Question: please provide explanation with the correct option Katy contributes $10,000 cash and land worth $35,000 to ABC partnership solely in exchange for a 10% interest

please provide explanation with the correct option

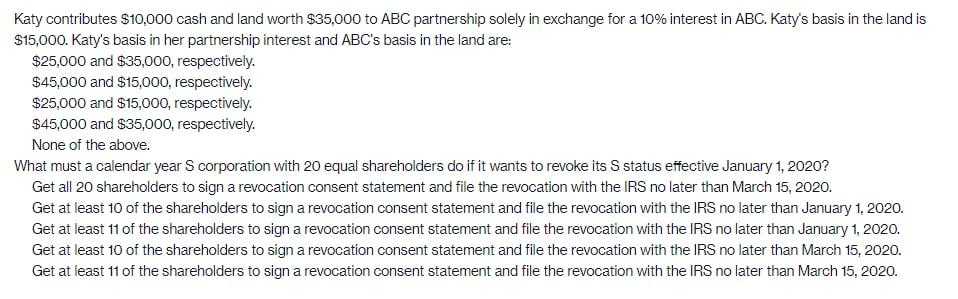

Katy contributes $10,000 cash and land worth $35,000 to ABC partnership solely in exchange for a 10% interest in ABC. Katy's basis in the land is $15,000. Katy's basis in her partnership interest and ABC's basis in the land are: $25,000 and $35,000, respectively. $45,000 and $15,000, respectively. $25,000 and $15,000, respectively. $45,000 and $35,000, respectively. None of the above. What must a calendar year S corporation with 20 equal shareholders do if it wants to revoke its S status effective January 1, 2020? Get all 20 shareholders to sign a revocation consent statement and file the revocation with the IRS no later than March 15, 2020. Get at least 10 of the shareholders to sign a revocation consent statement and file the revocation with the IRS no later than January 1, 2020. Get at least 11 of the shareholders to sign a revocation consent statement and file the revocation with the IRS no later than January 1, 2020. Get at least 10 of the shareholders to sign a revocation consent statement and file the revocation with the IRS no later than March 15, 2020. Get at least 11 of the shareholders to sign a revocation consent statement and file the revocation with the IRS no later than March 15, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts