Question: please provide excel equasions used for each column Pick a public company, go to Yahoo Finance, and download the last five years of data using

please provide excel equasions used for each column

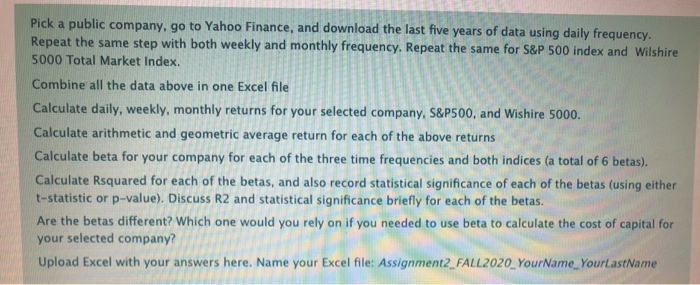

please provide excel equasions used for each column Pick a public company, go to Yahoo Finance, and download the last five years of data using daily frequency Repeat the same step with both weekly and monthly frequency. Repeat the same for S&P 500 index and Wilshire 5000 Total Market Index. Combine all the data above in one Excel file Calculate daily, weekly, monthly returns for your selected company, S&P500, and Wishire 5000. Calculate arithmetic and geometric average return for each of the above returns Calculate beta for your company for each of the three time frequencies and both indices (a total of 6 betas). Calculate Rsquared for each of the betas, and also record statistical significance of each of the betas (using either t-statistic or p-value). Discuss R2 and statistical significance briefly for each of the betas. Are the betas different? Which one would you rely on if you needed to use beta to calculate the cost of capital for your selected company? Upload Excel with your answers here. Name your Excel file: Assignment2_FALL2020_YourName_YourLastName Pick a public company, go to Yahoo Finance, and download the last five years of data using daily frequency Repeat the same step with both weekly and monthly frequency. Repeat the same for S&P 500 index and Wilshire 5000 Total Market Index. Combine all the data above in one Excel file Calculate daily, weekly, monthly returns for your selected company, S&P500, and Wishire 5000. Calculate arithmetic and geometric average return for each of the above returns Calculate beta for your company for each of the three time frequencies and both indices (a total of 6 betas). Calculate Rsquared for each of the betas, and also record statistical significance of each of the betas (using either t-statistic or p-value). Discuss R2 and statistical significance briefly for each of the betas. Are the betas different? Which one would you rely on if you needed to use beta to calculate the cost of capital for your selected company? Upload Excel with your answers here. Name your Excel file: Assignment2_FALL2020_YourName_YourLastName

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts