Question: please provide required material to the three problems. Thumbs up will follow! Gold Star Rice, Ltd., of Thailand exports Thal rice throughout Asia. The company

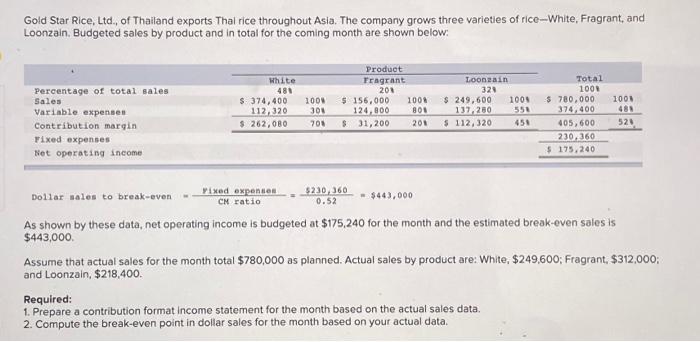

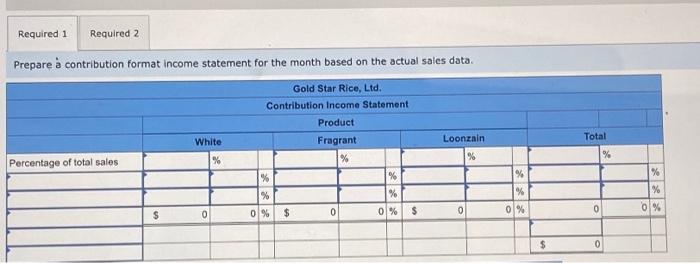

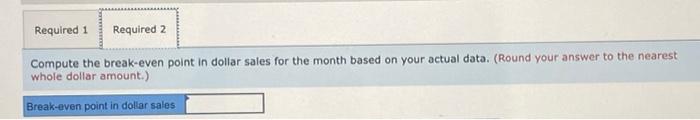

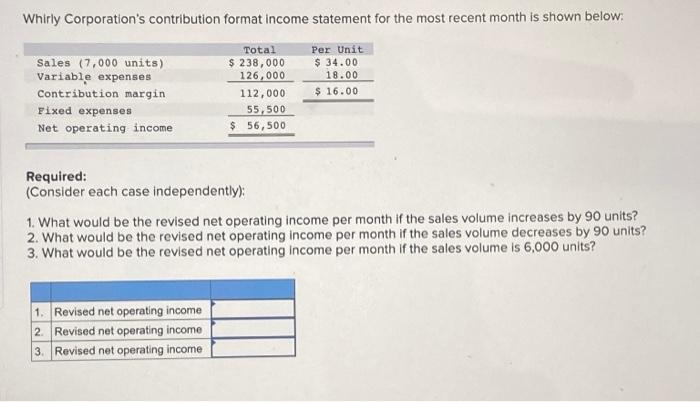

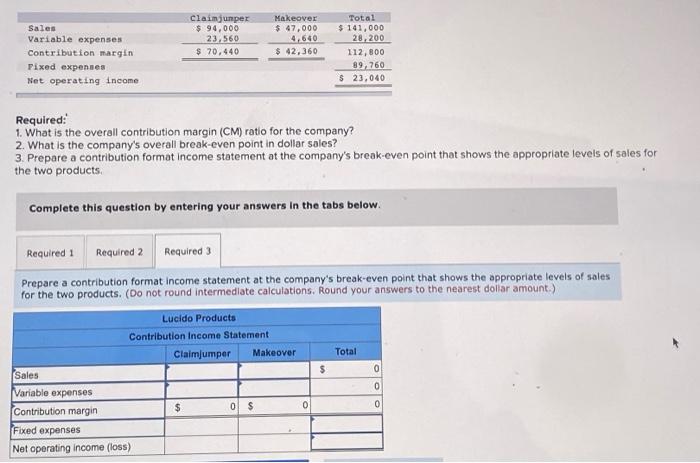

Gold Star Rice, Ltd., of Thailand exports Thal rice throughout Asia. The company grows three varieties of rice-White, Fragrant, and Loonzain. Budgeted sales by product and in total for the coming month are shown below: Percentage of total sales Sales Variable expenses Contribution margin Fixed expenses Not operating income White 481 $ 374,400 112,320 $ 262,080 1005 304 705 Product Fragrant 200 $ 156,000 1004 124,000 800 $ 31,200 201 Loonaan 320 $ 249,600 1005 137,280 550 $ 112,320 450 Total 100% $ 780,000 374,400 405,600 230,360 $ 175,240 1000 485 520 Dollar sales to break-even Fixed expenses $ 230, 2360 - $443,000 CM ratio 0.52 As shown by these data, net operating income is budgeted at $175,240 for the month and the estimated break-even sales is $443,000 Assume that actual sales for the month total $780,000 as planned. Actual sales by product are: White, $249,600; Fragrant, $312,000: and Loonzain, $218,400. Required: 1. Prepare a contribution format Income statement for the month based on the actual sales data. 2. Compute the break-even point in dollar sales for the month based on your actual data Required 1 Required 2 Prepare a contribution format income statement for the month based on the actual sales data. Gold Star Rice, Ltd. Contribution Income Statement Product White Fragrant Loonzain Percentage of total sales % % % % % $ 0 $ 0 % $ Total % % % % % % % 0 % 0 0 ols 0 % 0 $ 0 Required 1 Required 2 Compute the break-even point in dollar sales for the month based on your actual data. (Round your answer to the nearest whole dollar amount.) Break-even point in dollar salos Whirly Corporation's contribution format income statement for the most recent month is shown below: Sales (7,000 units) Variable expenses Contribution margin Fixed expenses Net operating income Total $ 238,000 126,000 112,000 55,500 $ 56,500 Per Unit $ 34.00 18.00 $ 16.00 Required: (Consider each case independently): 1. What would be the revised net operating income per month if the sales volume increases by 90 units? 2. What would be the revised net operating income per month if the sales volume decreases by 90 units? 3. What would be the revised net operating income per month if the sales volume is 6,000 units? 1. Revised net operating income 2. Revised net operating income 3. Revised net operating income Claimjumper $ 94,000 23.560 $ 70.440 Makeover $ 47,000 4,640 $ 42,360 Sales Variable expenses Contribution margin Pixed expenses Net operating income Total $ 141,000 28,200 112,800 89,760 $ 23,040 Required: 1. What is the overall contribution margin (CM) ratio for the company? 2. What is the company's overall break-even point in dollar sales? 3. Prepare a contribution format income statement at the company's break-even point that shows the appropriate levels of sales for the two products Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a contribution format income statement at the company's break-even point that shows the appropriate levels of sales for the two products. (Do not round intermediate calculations. Round your answers to the nearest dollar amount.) Lucido Products Contribution Income Statement Claimjumper Makeover Total $ 0 0 $ 0 0 Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) 0 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts