Question: Please provide explanation and solution for my guidance :) PROBLEMS Problem 7-1 (IFRS) vable Nasty Bank granted a loan to a borrower on January 1,

Please provide explanation and solution for my guidance :)

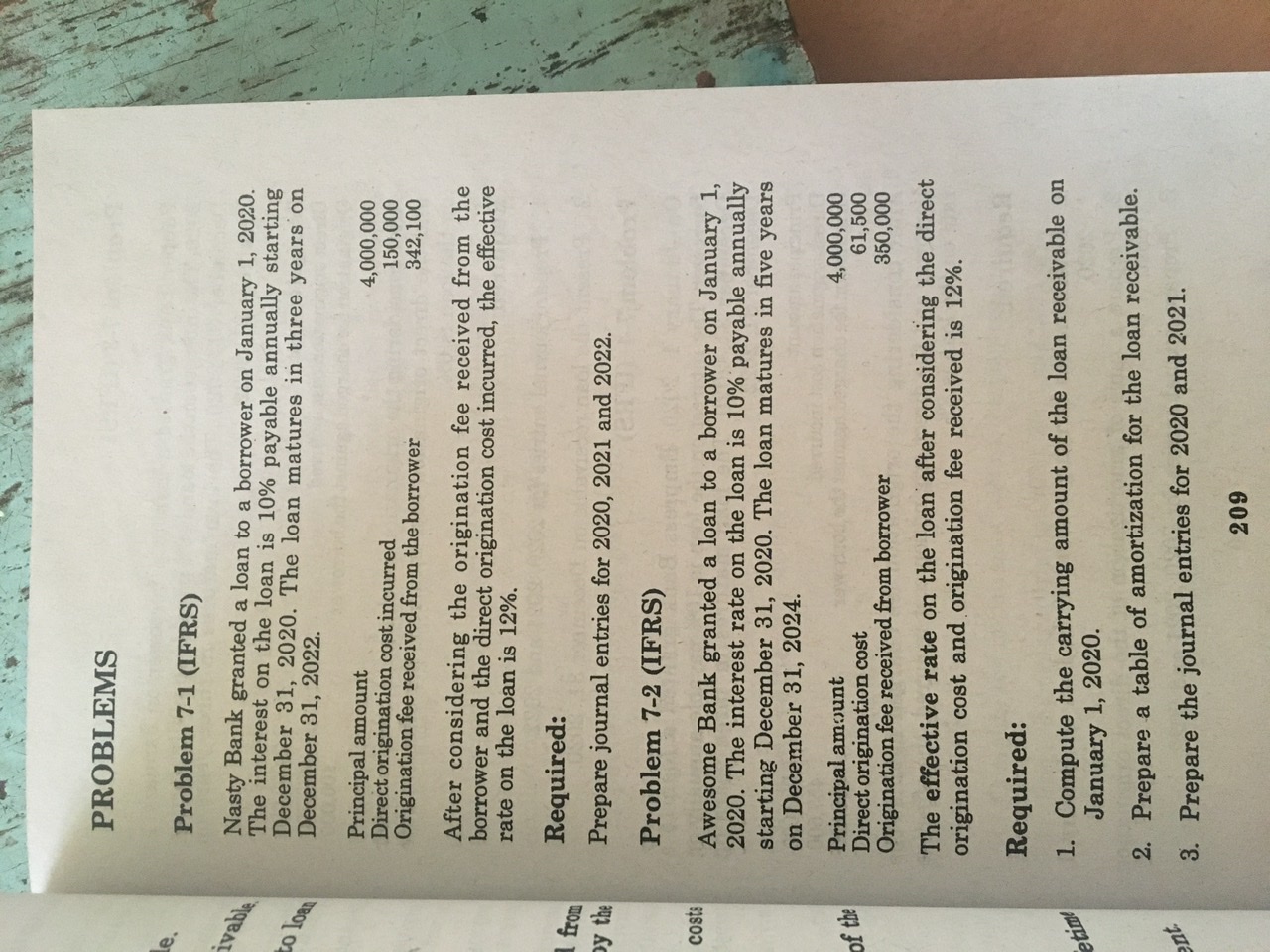

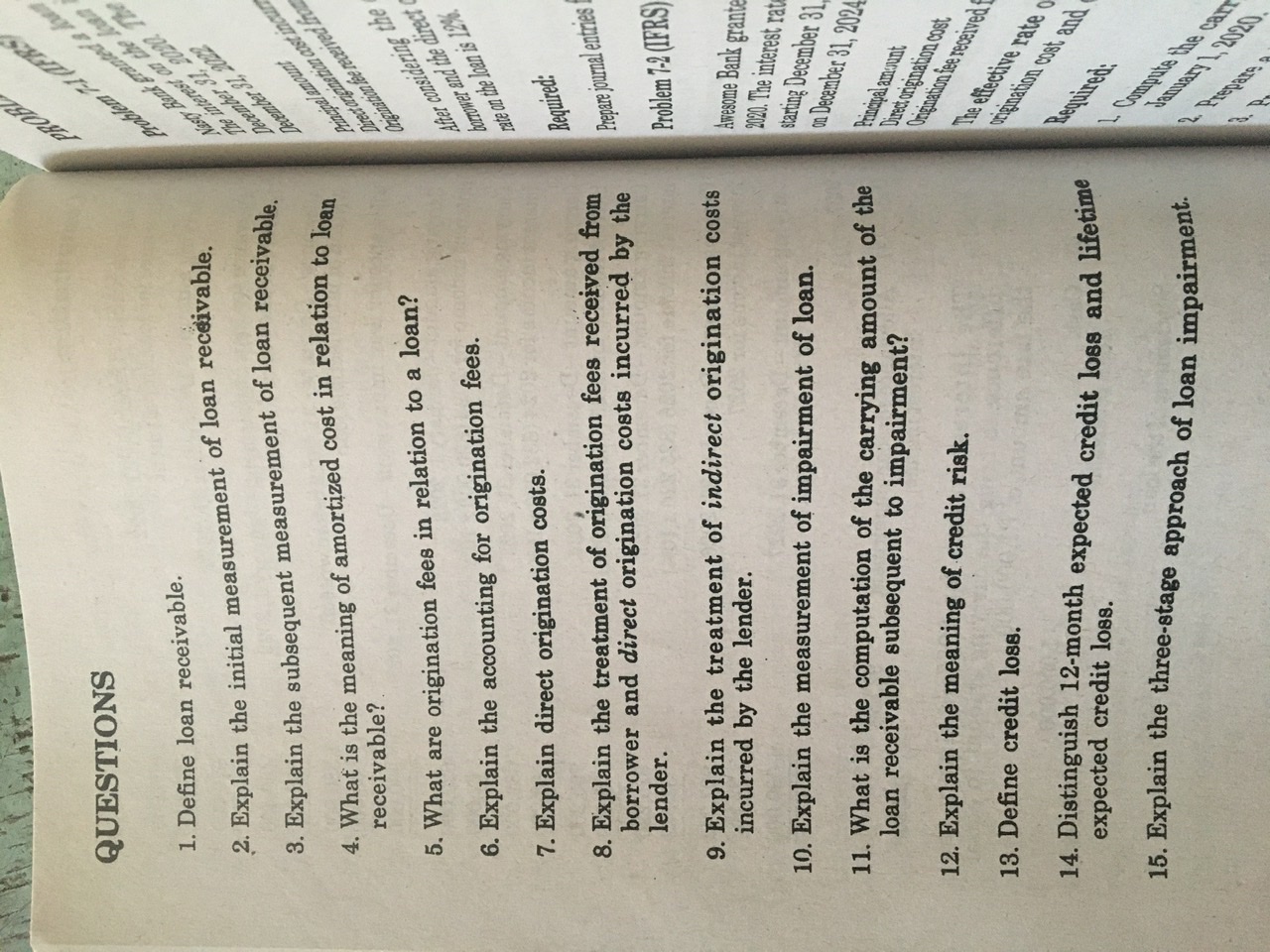

PROBLEMS Problem 7-1 (IFRS) vable Nasty Bank granted a loan to a borrower on January 1, 2020. The interest on the loan is 10% payable annually starting o loan December 31, 2020. The loan matures in three years on December 31, 2022. Principal amount 4,000,000 Direct origination cost incurred 150,000 Origination fee received from the borrower 342,100 After considering the origination fee received from the borrower and the direct origination cost incurred, the effective rate on the loan is 12%. Required: from y the Prepare journal entries for 2020, 2021 and 2022. Problem 7-2 (IFRS) costs Awesome Bank granted a loan to a borrower on January 1, 2020. The interest rate on the loan is 10% payable annually starting December 31, 2020. The loan matures in five years on December 31, 2024. 4,000,000 the Principal amount Direct origination cost 61,500 Origination fee received from borrower 350,000 The effective rate on the loan after considering the direct origination cost and origination fee received is 12%. Required: 1. Compute the carrying amount of the loan receivable on January 1, 2020. 2. Prepare a table of amortization for the loan receivable. 3. Prepare the journal entries for 2020 and 2021. 209QUESTIONS 1. Define loan receivable. 2. Explain the initial measurement of loan receivable. 3. Explain the subsequent measurement of loan receivable Principal amount 4. What is the meaning of amortized cost in relation to loan Direct origination cast inc Origination fee received bi receivable? 5. What are origination fees in relation to a loan? After considering the borrower and the direct 6. Explain the accounting for origination fees. rate on the loan is 12%. 7. Explain direct origination costs. Required: 8. Explain the treatment of origination fees received from Prepare journal entries borrower and direct origination costs incurred by the lender. Problem 7-2 (IFRS) 9. Explain the treatment of indirect origination costs incurred by the lender. Awesome Bank grante 2020. The interest rate 10. Explain the measurement of impairment of loan. starting December 31, on December 31, 2024 11. What is the computation of the carrying amount of the loan receivable subsequent to impairment? Principal amount Direct origination cost 12. Explain the meaning of credit risk. Origination fee received 13. Define credit loss. The effective rate origination cost and 14. Distinguish 12-month expected credit loss and lifetime expected credit loss. Required 15. Explain the three-stage approach of loan impairment. Compute the car January 1 2020 2. Prepara

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts