Question: please provide me the answer for a and b Buffalo Limited purchased an asset at a cost of $40.000 on March 1, 2023. The asset

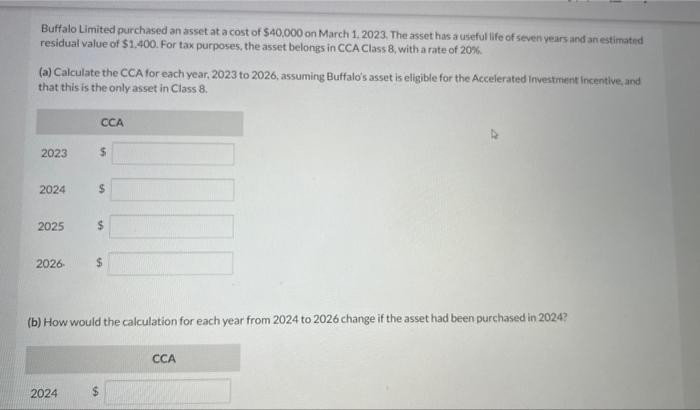

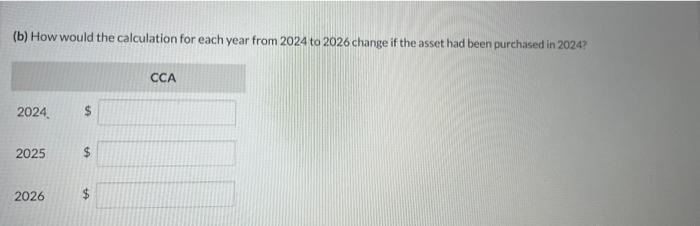

Buffalo Limited purchased an asset at a cost of $40.000 on March 1, 2023. The asset has a useful life of seven years and an estimated residual value of $1,400. For tax purposes, the asset belongs in CCA Class 8 , with a rate of 20%. (a) Calculate the CCA for each year, 2023 to 2026, assuming Buffalo's asset is eligible for the Accelerated Investmient incentive, and that this is the only asset in Class 8. (b) How would the calculation for each year from 2024 to 2026 change if the asset had been purchased in 2024 ? (b) How would the calculation for each year from 2024 to 2026 change if the asset had been purchased in 2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts