Question: Please provide detail solution steps! thank you so much! QUESTION 1 A company has a joint process that produces two joint products, U and V.

Please provide detail solution steps! thank you so much!

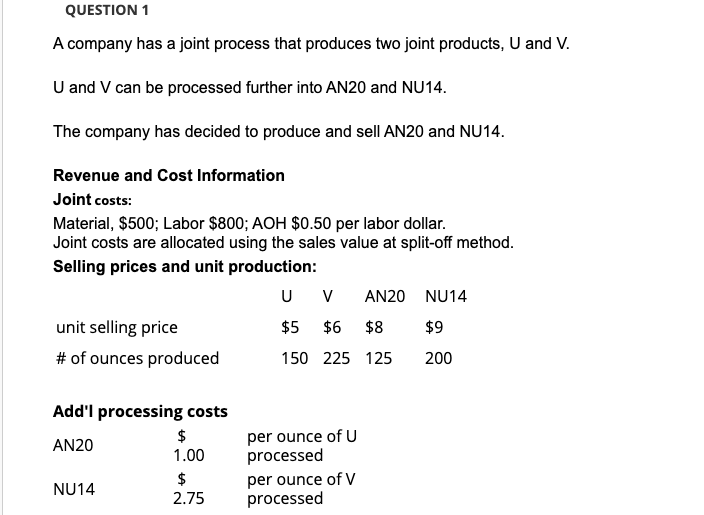

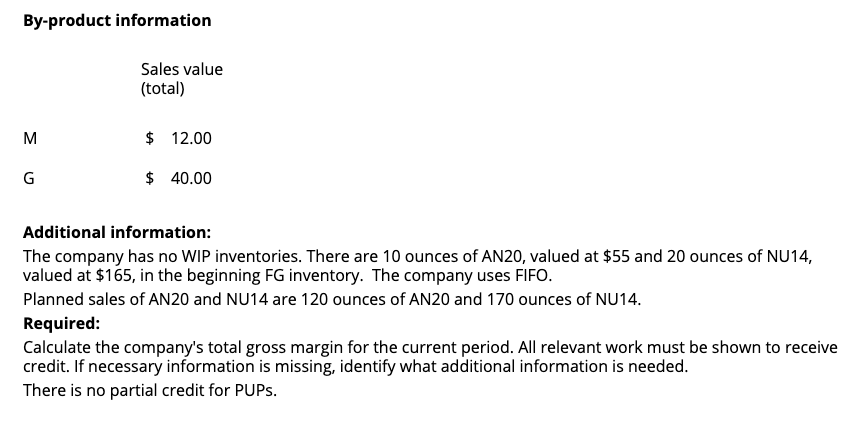

QUESTION 1 A company has a joint process that produces two joint products, U and V. U and V can be processed further into AN20 and NU14. The company has decided to produce and sell AN20 and NU14. Revenue and Cost Information Joint costs: Material, $500; Labor $800; AOH $0.50 per labor dollar. Joint costs are allocated using the sales value at split-off method. Selling prices and unit production: U V AN20 NU14 unit selling price $5 $6 $8 $9 # of ounces produced 150 225 125 200 Add'l processing costs $ AN20 1.00 $ NU14 2.75 per ounce of U processed per ounce of V processed By-product information Sales value (total) M $ 12.00 G $ 40.00 Additional information: The company has no WIP inventories. There are 10 ounces of AN20, valued at $55 and 20 ounces of NU14, valued at $165, in the beginning FG inventory. The company uses FIFO. Planned sales of AN20 and NU14 are 120 ounces of AN20 and 170 ounces of NU14. Required: Calculate the company's total gross margin for the current period. All relevant work must be shown to receive credit. If necessary information is missing, identify what additional information is needed. There is no partial credit for PUPs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts