Question: please provide excel spreadsheet, on how you arrived at the correct answer. Question 7 0/2 points The Brownstone Corporation bonds have 5 years remaining to

please provide excel spreadsheet, on how you arrived at the correct answer.

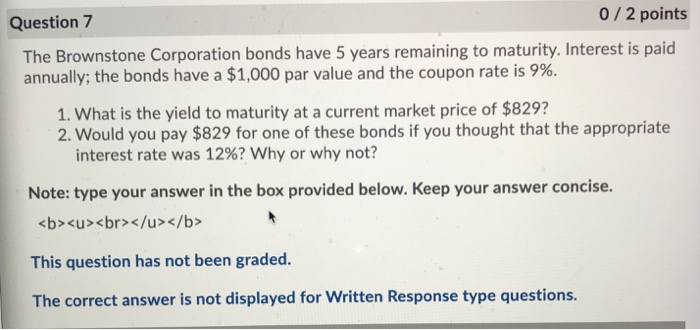

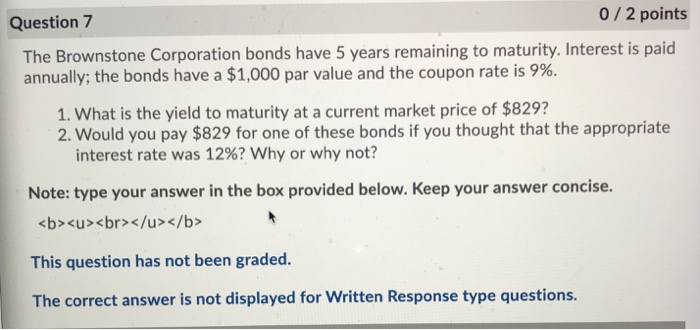

Question 7 0/2 points The Brownstone Corporation bonds have 5 years remaining to maturity. Interest is paid annually; the bonds have a $1,000 par value and the coupon rate is 9%. 1. What is the yield to maturity at a current market price of $829? 2. Would you pay $829 for one of these bonds if you thought that the appropriate interest rate was 12%? Why or why not? Note: type your answer in the box provided below. Keep your answer concise. This question has not been graded. The correct answer is not displayed for Written Response type questions

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock