Question: please provide explanantion or formulas on how to get each box not just the answer. thank you! (: Tiger Furnishings produces two models of cabinets

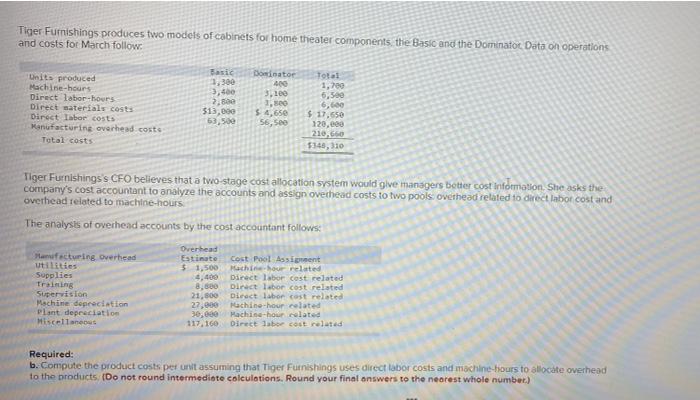

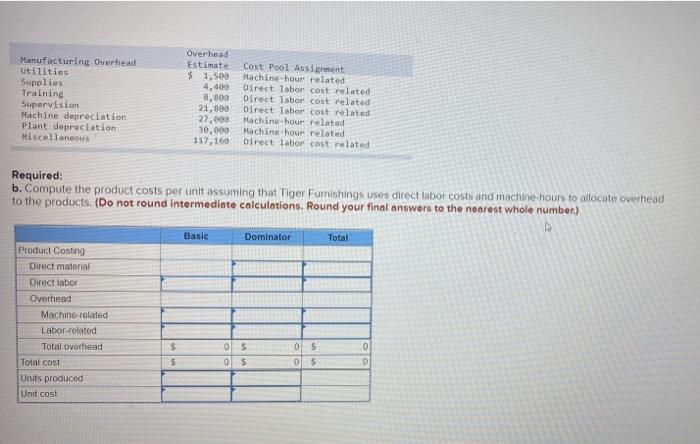

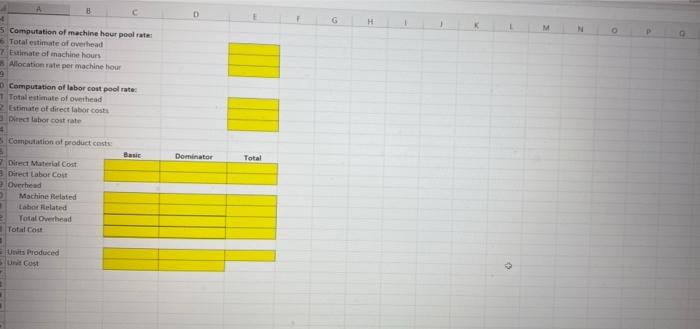

Tiger Furnishings produces two models of cabinets for home theater components the Basic and the Dominator Data on operations and costs for March follow. Dominator 400 Basic 1,300 3,400 2,800 513,000 63,500 Units produced Machine-hours Direct labor-hours Direct saterials costs Direct Labor costs Manufacturing overhead coste Total costs 3,100 2. $ 4,650 56,500 Total 1,700 6,500 6,660 $ 17.550 120.ee 210,660 5149, 310 Tiger Furnishings's CEO believes that a two-stage cost allocation system would give managers better cost information. She asks the company's cost accountant to analyze the accounts and assign overhead costs to two pools overhead related to direct labor cost and overhead related to machine-hours The analysis of overhead accounts by the cost accountant follows: Overhead Manufacturing Overhead Estimate Cost Pool Assignment Utilities $1,500 chinor related Supplies 4,400 Direct labor cost related Training 8.600 Direct labor cost related Supervision 21.500 Direct labor cost related Machine depreciation 27,000 Machine-hour related plant depreciation 30,000 Machine-hour related Miscellaneous 117.160 Direct labor cost related Required: b. Compute the product costs per unit assuming that Tiger Furnishings uses direct labor costs and machine hours to allocate overhead to the products. (Do not round intermediate colculations. Round your final answers to the nearest whole number.) Manufacturing Overhead Utilities Supplies Training Supervision Machine depreciation Plant depreciation Miscellaneous Overhead Estimate $ 1,500 4,400 8,360 21,800 27,000 30,000 117,160 Cost Pool Assignment Machine-hour related Direct labor cost related Direct Labor cost related Direct labor cost related Machine-hour related Machine-hour related Direct labor cost related Required: b. Compute the product costs per unit assuming that Tiger Furnishings uses direct labor costs and machine-hours to allocate overhead to the products. (Do not round intermediate calculations. Round your final answers to the nearest whole number) Basic Dominator Total Product Casting Direct material Direct labor Overhead Machine-related Labor related Total overhead Total cost Units produced Unit cost 0 $ $ 0 $ 0 $ 0 $ 05 O B D H O 5 Computation of machine hour pool rates 5 Total estimate of overhead 7 Estimate of inachine hours Allocation rate per machine hour Computation of labor cost pool rate 1 Total estimate of owerhead 2 Estimate of direct labor costs Dit labor cost rate 5 Computation of product casts: Dominator Total Direct Material Cost Direct Labor Cost Overhead Machine Related Labor Related Total Overhead Total Cost Units Produced Sun Cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts