Question: Please provide formulas and help me complete yellow cells us or Deficit or Balanced Fashion Trends, Inc., a regional fashion apparel retailer, wants to prepare

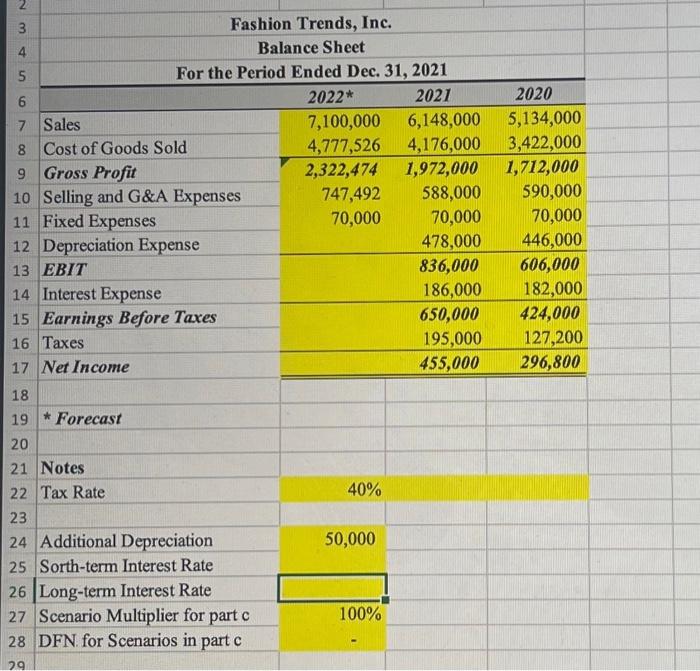

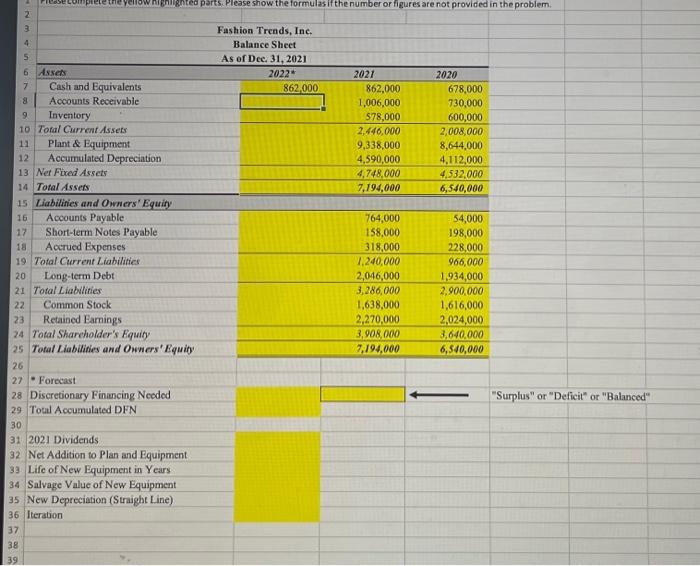

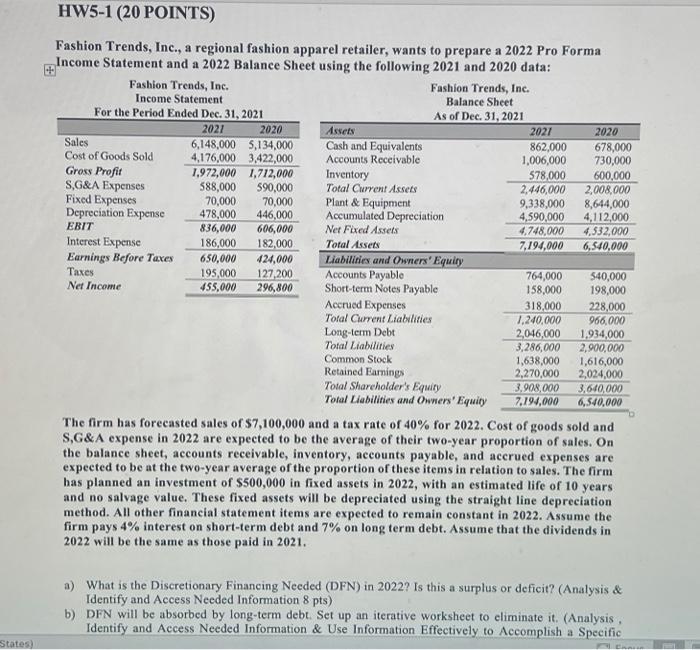

us" or "Deficit" or "Balanced" Fashion Trends, Inc., a regional fashion apparel retailer, wants to prepare a 2022 Pro Forma Income Statement and a 2022 Balance Sheet using the following 2021 and 2020 data: Fashion Trends, Inc. Income Statement Fashion Trends, Inc. The firm has forecasted sales of $7,100,000 and a tax rate of 40% for 2022 . Cost of goods sold and S,G\&A expense in 2022 are expected to be the average of their two-year proportion of sales. On the balance sheet, accounts receivable, inventory, accounts payable, and accrued expenses are expected to be at the two-year average of the proportion of these items in relation to sales. The firm has planned an investment of $500,000 in fixed assets in 2022 , with an estimated life of 10 years and no salvage value. These fixed assets will be depreciated using the straight line depreciation method. All other financial statement items are expected to remain constant in 2022. Assume the firm pays 4% interest on short-term debt and 7% on long term debt. Assume that the dividends in 2022 will be the same as those paid in 2021 . a) What is the Discretionary Financing Needed (DFN) in 2022? Is this a surplus or deficit? (Analysis \& Identify and Access Needed Information 8 pts) b) DFN will be absorbed by long-term debt. Set up an iterative worksheet to eliminate it. (Analysis, Identify and Access Needed Information \& Use Information Effectively to Accomplish a Specific Fashion Trends, Inc. Balance Sheet For the Period Ended Dec. 31, 2021 \begin{tabular}{|lrrr} \hline & \multicolumn{1}{c}{2022} & \multicolumn{1}{c}{2021} & \multicolumn{1}{c}{2020} \\ \hline Sales & 7,100,000 & 6,148,000 & 5,134,000 \\ \hline Cost of Goods Sold & 4,777,526 & 4,176,000 & 3,422,000 \\ \hline Gross Profit & 2,322,474 & 1,972,000 & 1,712,000 \\ Selling and G\&A Expenses & 747,492 & 588,000 & 590,000 \\ Fixed Expenses & 70,000 & 70,000 & 70,000 \\ Depreciation Expense & & 478,000 & 446,000 \\ \hline EBIT & & 836,000 & 606,000 \\ Interest Expense & & 186,000 & 182,000 \\ \hline Earnings Before Taxes & & 650,000 & 424,000 \\ Taxes & & 455,000 & 127,200 \\ \hline Net Income & & & 296,800 \\ \hline \hline \end{tabular} * Forecast Notes Tax Rate 40% Additional Depreciation 50,000 Sorth-term Interest Rate Long-term Interest Rate Scenario Multiplier for part c DFN for Scenarios in part c us" or "Deficit" or "Balanced" Fashion Trends, Inc., a regional fashion apparel retailer, wants to prepare a 2022 Pro Forma Income Statement and a 2022 Balance Sheet using the following 2021 and 2020 data: Fashion Trends, Inc. Income Statement Fashion Trends, Inc. The firm has forecasted sales of $7,100,000 and a tax rate of 40% for 2022 . Cost of goods sold and S,G\&A expense in 2022 are expected to be the average of their two-year proportion of sales. On the balance sheet, accounts receivable, inventory, accounts payable, and accrued expenses are expected to be at the two-year average of the proportion of these items in relation to sales. The firm has planned an investment of $500,000 in fixed assets in 2022 , with an estimated life of 10 years and no salvage value. These fixed assets will be depreciated using the straight line depreciation method. All other financial statement items are expected to remain constant in 2022. Assume the firm pays 4% interest on short-term debt and 7% on long term debt. Assume that the dividends in 2022 will be the same as those paid in 2021 . a) What is the Discretionary Financing Needed (DFN) in 2022? Is this a surplus or deficit? (Analysis \& Identify and Access Needed Information 8 pts) b) DFN will be absorbed by long-term debt. Set up an iterative worksheet to eliminate it. (Analysis, Identify and Access Needed Information \& Use Information Effectively to Accomplish a Specific Fashion Trends, Inc. Balance Sheet For the Period Ended Dec. 31, 2021 \begin{tabular}{|lrrr} \hline & \multicolumn{1}{c}{2022} & \multicolumn{1}{c}{2021} & \multicolumn{1}{c}{2020} \\ \hline Sales & 7,100,000 & 6,148,000 & 5,134,000 \\ \hline Cost of Goods Sold & 4,777,526 & 4,176,000 & 3,422,000 \\ \hline Gross Profit & 2,322,474 & 1,972,000 & 1,712,000 \\ Selling and G\&A Expenses & 747,492 & 588,000 & 590,000 \\ Fixed Expenses & 70,000 & 70,000 & 70,000 \\ Depreciation Expense & & 478,000 & 446,000 \\ \hline EBIT & & 836,000 & 606,000 \\ Interest Expense & & 186,000 & 182,000 \\ \hline Earnings Before Taxes & & 650,000 & 424,000 \\ Taxes & & 455,000 & 127,200 \\ \hline Net Income & & & 296,800 \\ \hline \hline \end{tabular} * Forecast Notes Tax Rate 40% Additional Depreciation 50,000 Sorth-term Interest Rate Long-term Interest Rate Scenario Multiplier for part c DFN for Scenarios in part c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts