Question: Please provide full solution On 1 July 2013, River Ltd acquired all the assets and liabilities of Creek Ltd (a manufacturing company). Creek Ltd has

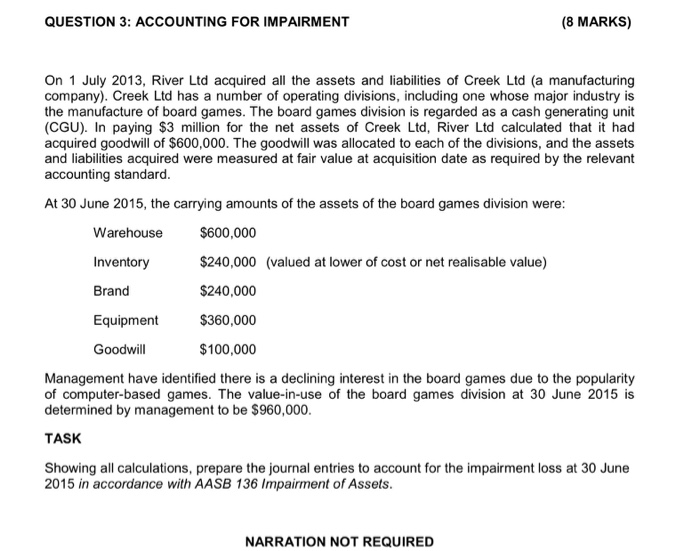

On 1 July 2013, River Ltd acquired all the assets and liabilities of Creek Ltd (a manufacturing company). Creek Ltd has a number of operating divisions, including one whose major industry is the manufacture of board games. The board games division is regarded as a cash generating unit (CGU). In paying exist3 million for the net assets of Creek Ltd, River Ltd calculated that it had acquired goodwill of exist600,000. The goodwill was allocated to each of the divisions, and the assets and liabilities acquired were measured at fair value at acquisition date as required by the relevant accounting standard. At 30 June 2015, the carrying amounts of the assets of the board games division were: Warehouse exist600,000 Inventory exist240,000 (valued at lower of cost or net realisable value) Brand exist240,000 Equipment exist360,000 Goodwill exist100,000 Management have identified there is a declining interest in the board games due to the popularity of computer-based games. The value-in-use of the board games division at 30 June 2015 is determined by management to be exist960,000. Showing all calculations, prepare the journal entries to account for the impairment loss at 30 June 2015 in accordance with AASB 136 Impairment of Assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts