Question: please provide full step by step answers with clear explanation and highlights and bold the answer On December 31, 2020, Toro Company's Allowance for Doubtful

please provide full step by step answers with clear explanation and highlights and bold the answer

please provide full step by step answers with clear explanation and highlights and bold the answer

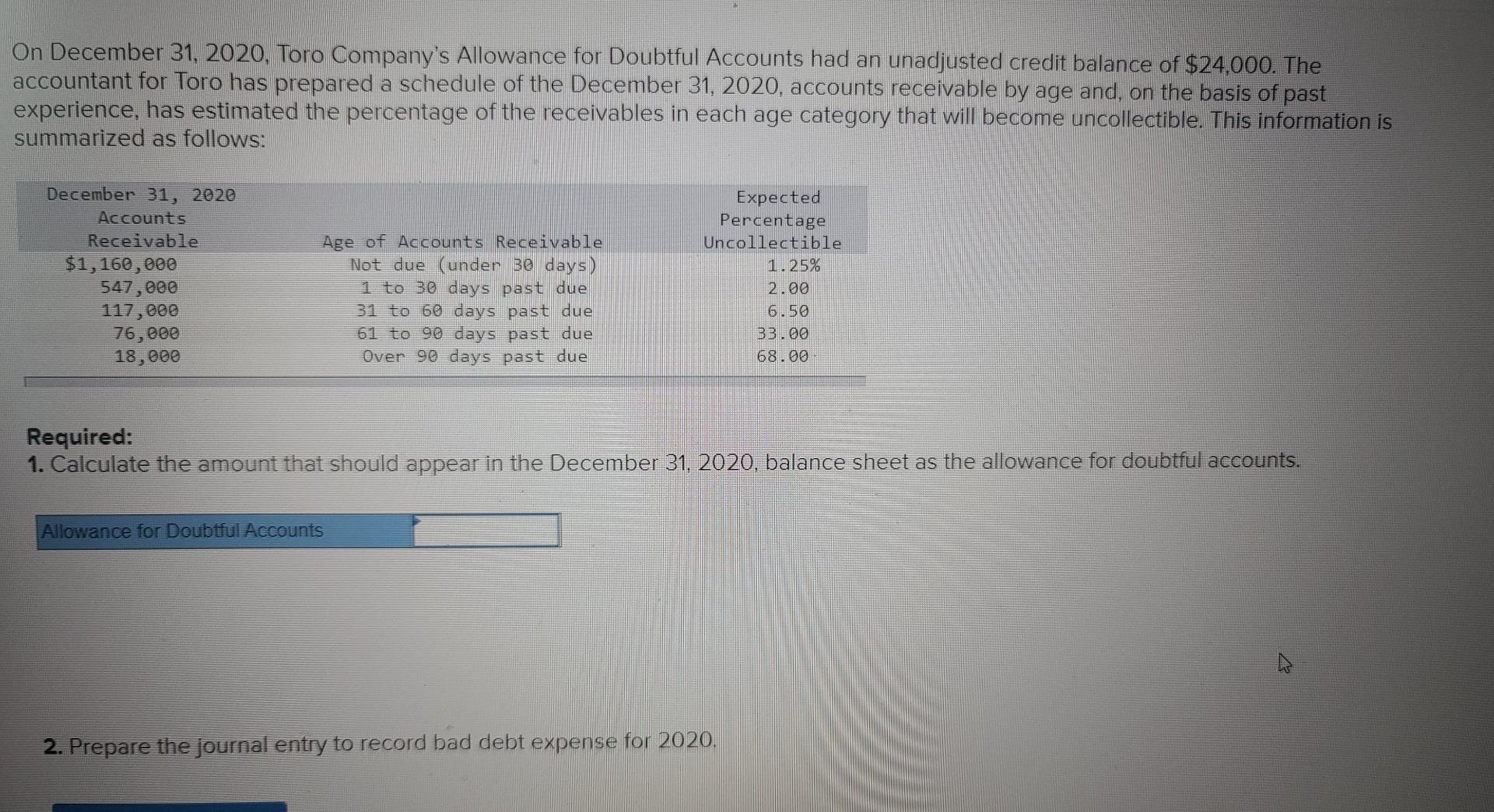

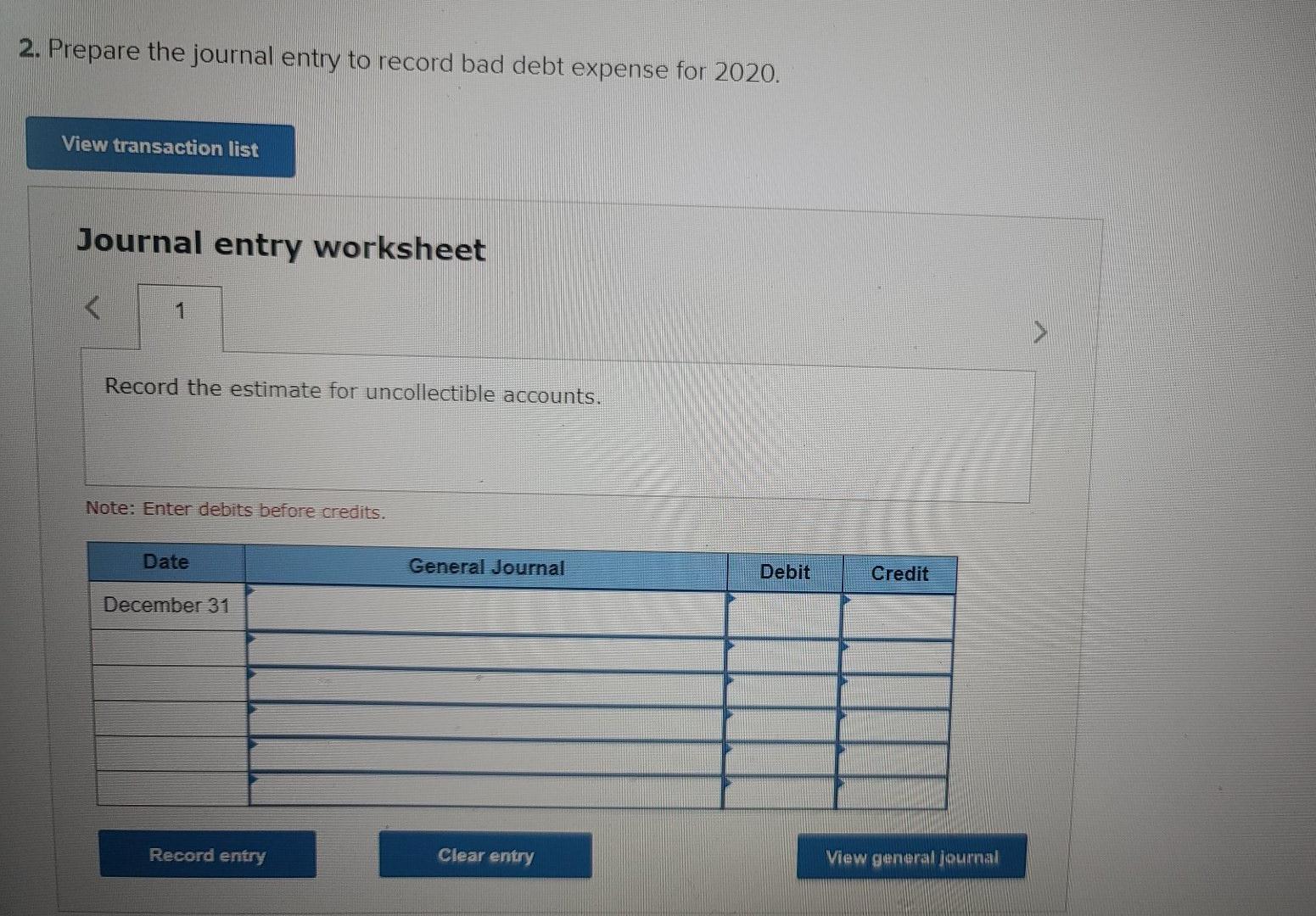

On December 31, 2020, Toro Company's Allowance for Doubtful Accounts had an unadjusted credit balance of $24,000. The accountant for Toro has prepared a schedule of the December 31, 2020, accounts receivable by age and, on the basis of past experience, has estimated the percentage of the receivables in each age category that will become uncollectible. This information is summarized as follows: December 31, 2020 Accounts Receivable $1,160,000 547,000 117,000 76,000 18,000 Age of Accounts Receivable Not due (under 30 days) 1 to 30 days past due 31 to 60 days past due 61 to 90 days past due Over 90 days past due Expected Percentage Uncollectible Allowance for Doubtful Accounts Required: 1. Calculate the amount that should appear in the December 31, 2020, balance sheet as the allowance for doubtful accounts. 1.25% 2.00 6.50 33.00 68.00 2. Prepare the journal entry to record bad debt expense for 2020.

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

1 Accounts receivable a Expected percentage uncollectible b Expect... View full answer

Get step-by-step solutions from verified subject matter experts