Question: please provide formulas Chapter 3 - Master it! The extensible Business Reporting Language (XBRL) is likely the future of financial reporting. XBRL is a computer

please provide formulas

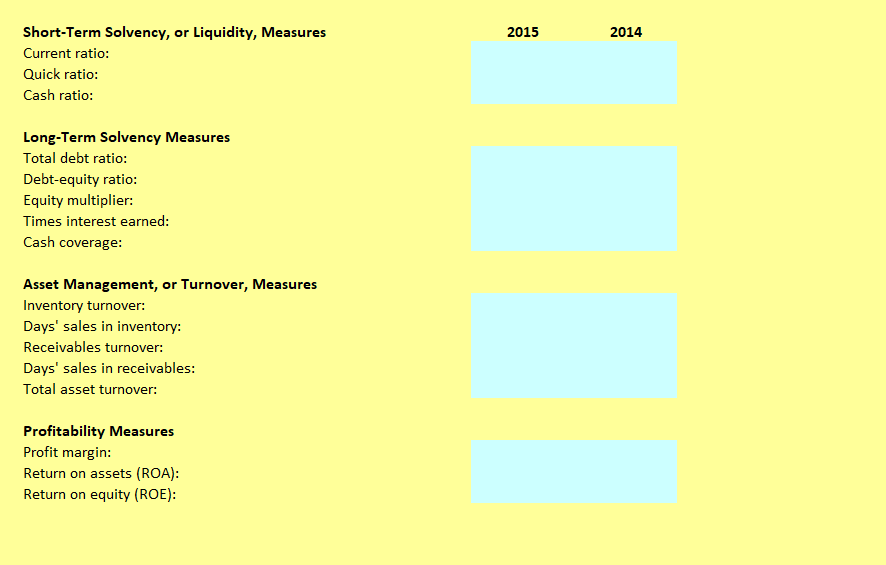

Chapter 3 - Master it! The extensible Business Reporting Language (XBRL) is likely the future of financial reporting. XBRL is a computer language that "tags" each item and specifies what that item is. XBRL reporting has already been adopted for use in Australia, Japan, and the United Kingdom. As of early 2009, a Securities and Exchange Commission advisory committee has recommended that U.S. companies be required to submit financial reports to the SEC in XBRL format. It has been suggested that requiring XBRL be gradually implemented, so it could be several years before we see all companies file XBRL financial reports. All listed U.S. companies file electronic reports with the SEC, but the reports are only available in html or text format. XBRL reporting will allow investors to quickly download financial statements for analysis. Currently, several companies voluntarily submit financial statements in XBRL format. For this assignment, go to the SEC website at www.sec.gov. Once there search for a company and click the link that says "Interactive Data" in the report list and follow the link. Now follow the "Interactive Data Viewers" link, then "Interactive Financial Reports." Download the income statement and balance sheet from the annual report for the company you chose. Using these reports, calculate the financial ratios for the company from the data available, typically two or three years. Do you notice any changes in these ratios that might 2015 2014 Short-Term Solvency, or Liquidity, Measures Current ratio: Quick ratio: Cash ratio: Long-Term Solvency Measures Total debt ratio: Debt-equity ratio: Equity multiplier: Times interest earned: Cash coverage: Asset Management, or Turnover, Measures Inventory turnover: Days' sales in inventory: Receivables turnover: Days' sales in receivables: Total asset turnover: Profitability Measures Profit margin: Return on assets (ROA): Return on equity (ROE)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts