Question: Please provide detail calculating steps. Thanks! Let's build a binomial model for the stock of ABC Company. It has an expected return of 10% per

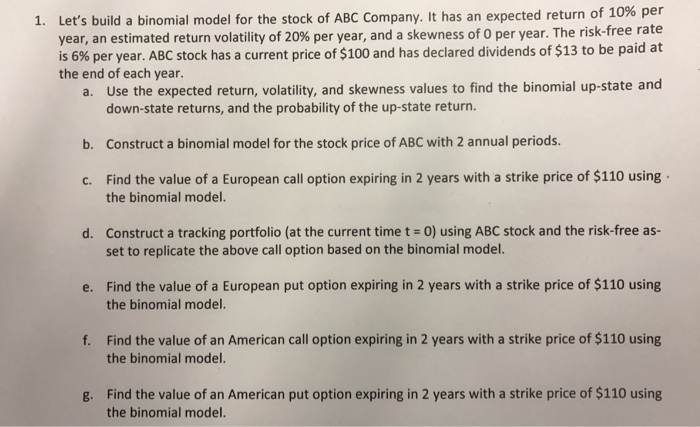

Let's build a binomial model for the stock of ABC Company. It has an expected return of 10% per year, an estimated return volatility of 20% per year, and a skewness of 0 per year. The risk-free rate is 6% per year. ABC stock has a current price of $100 and has declared dividends of $13 to be paid at the end of each year. Use the expected return, volatility, and skewness values to find the binomial up-state and down-state returns, and the probability of the up-state return. Construct a binomial model for the stock price of ABC with 2 annual periods. Find the value of a European call option expiring in 2 years with a strike price of $110 using the binomial model. Construct a tracking portfolio (at the current time t = 0) using ABC stock and the risk-free asset to replicate the above call option based on the binomial model. Find the value of a European put option expiring in 2 years with a strike price of $110 using the binomial model. Find the value of an American call option expiring in 2 years with a strike price of $110 using the binomial model. Find the value of an American put option expiring in 2 years with a strike price of $110 using the binomial model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts