Question: please provide currect answer and also explain currect and incurrect answer HH123 is a corporation, organized and operating with an educational purpose. Assets are less

please provide currect answer and also explain currect and incurrect answer

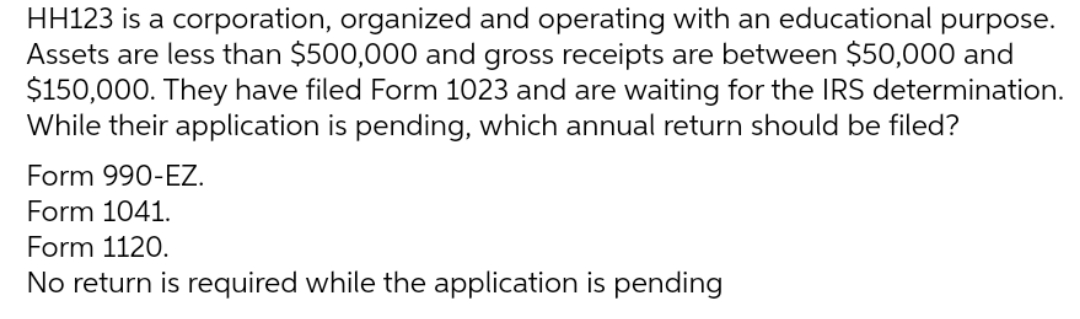

HH123 is a corporation, organized and operating with an educational purpose. Assets are less than $500,000 and gross receipts are between $50,000 and $150,000. They have filed Form 1023 and are waiting for the IRS determination. While their application is pending, which annual return should be filed? Form 990-EZ. Form 1041. Form 1120. No return is required while the application is pending

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts