Question: Please provide every process to solve it. Not only the answer. Include formula. Thanks. 10. Prepare a cash flow projection for a construction company that

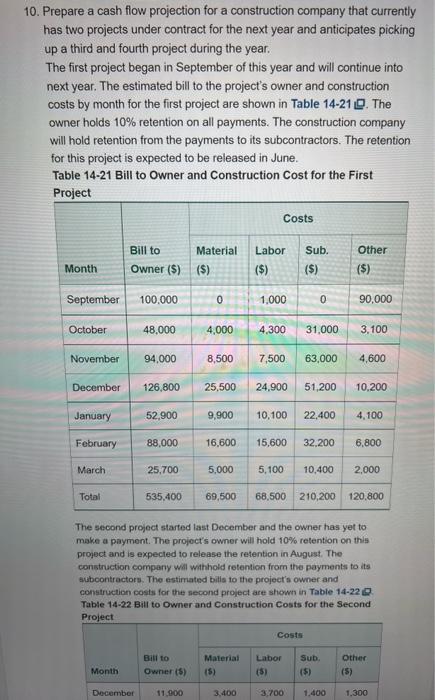

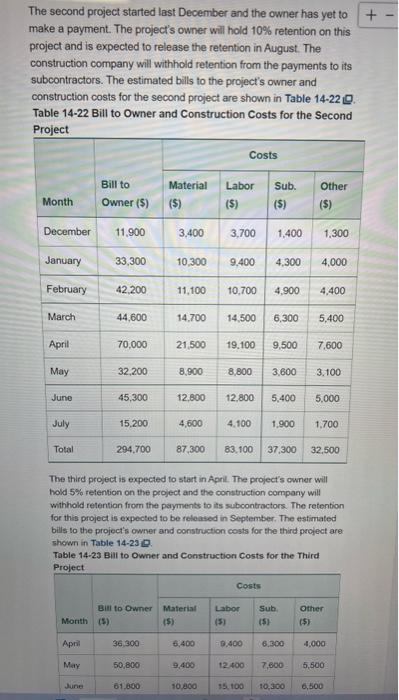

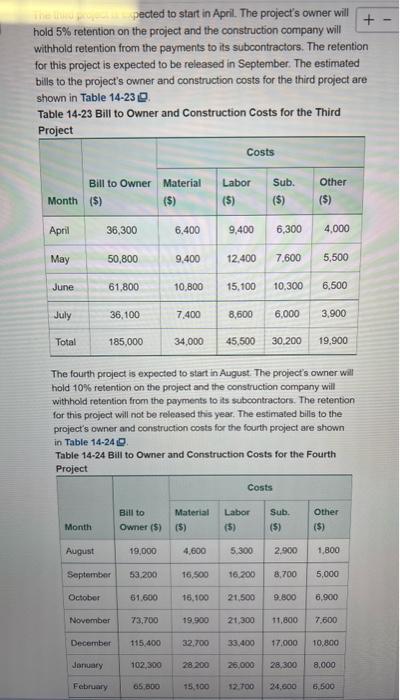

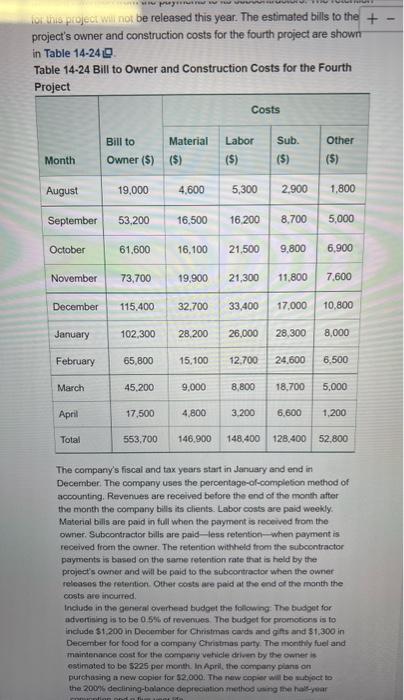

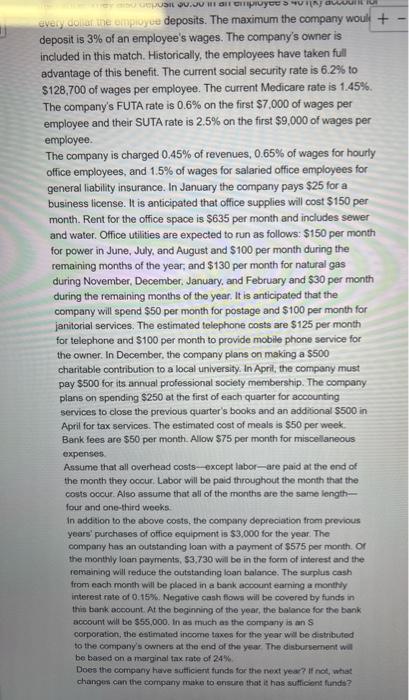

10. Prepare a cash flow projection for a construction company that currently has two projects under contract for the next year and anticipates picking up a third and fourth project during the year. The first project began in September of this year and will continue into next year. The estimated bill to the project's owner and construction costs by month for the first project are shown in Table 14-21 . The owner holds 10% retention on all payments. The construction company will hold retention from the payments to its subcontractors. The retention for this project is expected to be released in June. Table 14-21 Bill to Owner and Construction Cost for the First Proiect The second project started last December and the owner has yet to make a payment. The project's owner will hold 10% retention on this project and is expected to release the retention in August. The construction company will withold retention from the payments to its aubcontractors. The estimated bills to the project's owner and construction costs for the second project are shown in Table 14-22 IZ. Table 14-22 Bill to Owner and Construction Costs for the Second Project The second project started last December and the owner has yet to make a payment. The project's owner will hold 10% retention on this project and is expected to release the retention in August. The construction company will withhold retention from the payments to its subcontractors. The estimated bills to the project's owner and construction costs for the second project are shown in Table 14-22 [. Table 14-22 Bill to Owner and Construction Costs for the Second Proiect The third project is expected to start in Apri. The project's owner will hold 5% retention on the project and the construction company will withhold retertion from the payments to its subcontractors. The retention for this project is expected to be reloased in September. The estimated bills to the project's owner and construction costs for the third project are shown in Table 14-23 D. Table 14-23 Bill to Owner and Construction Costs for the Third Prolect. pected to start in Apri. The project's owner will hold 5% retention on the project and the construction company will withhold retention from the payments to its subcontractors. The retention for this project is expected to be released in September. The estimated bills to the project's owner and construction costs for the third project are shown in Table 14-23 . Table 14-23 Bill to Owner and Construction Costs for the Third Proiect The fourth project is expected to start in August. The project's owner will hold 10% retention on the project and the construction company will withhold retention from the payments to its subcontractors. The retention for this project will not be released this year, The estimated bills to the project's owner and construction costs for the fourth project are shown in Table 1424Q. Table 14-24 Bill to Owner and Construction Costs for the Fourth Proinct ivi whis project wu not be released this year. The estimated bills to the + project's owner and construction costs for the fourth project are shown in Table 14-24 . Table 14-24 Bill to Owner and Construction Costs for the Fourth Proiect The company's fiscal and tax years start in January and end in December. The company uses the percentage-of-completion method of accounting. Rervenues are received betore the end of the month after the month the company bills its clients. Labor costs are paid weekly. Material bills are paid in full when the payment is received from the owner. Subcontractor bilis are paid-less retention-when payment is received from the owner. The retention withheld from the subcontractor payments is based on the same retention rate that is held by the project's owner and will be paid to the subcortractor when the owner: releases the reterition. Other costs are paid at the end of the manth the corsts are incurred. thicluse in the general overhead budget the folowing. The budget for advertising is to be 0.5% of reveruves. The budget for promictions is to inctude $1,200 in December for Christmas cards and g ffss and $1,300 in Decernber for food for a company Christmas party. The monthly fuel and imairaenance cost for the copreviy vehicle drivan by the onner is ostimated to be $225 por muntt. In April, the compary puans on purchasing a now copier for $2.000. The new copier will be aubioct to. the zooss declining-balance deprecation method uning fine habyear The company's fiscal and tax years start in January and end in December. The company uses the percentage-of-completion method of accounting. Revenues are received before the end of the month after the month the company bills its clients. Labor costs are paid weekly. Material bills are paid in full when the payment is received from the owner. Subcontractor bills are paid-less retention - when payment is received from the owner. The retention withheld from the subcontractor payments is based on the same retention rate that is held by the project's owner and will be paid to the subcontractor when the owner releases the retention. Other costs are paid at the end of the month the costs are incurred. Include in the general overhead budget the following: The budget for advertising is to be 0.5% of revenues. The budget for promotions is to include $1,200 in December for Christmas cards and gifts and $1,300 in December for food for a company Christmas party. The monthly fuel and maintenance cost for the company vehicle driven by the owner is estimated to be $225 per month. In April, the company plans on purchasing a new copier for $2,000. The new copier will be subject to the 200% declining-balance depreclation method using the half-year. convention and a five-year life. The company employs three workers: the owner, an estimator, and a secretarylbookkeeper. The owner is paid $5,000 per month. The estimator is paid $26.50 per hour and works an average of 25 hours per week. The secretarylbookkeeper is paid $21.75 per hour and works an average of 45 hours per week. All of the hourly omployees are paid for 52 weeks of work per year. Time-and-a-half must be paid to hourly employees for work over 40 hours per wcek. The company contributes $175 per month per employee - including the owner-for heulth insurance. They also deposit $0.50 in an employee's 401(k) account for every dollar the employee deposits. The maximum the company would deposit is 3% of an employee's wages. The company's owner is included in this match. Historically, the employees have taken full advantigge of this benefit. The current social security rate is 6.2% to $128,700 of wages per employee. The current Medicare rate is 1.45%. The company's FUTA rate is 0.6% on the tirst $7.000 of wages per employee and their SUTA rate is 2.5% on the first $9.000 of wages per employee. The company is charged 0.45% of revenues, 0.65% of wages for hourly office employees, and 1.5% of wages for salaried otfice employees for general liability insurance. In January the company pays $25 for a business licanse, it is anticipated that office supplies will cost $150 per manth. Rent for two office spece is 5635 per month and includen sewor and water. Office unilies are expected to run as follows: $150 per month. for powor in Juno, July, and Auguot and \$100 per manth duning the remaining monthe of the year, and $130 per month for natural gus during November, December, January, and Februaly and 530 por month cering the tomaining montha of the year itis snticipated that the deposit is 3% of an employee's wages. The company's owner is included in this match. Historically, the employees have taken full advantage of this benefit. The current social security rate is 6.2% to $128,700 of wages per employee. The current Medicare rate is 1.45%. The company's FUTA rate is 0.6% on the first $7.000 of wages per employee and their SUTA rate is 2.5% on the first $9,000 of wages per employee. The company is charged 0.45% of revenues, 0.65% of wages for hourly office employees, and 1.5% of wages for salaried office employees for general liability insurance. In January the company pays $25 for a business license. It is anticipated that office supplies will cost $150 per month. Rent for the office space is $635 per month and includes sewer and water. Office utilities are expected to run as follows: $150 per month for power in June, July, and August and $100 per month during the remaining months of the year, and $130 per month for natural gas during November, December. January, and February and $30 per month during the remaining months of the year. It is anticipated that the company will spend $50 per month for postage and $100 per month for janitorial services. The estimated telephone costs are $125 per month for telephone and $100 per month to provide mobile phone service for the owner. In December, the company plans on making a 5500 charitable contribution to a local university. In Apri, the company must pay $500 for its annual professional society membership. The company plans on spending $250 at the first of each quarter for accounting services to close the previous quarter's books and an addifional $500 in April for tax servicos. The estimated cost of meals is $50 per week. Bank fees are $50 per month. Allow $75 per month for miscellaneous expenses. Assume that all overhead costs - excopt labor-are paid at the end of the month they occur. Labor will be paid throughout the month that the costs occur. Also assume that all of the months are the same lengthfour and one-third weeks: In addition to the above costs, the company depreciation trom previous years' purchases of attice equipment is $3,000 for the year. The company has an cutstanding loan with a payment of $575 per month. Or the monthly loan payments, $3.730 will be in the form of interest and the rombining will reduce the outstanding loan balance. The surplus cash from each month will be placed in a bank acoount eaming a montrty interest rate of 0.15%. Negotive cash flows will be covered by funds in thin bank account, At the boginning of the year, the bolance for the bank acooum will be $55,000. In as much as the company is an S corporation, the estimatad income taxes for the year wall be distributed to the company's owners at tha end of the year. The disburvement wall be based on a marginal tax rate of 24%. Does the company have sutticient funda far the noxt year? If not, what charges can the company make to onsure that it has sulficont finds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts