Question: please provide solution. last post in chegg sample solution; 7. 42. X, and Yare in partnership, sharing prolits equally and preparing their accounts to 31

please provide solution. last post in chegg

sample solution;

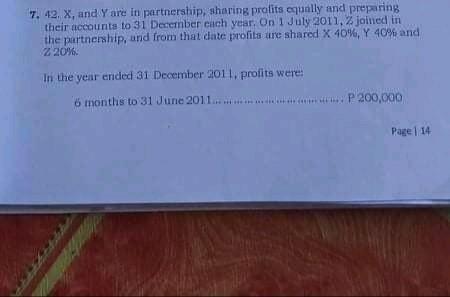

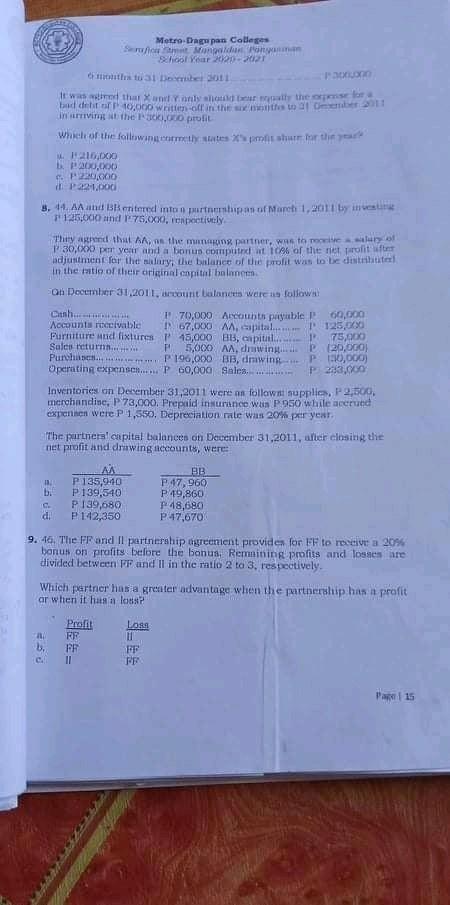

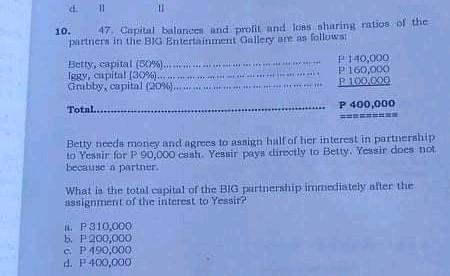

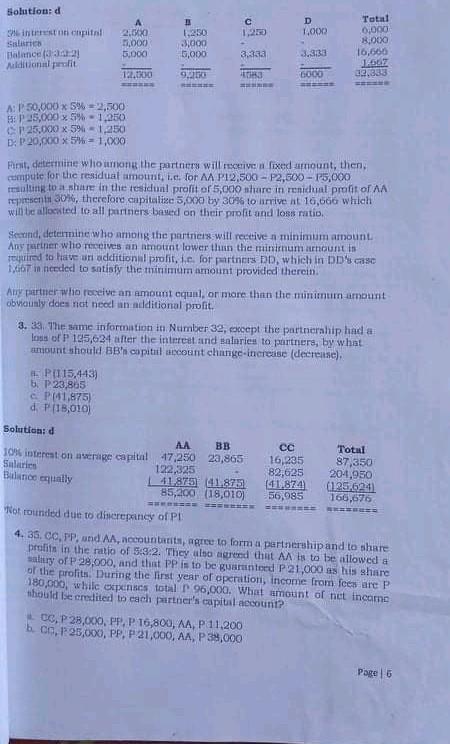

7. 42. X, and Yare in partnership, sharing prolits equally and preparing their accounts to 31 December each year. On 1 July 2011, joined in the partnership, and from that date profits are shared X 40%, Y 40% and 2 20% In the year ended 31 December 2011. profits were: 6 months to 31 June 2011..... P200,000 Page 14 Metro Dagupan Colleges Strong chorion school Year 2002 Contrato at Dober 2011 ward the only and the one for od 10.000 White of the member Un visit the profil 210.000 P200,000 P20,000 in P42 pod 3. 11 AA and Bountered into a partnership of March 1, 2011 by in T125.000 and 75.000, respectively They do the managing partner, was to me P 30,00 per year and a bonus compt at 10% of the metrolitiet adjustment for the mury, the Lalance of the prolit was to be distribute in the ratio of their original capital balance u December 31, 2011, account balances were as follow Cush... 70,000 Accounts payable P 60,000 Wocount rolvable IN 67,000A, pital. 125,000 Purniture and fixtures P45,000 B1, capital 1 75,000 Sales return... P5.000 AA. dmwing P20,000) Purchase P 190.000 BB, drawing P=0,000) Operating expensch... P60,000 Sales.... P233.000 Inventories on December 31, 2011 were an follow supplies, P2,500 merchandine, P73,000. Prepaid insurance wan P.950 while accrued exponen were P 1,550, Depreciation rate was 20% per year. The partnera capital balance on December 31,2011, alter closing the net profit and drawing accounts, were BB P135,940 P. 47,960 bi P139,540 P 49,860 P139,080 48,680 d P 142,350 P47,670 9. 16. The FF and Il partnership Agreement provides for FF to recive a 20% bonus on profits before the bonus, Remmining profits and losses inte divided between FF and Il in the ratio 2 to 3. respectively. Which partner has a greater advantage when the partnership has a profit ar when it has a loss Profil FE PE II Lasa 11 FF FR Part 15 11 11 10. 47 Capital balance and profit and load sharing ratio of the partners in the BIG Entertainment Gallery are as follows Betty, capital (30%).............. P140,000 Iggy, capital (30%)..... P160,000 Grubby, capital (20%). POO.000 Totnl.......... P 400,000 Betty needs money and agrees to nsnign half of her interest in partnership to Yessir for p 90,000 cash. Yessir pava directly to Betty. Yestir does not because s partner. What in the total capital of the BIG partnership immediately after the assignment of the interest to Yessir IP 810,000 b. P 200.000 c. P 490,000 d. P 400,000 Solution: 1,200 D 1.000 1.250 intestinal Siste Balance 302 Auditional pealt 2.000 1000 5.000 3000 5,000 Total 0,000 8.000 16,666 JEZ 32.333 3,33 3.333 12.000 9 10 6000 A: P50,000 x 5% = 2,500 35,000 x 5% -1,250 25,000 x 5% -1,250 D: 20,000 x 5% = 1,0x70 Frit, determine who among the partners will receive fixed mount, then compute for the residual amount tc. for MA P12,500 - P2,500 - 15,000 ating to a share in the residual profit of 5,000 share in renical profit of AA present 308, therefore capitalize 5,000 by 30% to arrive at 16,666 which will be allocated to all puriners based on their profit and loss ratio. Secund, determine who among the partners will receive a minimum amount Any uriner who receives an amotrat lower than the minimum annuntis required to be url additional profit, ic. for partners DD, which in DD's caso 17 in needed to satisfy the minimum amount provided therein Any partner who receive an amount equal, or more than the minimum amount obviously does not need an additional profit. 3.3. The same information in Number 32, coept the partnership had a lots of P 125,624 after the interest and salaries to partners, by what sniount should BB'n capitil ccount change increase (decrease), P1115,443) 5 P 23,865

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts