Question: please provide detailed info and decide if additional info is relevant to calculation. respond asap. $200,000 $120,000 $ 80,000 ABC Manufacturing Inc. Income Statement Year

please provide detailed info and decide if additional info is relevant to calculation. respond asap.

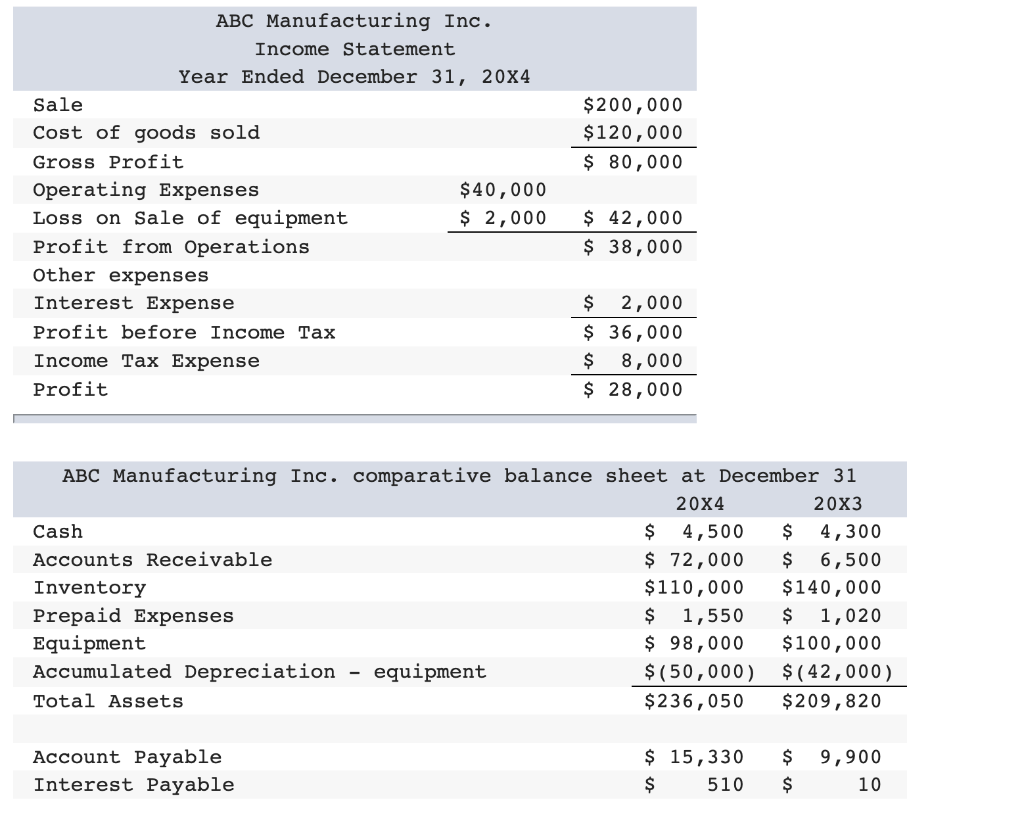

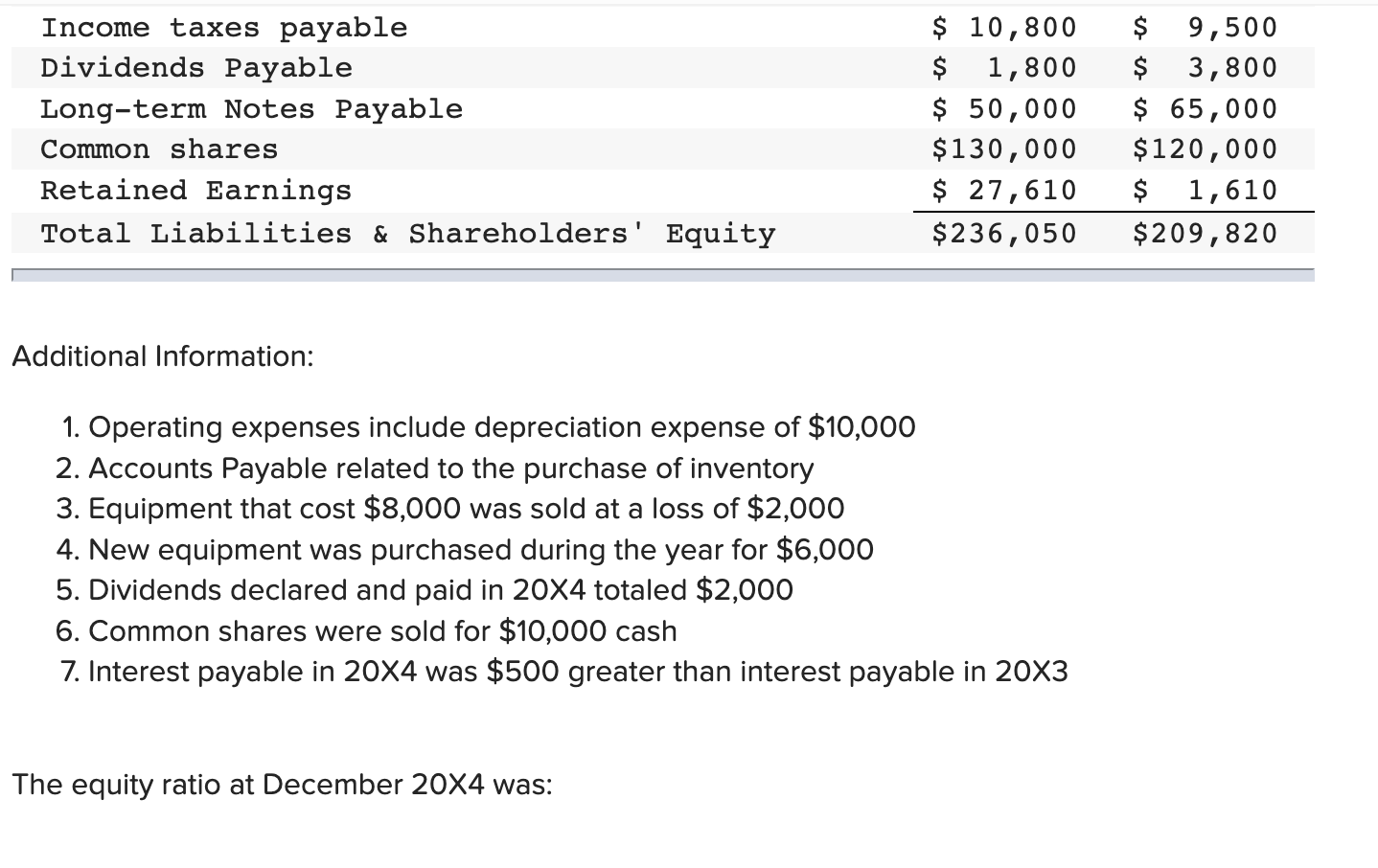

$200,000 $120,000 $ 80,000 ABC Manufacturing Inc. Income Statement Year Ended December 31, 20X4 Sale Cost of goods sold Gross Profit Operating Expenses $40,000 Loss on Sale of equipment $ 2,000 Profit from Operations Other expenses Interest Expense Profit before Income Tax Income Tax Expense Profit $ 42,000 $ 38,000 $ 2,000 $ 36,000 $ 8,000 $ 28,000 ABC Manufacturing Inc. comparative balance sheet at December 31 20X4 20X3 Cash $ 4,500 $ 4,300 Accounts Receivable $ 72,000 $ 6,500 Inventory $110,000 $140,000 Prepaid Expenses $ 1,550 $ 1,020 Equipment $ 98,000 $100,000 Accumulated Depreciation equipment $(50,000) $(42,000) Total Assets $ 236,050 $209,820 Account Payable Interest Payable $ 15,330 $ 510 $ $ 9,900 10 Income taxes payable Dividends Payable Long-term Notes Payable Common shares Retained Earnings Total Liabilities & Shareholders' Equity $ 10,800 $ 1,800 $ 50,000 $130,000 $ 27,610 $236,050 $ 9,500 $ 3,800 $ 65,000 $120,000 $ 1,610 $209,820 Additional Information: 1. Operating expenses include depreciation expense of $10,000 2. Accounts Payable related to the purchase of inventory 3. Equipment that cost $8,000 was sold at a loss of $2,000 4. New equipment was purchased during the year for $6,000 5. Dividends declared and paid in 20X4 totaled $2,000 6. Common shares were sold for $10,000 cash 7. Interest payable in 20X4 was $500 greater than interest payable in 20X3 The equity ratio at December 20X4 was: Multiple Choice Equal or above 1.73 o Between 0.64 and 1.73 d Between 0.43 and 0.63 o Equal or below 0.42 None of the other alternatives are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts