Question: please provide explanation with the correct answer , use excel 11 Mr. Hopper is expected to retire in 30 years and he wishes accumulate $1,000,000

please provide explanation with the correct answer , use excel

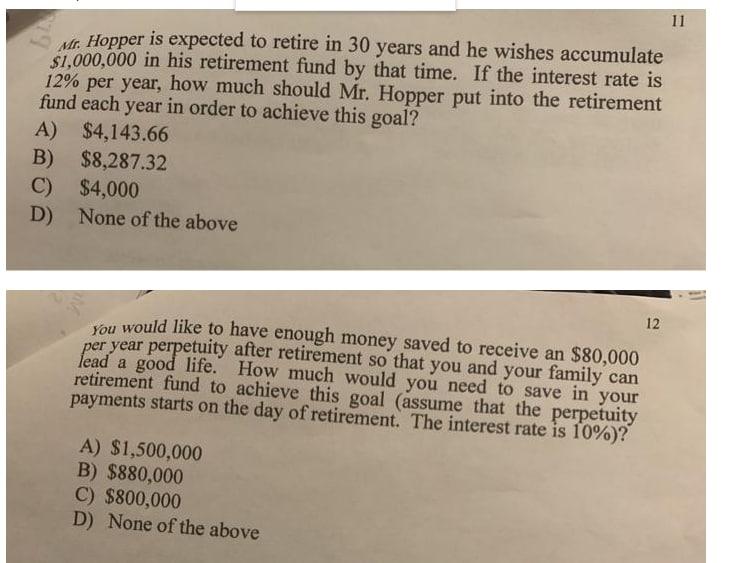

11 Mr. Hopper is expected to retire in 30 years and he wishes accumulate $1,000,000 in his retirement fund by that time. If the interest rate is 12% per year, how much should Mr. Hopper put into the retirement fund each year in order to achieve this goal? A) $4,143.66 B) $8,287.32 C) $4,000 D) None of the above 12 you would like to have enough money saved to receive an $80,000 per year perpetuity after retirement so that you and your family can lead a good life. How much would you need to save in your retirement fund to achieve this goal (assume that the perpetuity payments starts on the day of retirement. The interest rate is 10%)? A) $1,500,000 B) $880,000 C) $800,000 D) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts