Question: please provide correct answer with explanation narrations calculation no copy paste Edd lebrock Manifolds, Inc. acquired the following assets in January;r EDIE: Manufacturing Equipment Cost:

please provide correct answer with explanation narrations calculation no copy paste

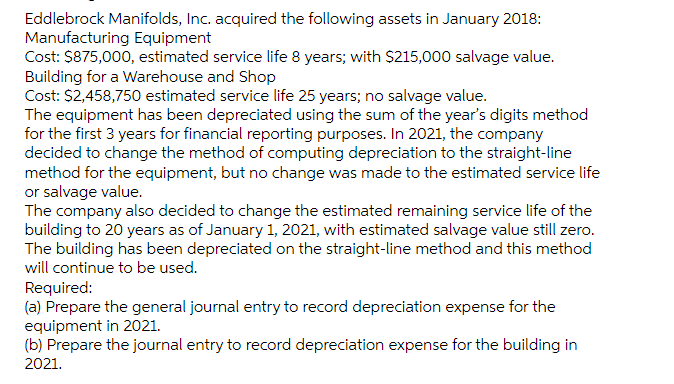

Edd lebrock Manifolds, Inc. acquired the following assets in January;r EDIE: Manufacturing Equipment Cost: 8876,0012}, estimated service life 8 years; with $35,001:! salvage value. Building for a Warehouse and Shop Cost: $2,458,?50 estimated service life 25 years; no salvage value. The equipment has been depreciated using the sum of the year's digits method forthe first 3 years for financial reporting purposes. In 2021. the companyr decided to change the method of computing depreciation to the straightline method forthe equipment. but no change was made to the estimated service life or salvage value. The company also decided to change the estimated remaining service life of the building to EU years as of Januaryr 1. 2021. with estimated salvage value still zero. The building has been depreciated on the straightline method and this method will continue to be used. Required: [a] Prepare the general journal entry to record depreciation expense for the equipment in 2021. [b] Prepare the journal entry to record depreciation expense for the building in 2011

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts