provide correct answer for all, want good mark.

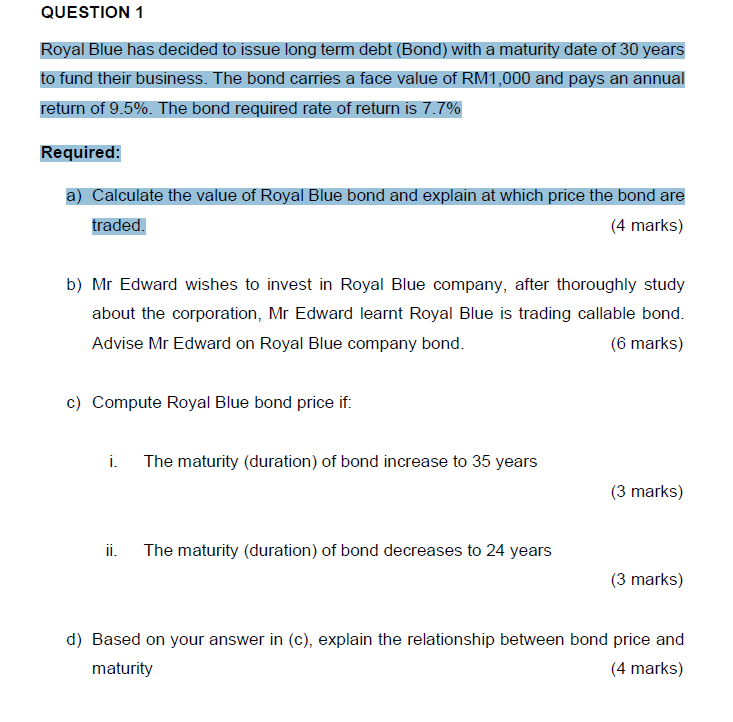

QUESTION 1 Royal Blue has decided to issue long term debt (Bond) with a maturity date of 30 years to fund their business. The bond carries a face value of RM1,000 and pays an annual return of 9.5%. The bond required rate of return is 7.7% Required: a) Calculate the value of Royal Blue bond and explain at which price the bond are traded. (4 marks) b) Mr Edward wishes to invest in Royal Blue company, after thoroughly study about the corporation, Mr Edward learnt Royal Blue is trading callable bond. Advise Mr Edward on Royal Blue company bond. (6 marks) c) Compute Royal Blue bond price if i. The maturity (duration) of bond increase to 35 years (3 marks) ii. The maturity (duration) of bond decreases to 24 years (3 marks) d) Based on your answer in (c), explain the relationship between bond price and maturity (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts