Question: You have been approached by a food retailer that is interested in buying into the largest food wholesaler in Kenya. He has asked you

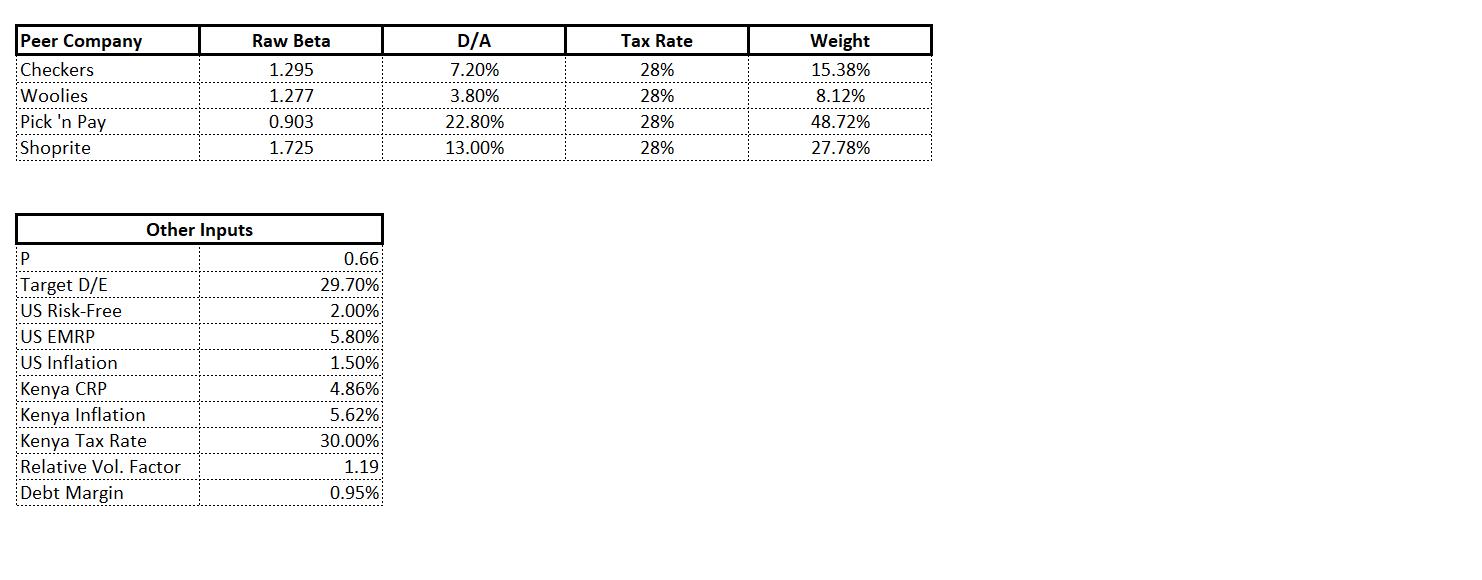

You have been approached by a food retailer that is interested in buying into the largest food wholesaler in Kenya. He has asked you to assist in calculating an appropriate WACC for his valuation, and specifically requested that you apply the Damodaran international cost of capital method. Using the data provided, calculate the cost and equity and WACC. Peer Company Checkers Woolies --------- ------------ Pick 'n Pay Shoprite P Target D/E US Risk-Free ...... --------------------- US EMRP ....... US Inflation ------------ Kenya CRP Kenya Inflation Kenya Tax Rate --------------------- Relative Vol. Factor Debt Margin Raw Beta 1.295 1.277 0.903 1.725 Other Inputs 0.66 *********** 29.70% 2.00% 5.80% . 1.50% ... 4.86% 5.62% 30.00% ....... 1.19 ......... 0.95% ...... D/A 7.20% 3.80% 22.80% 13.00% Tax Rate 28% 28% 28% 28% Weight 15.38% 8.12% ... 48.72% 27.78%

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts