Question: please provide excel formulas for excel sheet problems Hudson Company reports the following contribution margin income statement. Units sold Variable cost HUDSON COMPANY Contribution Margin

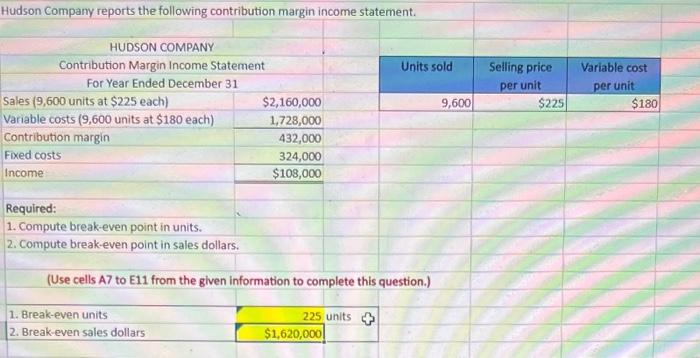

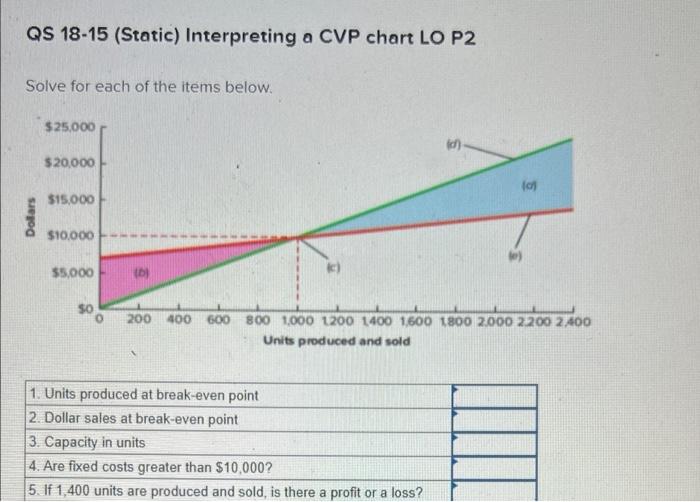

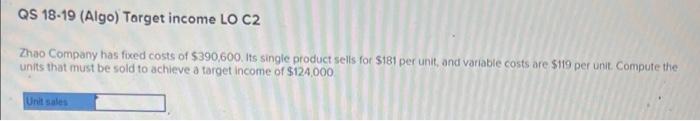

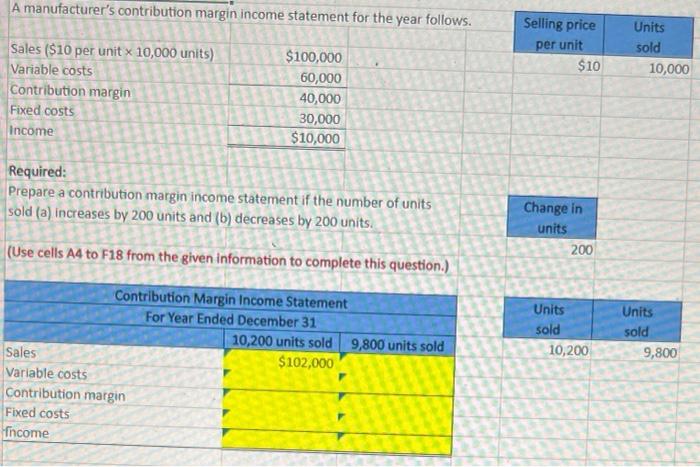

Hudson Company reports the following contribution margin income statement. Units sold Variable cost HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (9,600 units at $225 each) $2,160,000 Variable costs (9,600 units at $180 each) 1,728,000 Contribution margin 432,000 Fixed costs 324,000 Income $108,000 Selling price per unit $225 per unit 9,600 $180 Required: 1. Compute break-even point in units. 2. Compute break-even point in sales dollars. (Use cells A7 to E11 from the given information to complete this question.) 1. Break-even units 2. Break-even sales dollars 225 units $1,620,000 QS 18-15 (Static) Interpreting a CVP chart LO P2 Solve for each of the items below. $ 25,000 ch $20,000 10 $15,000 Dollars $10.000 e) $5,000 c) 200 400 600 800 1.000 1200 1400 1,600 1800 2.000 2.200 2400 Units produced and sold 1. Units produced at break-even point 2. Dollar sales at break-even point 3. Capacity in units 4. Are fixed costs greater than $10,000? 5. If 1,400 units are produced and sold, is there a profit or a loss? QS 18-19 (Algo) Torget income LO C2 Zhao Company has fixed costs of 5390,600. Its single product sells for S181 per unit, and variable costs are $119 per unit. Compute the units that must be sold to achieve a target income of $124.000 Unit sales A manufacturer's contribution margin income statement for the year follows. Selling price per unit $10 Units sold 10,000 Sales ($10 per unit x 10,000 units) Variable costs Contribution margin Fixed costs Income $100,000 60,000 40,000 30,000 $10,000 Required: Prepare a contribution margin income statement if the number of units sold (a) increases by 200 units and (b) decreases by 200 units. Change in units 200 (Use cells A4 to F18 from the given information to complete this question.) Units sold Contribution Margin Income Statement For Year Ended December 31 10,200 units sold 9,800 units sold Sales $102,000 Variable costs Contribution margin Fixed costs Income Units sold 9,800 10,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts