Question: please provide full explanation answer. On September 5, 2020, Nelson Lumber purchased timber rights in Northern Quebec for $540,000, paying $108,000 cash and the balance

please provide full explanation answer.

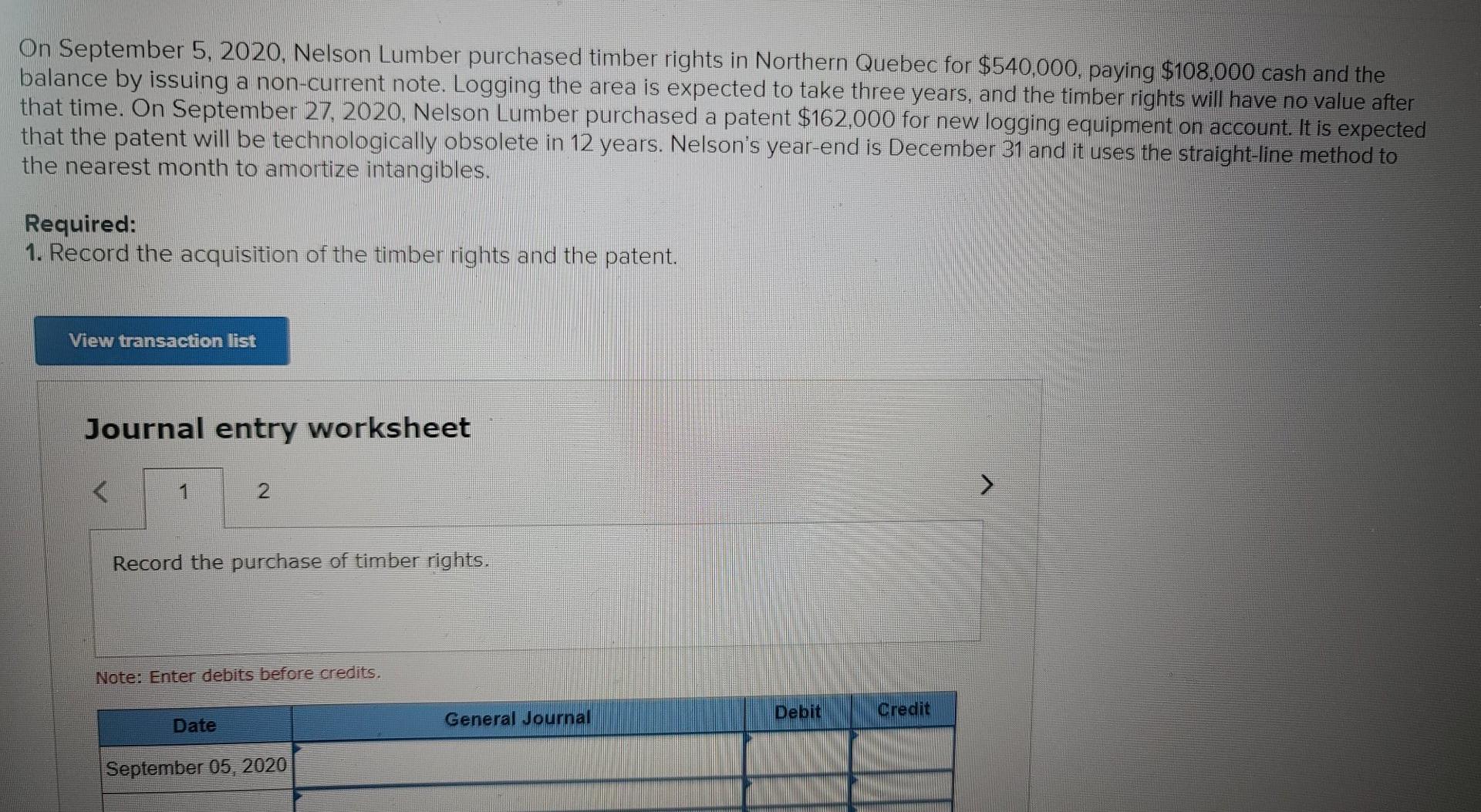

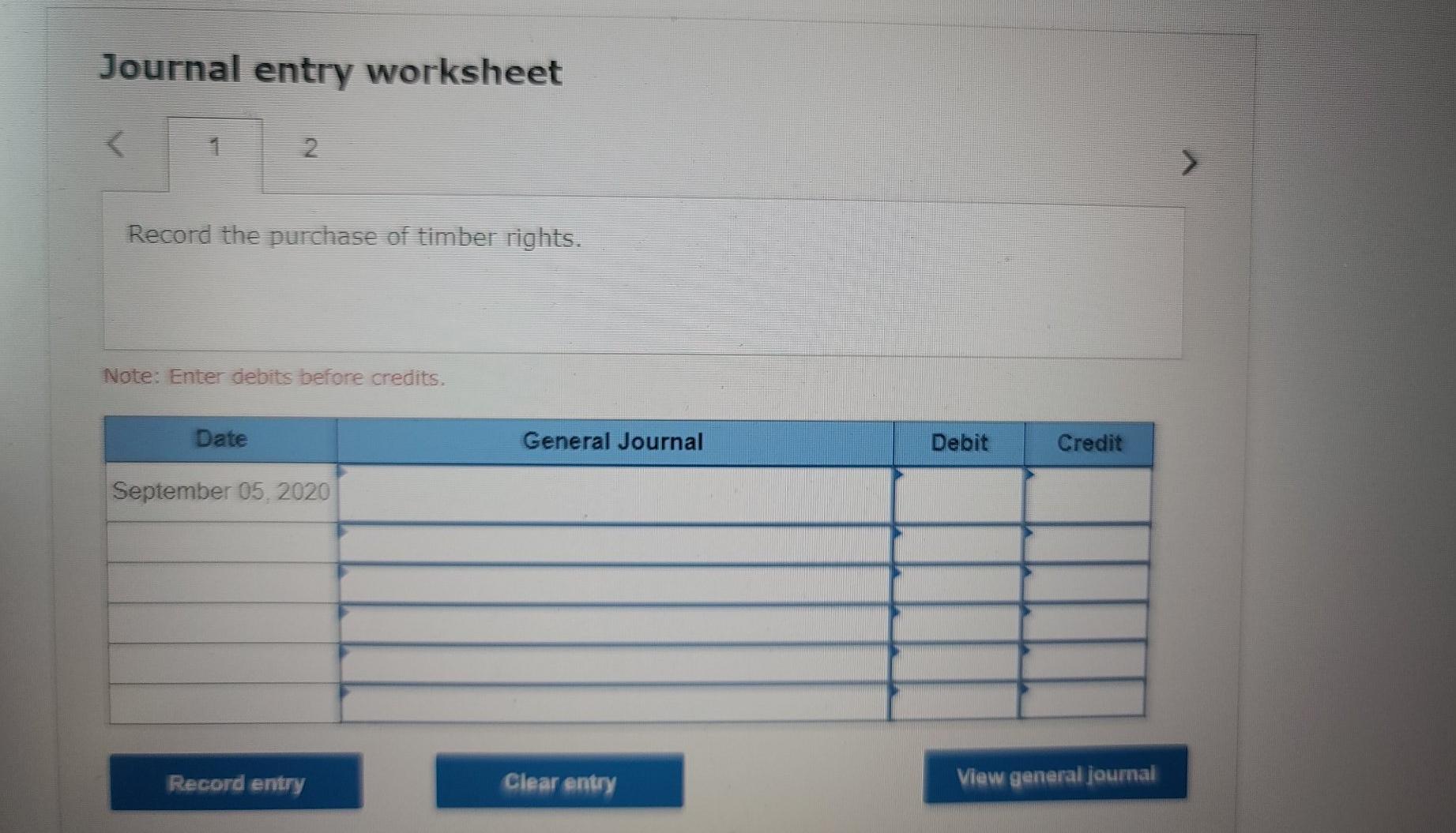

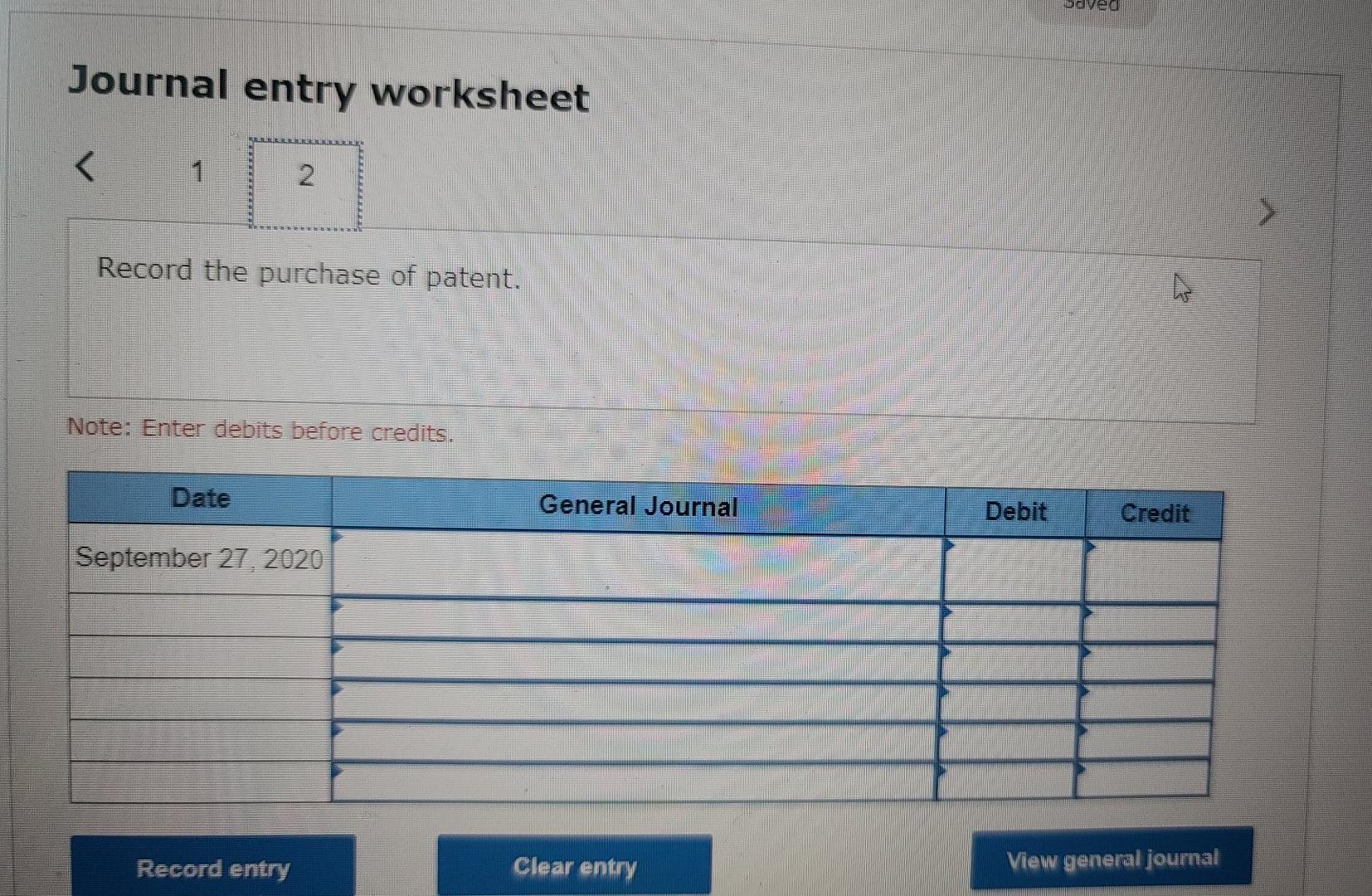

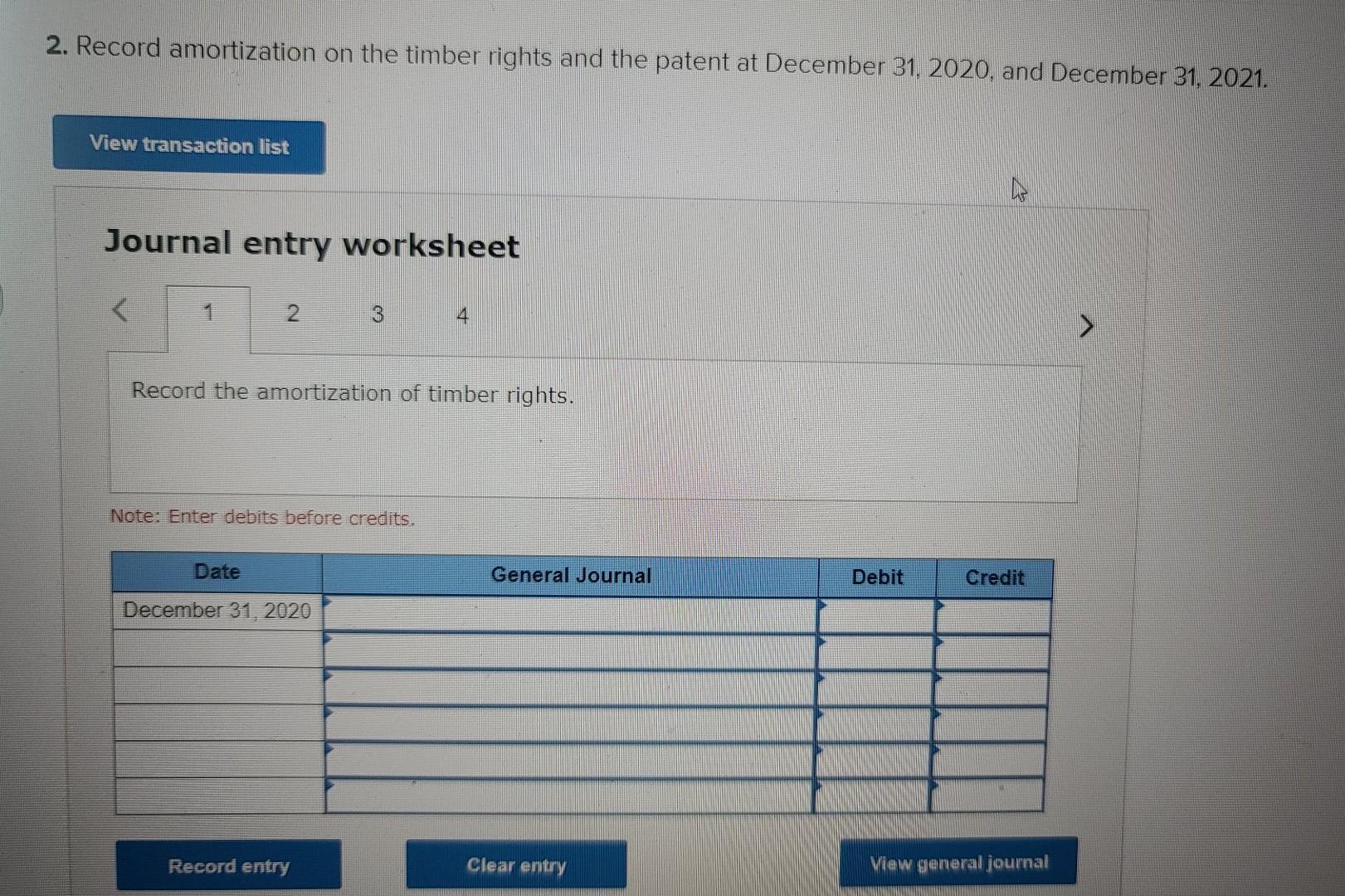

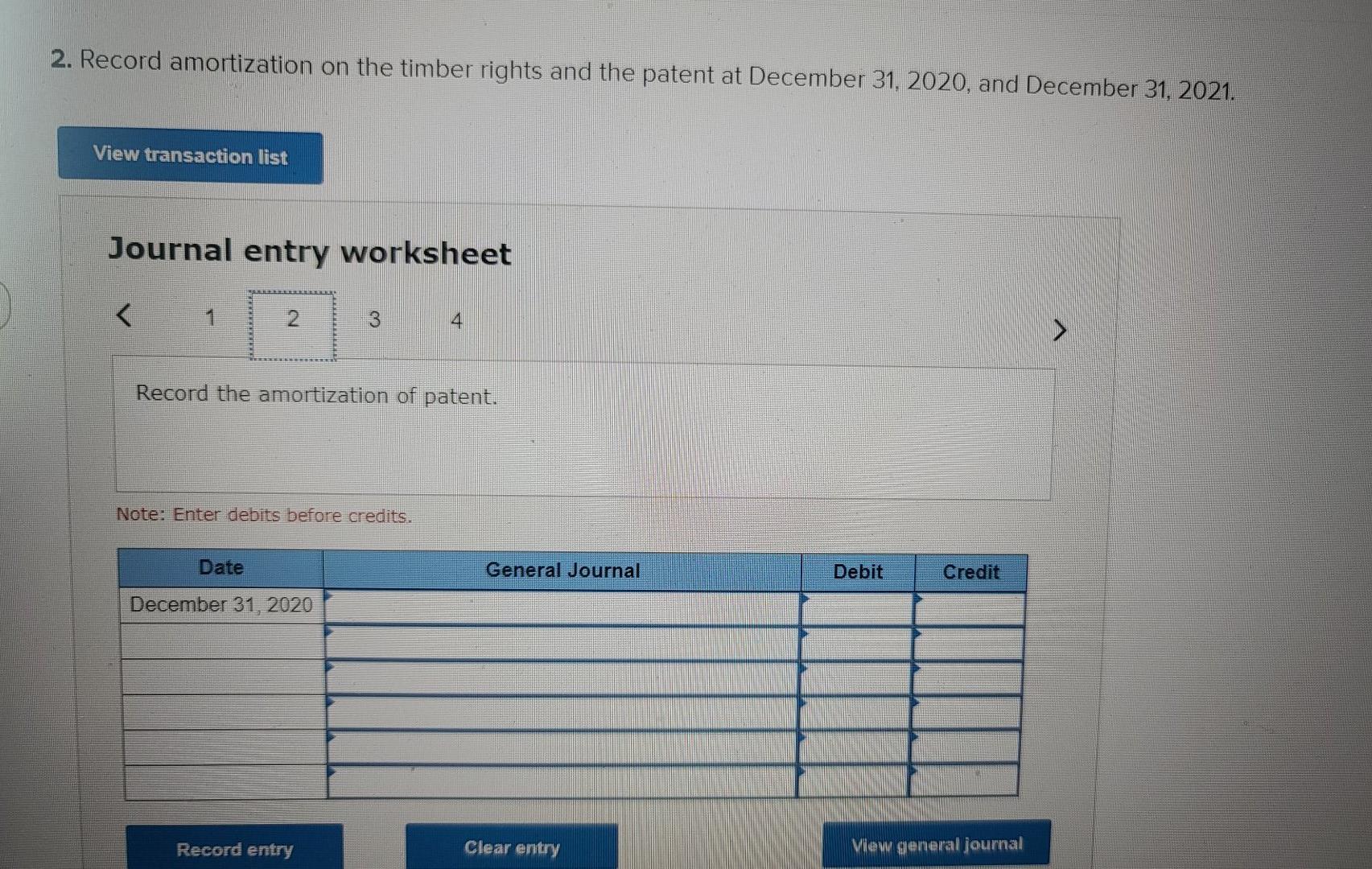

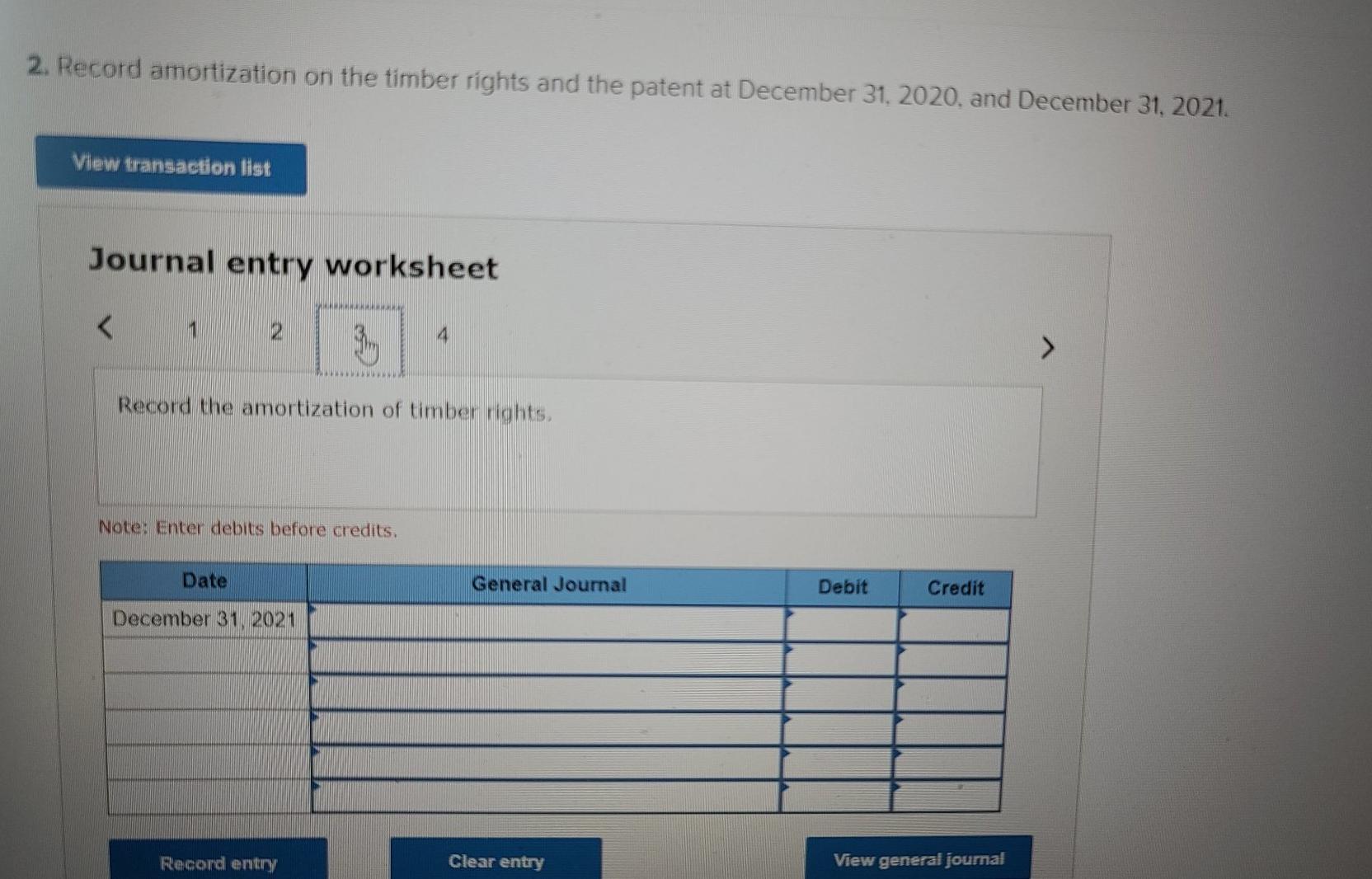

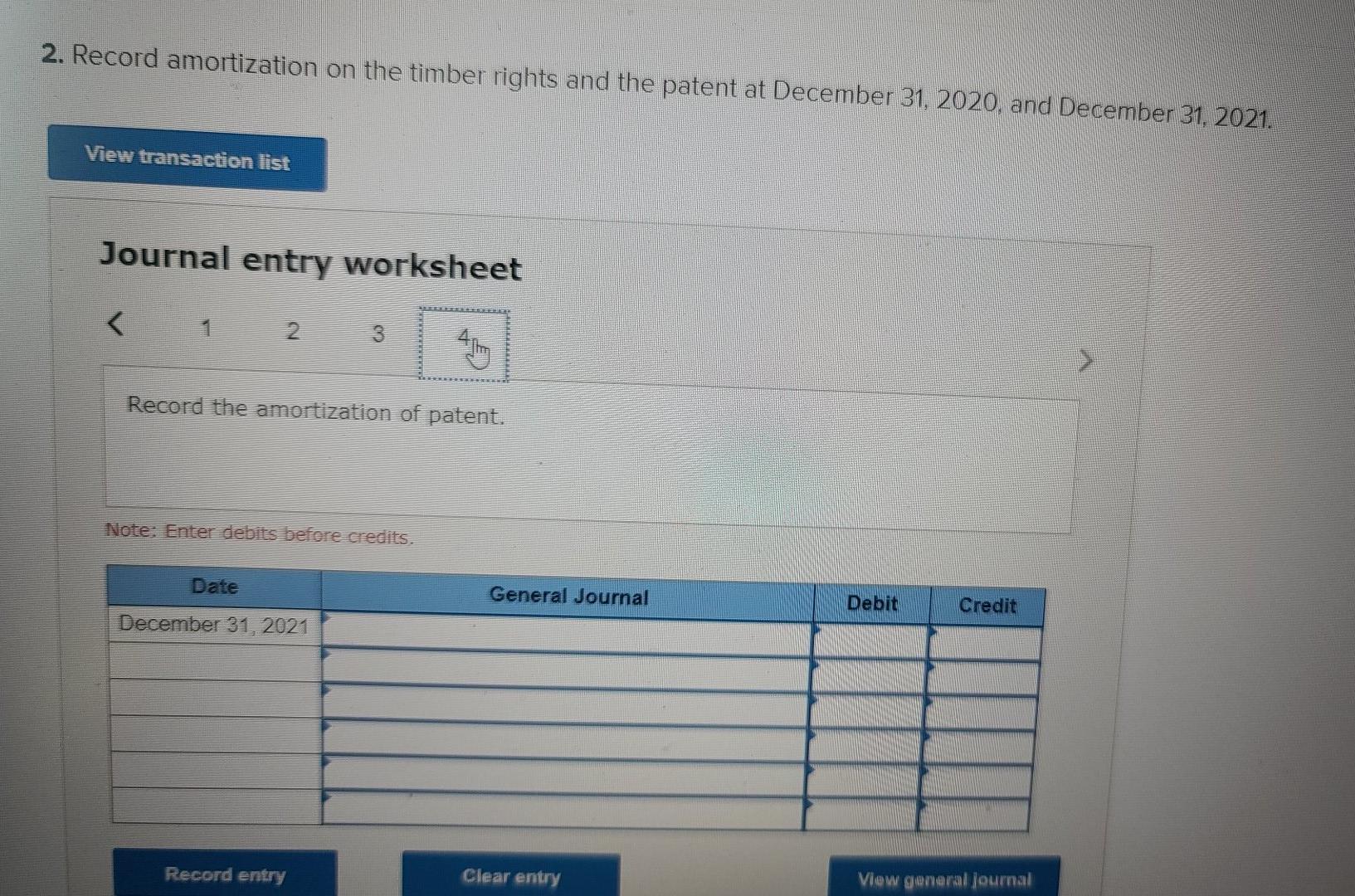

On September 5, 2020, Nelson Lumber purchased timber rights in Northern Quebec for $540,000, paying $108,000 cash and the balance by issuing a non-current note. Logging the area is expected to take three years, and the timber rights will have no value after that time. On September 27, 2020, Nelson Lumber purchased a patent $162,000 for new logging equipment on account. It is expected that the patent will be technologically obsolete in 12 years. Nelson's year-end is December 31 and it uses the straight-line method to the nearest month to amortize intangibles. Required: 1. Record the acquisition of the timber rights and the patent. View transaction list Journal entry worksheet 1 2 Record the purchase of timber rights. Note: Enter debits before credits. Debit Credit Date General Journal September 05, 2020 Journal entry worksheet 2. Record the purchase of timber rights. Note: Enter debits before credits. Date General Journal Debit Credit September 05, 2020 Record entry Clear entry View general journal OVEO Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts