Question: Please provide formulas and answer Question 3 20 pts ROR Inc. bought building for its headquarters in the year 2010. The purchase cost was 792969

Please provide formulas and answer

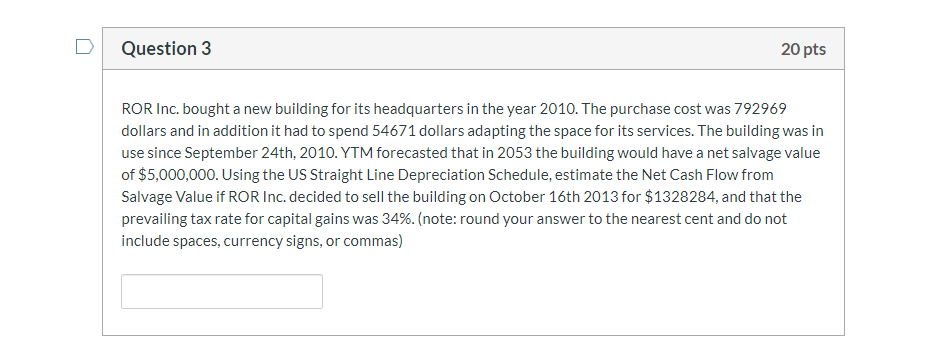

Question 3 20 pts ROR Inc. bought building for its headquarters in the year 2010. The purchase cost was 792969 a new dollars and in addition it had to spend 54671 dollars adapting the space for its services. The building was in use since September 24th, 2010. YTM forecasted that in 2053 the building would have a net salvage value of $5,000,000. Using the US Straight Line Depreciation Schedule, estimate the Net Cash Flow from Salvage Value if ROR Inc. decided to sell the building on October 16th 2013 for $1328284, and that the prevailing tax rate for capital gains was 34%. (note: round your answer to the nearest cent and do not include spaces, currency signs, or commas)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts