Question: Please provide detailed problem-solving steps and annotations by using formulas of Capital Budget (NPV, IRR, etc.). Mr Charles Montgomery Burns, of Springfield Nuclear Power Plant

Please provide detailed problem-solving steps and annotations by using formulas of Capital Budget (NPV, IRR, etc.).

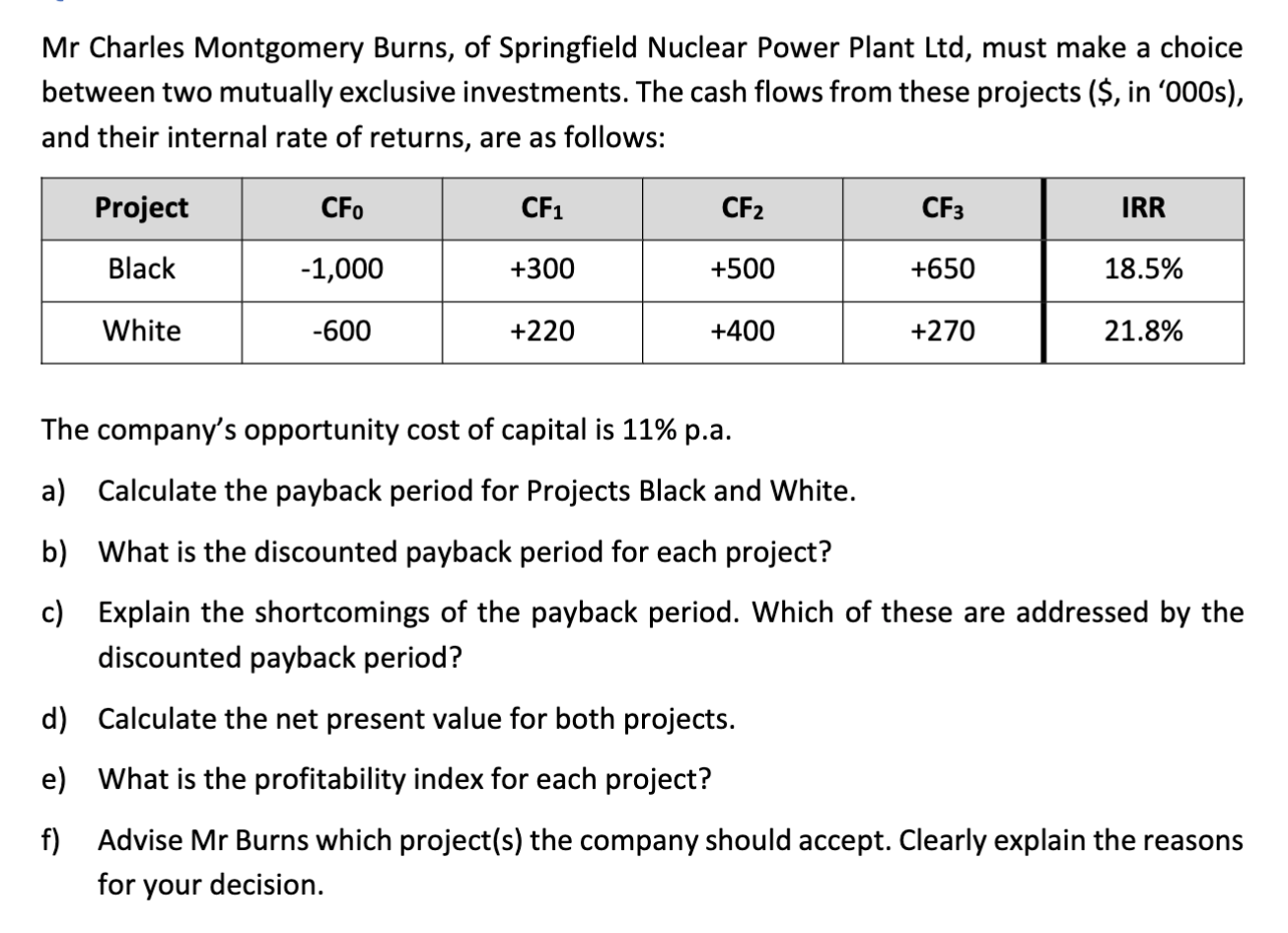

Mr Charles Montgomery Burns, of Springfield Nuclear Power Plant Ltd, must make a choice between two mutually exclusive investments. The cash flows from these projects ( $, in '000s), and their internal rate of returns, are as follows: The company's opportunity cost of capital is 11% p.a. a) Calculate the payback period for Projects Black and White. b) What is the discounted payback period for each project? c) Explain the shortcomings of the payback period. Which of these are addressed by the discounted payback period? d) Calculate the net present value for both projects. e) What is the profitability index for each project? f) Advise Mr Burns which project(s) the company should accept. Clearly explain the reasons for your decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts