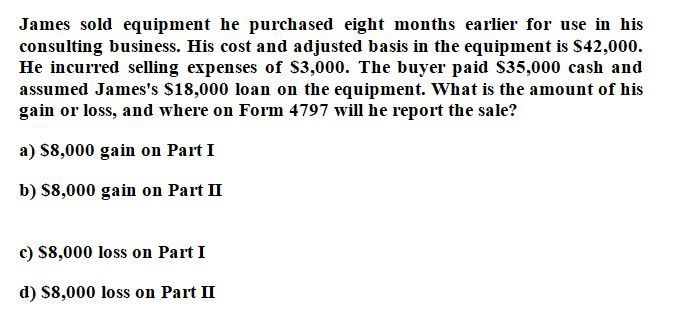

Question: Please provide problem with accounting question James sold equipment he purchased eight months earlier for use in his consulting business. His cost and adjusted basis

Please provide problem with accounting question

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock