Question: please provide sol X. Miguel Inc. has a contract with its president, Nan Santos, to pay her a bonus during each of the years 2019,

please provide sol

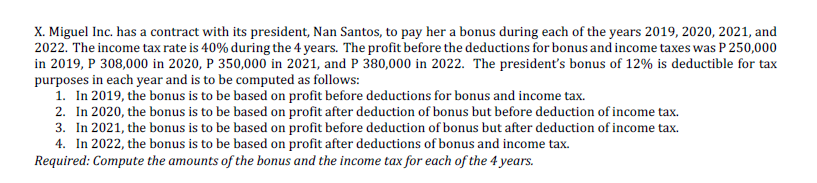

X. Miguel Inc. has a contract with its president, Nan Santos, to pay her a bonus during each of the years 2019, 2020, 2021, and 2022. The income tax rate is 40% during the 4 years. The profit before the deductions for bonus and income taxes was P 250,000 in 2019, P 308,000 in 2020, P 350,000 in 2021, and P 380,000 in 2022. The president's bonus of 12% is deductible for tax purposes in each year and is to be computed as follows: 1. In 2019, the bonus is to be based on profit before deductions for bonus and income tax. 2. In 2020, the bonus is to be based on profit after deduction of bonus but before deduction of income tax. 3. In 2021, the bonus is to be based on profit before deduction of bonus but after deduction of income tax. 4. In 2022, the bonus is to be based on profit after deductions of bonus and income tax. Required: Compute the amounts of the bonus and the income tax for each of the 4 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts