Question: Please provide detailed feedback with the formula steps to solve the problems, thanks! Resources Microsoft Exce Capital Budgeting Decision Models Template calculate the following problems

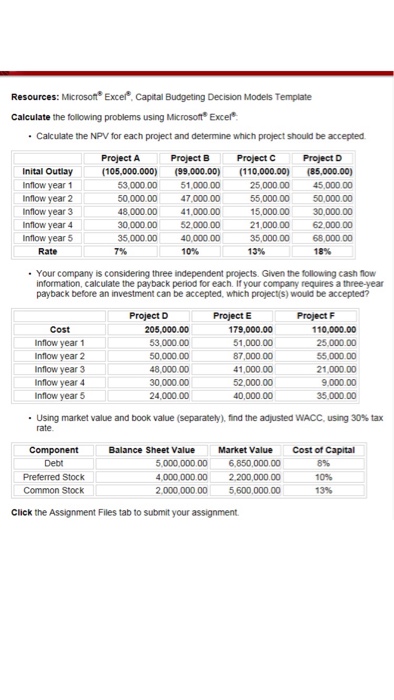

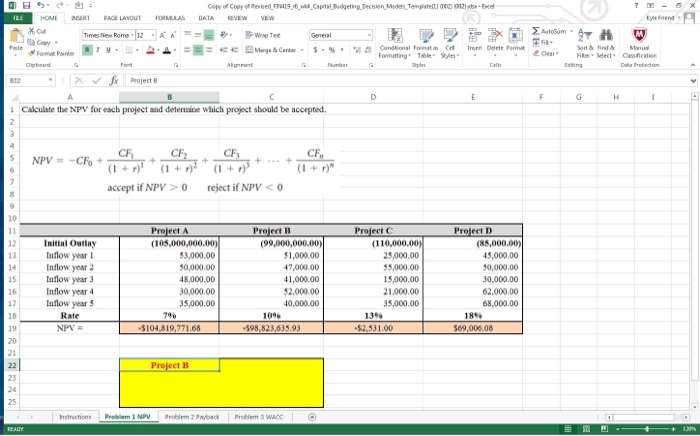

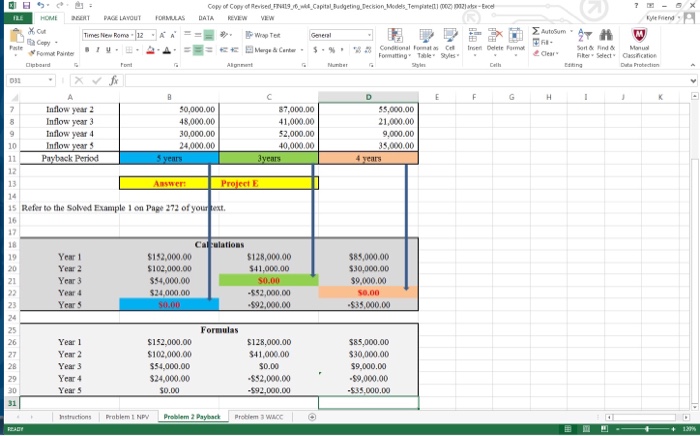

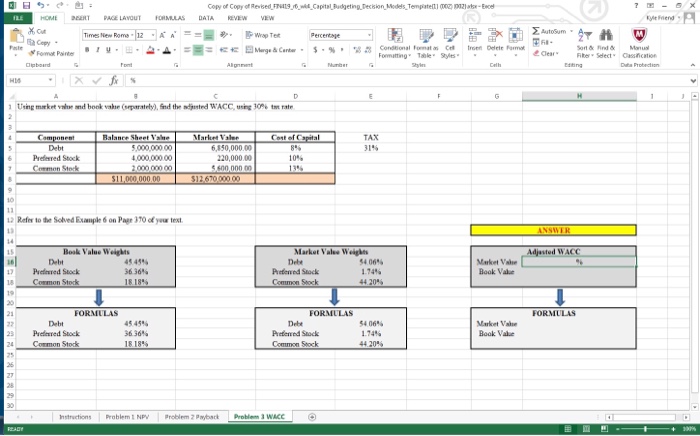

Resources Microsoft Exce Capital Budgeting Decision Models Template calculate the following problems using Microsot Excer Calculate the NPV for each project and determine which projectshould be accepted. Project A Project B Project C Project D Inital outlay (105.000.000 (99,000.00 (110,000.00) (85,000.00) 53,000.00 51,000.00 25,000.00 45.000.00 inflow year 1 Inflow year 2 50,000.00 47,000.00 55.000.000 50,000.00 year 3 Inflow 48,000.00 41,000.00 15.000.00 30,000.00 year 4 Inflow 30,000.00 52,000.00 21,000.00 62.000.00 inflow year 5 35,000.00 40,000.00 35,000,000 68,000,000 Rate 10% 13% 18% Your company is considering three independent projects. Given the following cash fow information, calculate the payback period for each. If your company requires athree-ear payback before an investment can be accepted, which project(s) would be accepted? Project D Project E Project F Cost 205,000.00 179,000.00 110,000.00 51,000.00 53,000.00 25.000.00 Inflow year 1 Inflow year 2 50,000.00 87,000.00 55,000.00 48,000.00 41,000.00 Inflow year 3 21.000.00 52,000.00 9,000.00 inflow year 4 300,000.00 inflow year 5 24,000.00 40,000.00 Using market value and book value (separately) find the adusted WACC, using 30% tax Component Balance Sheet Value Market Value Cost of Capital 5,000,000.00 6,850,000,000 Preferred stock 4,000,000.00 2.200.000,00 10% Common Stock 2,000,000.00 5,600,000.00 13% Click the Assignment Files tab to submit your assignment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts