Question: Please provide detailed answer in organized manner, preferably Excel Sheet (i.e. Not Hand Written) A pension fund manager is considering three mutual funds. The first

Please provide detailed answer in organized manner, preferably Excel Sheet (i.e. Not Hand Written)

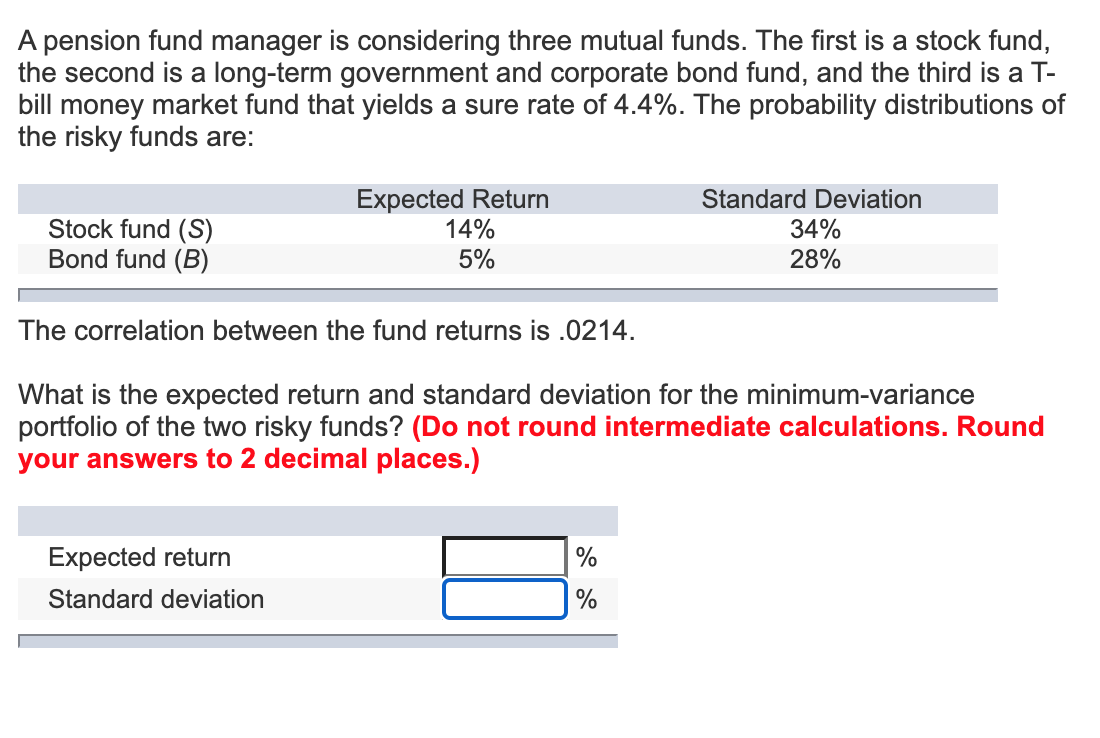

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T- bill money market fund that yields a sure rate of 4.4%. The probability distributions of the risky funds are: Stock fund (S) Bond fund (B) Expected Return 14% 5% Standard Deviation 34% 28% The correlation between the fund returns is .0214. What is the expected return and standard deviation for the minimum-variance portfolio of the two risky funds ? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Expected return Standard deviation % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts