Question: Please Provide detailed step-by step solution for each 3) Suppose you agree to borrow money from a bank at an annual compound rate of discount

Please Provide detailed step-by step solution for each

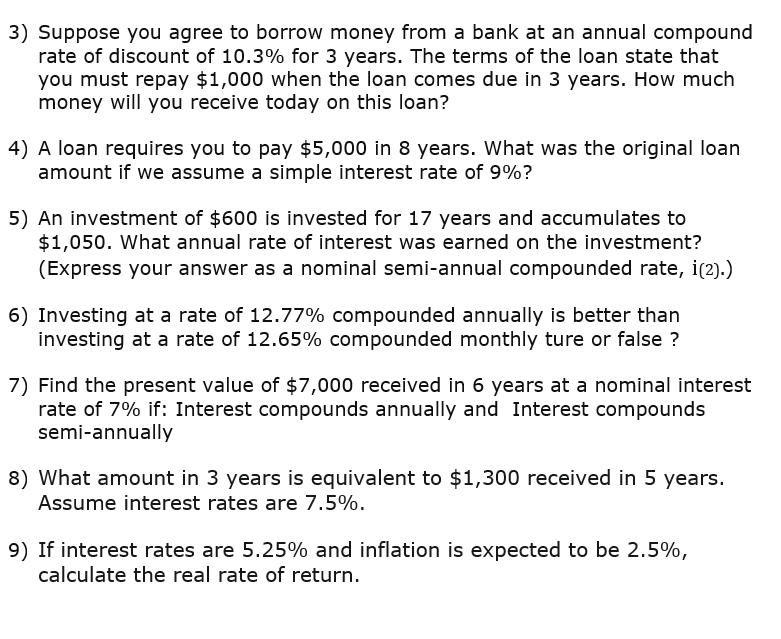

3) Suppose you agree to borrow money from a bank at an annual compound rate of discount of 10.3% for 3 years. The terms of the loan state that you must repay $1,000 when the loan comes due in 3 years. How much money will you receive today on this loan? 4) A loan requires you to pay $5,000 in 8 years. What was the original loan amount if we assume a simple interest rate of 9%? 5) An investment of $600 is invested for 17 years and accumulates to $1,050. What annual rate of interest was earned on the investment? (Express your answer as a nominal semi-annual compounded rate, i(2).) 6) Investing at a rate of 12.77% compounded annually is better than investing at a rate of 12.65% compounded monthly ture or false ? 7) Find the present value of $7,000 received in 6 years at a nominal interest rate of 7% if: Interest compounds annually and Interest compounds semi-annually 8) What amount in 3 years is equivalent to $1,300 received in 5 years. Assume interest rates are 7.5%. 9) If interest rates are 5.25% and inflation is expected to be 2.5%, calculate the real rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts