Question: Please provide details of your solution (step by step). Partial credit will be given based on your responses. 1. You are running a company which

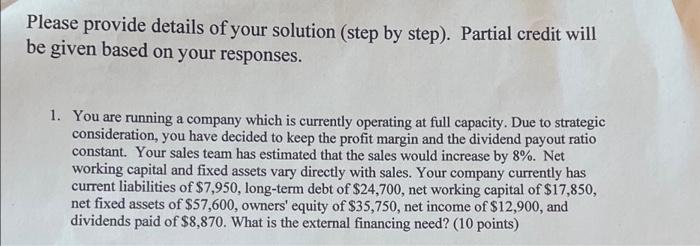

Please provide details of your solution (step by step). Partial credit will be given based on your responses. 1. You are running a company which is currently operating at full capacity. Due to strategic consideration, you have decided to keep the profit margin and the dividend payout ratio constant. Your sales team has estimated that the sales would increase by 8%. Net working capital and fixed assets vary directly with sales. Your company currently has current liabilities of $7,950, long-term debt of $24,700, net working capital of $17,850, net fixed assets of $57,600, owners' equity of $35,750, net income of $12,900, and dividends paid of $8,870. What is the external financing need? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts