Question: Please provide formulas on excel for empty cells! :) You plan to purchase 100 shares of EXCO today, and sell them 12 years from today

Please provide formulas on excel for empty cells! :)

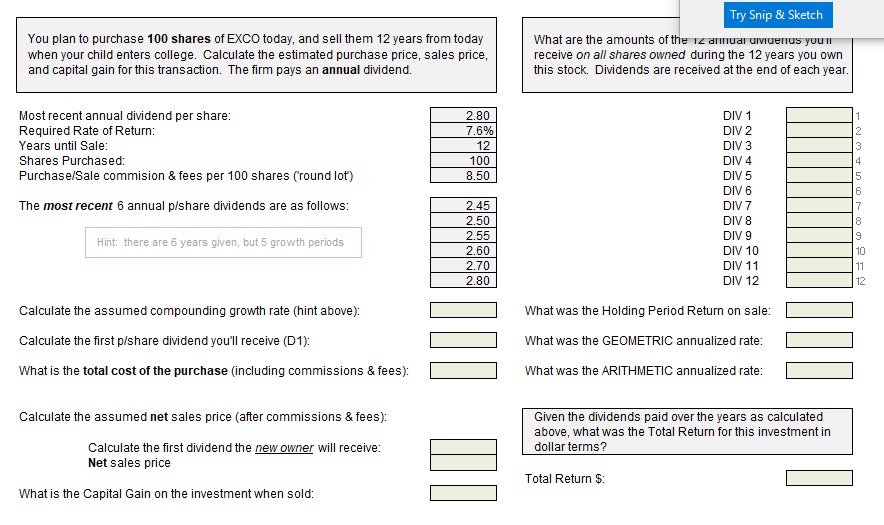

You plan to purchase 100 shares of EXCO today, and sell them 12 years from today when your child enters college. Calculate the estimated purchase price, sales price, and capital gain for this transaction. The firm pays an annual dividend. Try Snip & Sketch What are the amounts of the iz armuar urvivenus your receive on all shares owned during the 12 years you own this stock. Dividends are received at the end of each year. Most recent annual dividend per share: Required Rate of Return: Years until Sale: Shares Purchased Purchase/Sale commision & fees per 100 shares (round lot) The most recent 6 annual p/share dividends are as follows: 2.80 7.6% 12 100 8.50 DIV 1 DIV 2 DIV 3 DIV 4 DIV 5 DIV 6 DIV 7 DIV 8 DIV 9 DIV 10 DIV 11 DIV 12 1 2 3 4 5 6 7 8 9 10 11 12 Hint: there are 6 years given, but 5 growth periods 2.45 2.50 2.55 2.60 2.70 2.80 Calculate the assumed compounding growth rate (hint above): Calculate the first p/share dividend you'll receive (D1): What is the total cost of the purchase (including commissions & fees): 000 What was the Holding Period Return on sale: What was the GEOMETRIC annualized rate: What was the ARITHMETIC annualized rate: Calculate the assumed net sales price (after commissions & fees): Calculate the first dividend the new owner will receive: Net sales price Given the dividends paid over the years as calculated above, what was the Total Return for this investment in dollar terms? ULI Total Return $: What is the Capital Gain on the investment when sold: You plan to purchase 100 shares of EXCO today, and sell them 12 years from today when your child enters college. Calculate the estimated purchase price, sales price, and capital gain for this transaction. The firm pays an annual dividend. Try Snip & Sketch What are the amounts of the iz armuar urvivenus your receive on all shares owned during the 12 years you own this stock. Dividends are received at the end of each year. Most recent annual dividend per share: Required Rate of Return: Years until Sale: Shares Purchased Purchase/Sale commision & fees per 100 shares (round lot) The most recent 6 annual p/share dividends are as follows: 2.80 7.6% 12 100 8.50 DIV 1 DIV 2 DIV 3 DIV 4 DIV 5 DIV 6 DIV 7 DIV 8 DIV 9 DIV 10 DIV 11 DIV 12 1 2 3 4 5 6 7 8 9 10 11 12 Hint: there are 6 years given, but 5 growth periods 2.45 2.50 2.55 2.60 2.70 2.80 Calculate the assumed compounding growth rate (hint above): Calculate the first p/share dividend you'll receive (D1): What is the total cost of the purchase (including commissions & fees): 000 What was the Holding Period Return on sale: What was the GEOMETRIC annualized rate: What was the ARITHMETIC annualized rate: Calculate the assumed net sales price (after commissions & fees): Calculate the first dividend the new owner will receive: Net sales price Given the dividends paid over the years as calculated above, what was the Total Return for this investment in dollar terms? ULI Total Return $: What is the Capital Gain on the investment when sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts