Question: The following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed

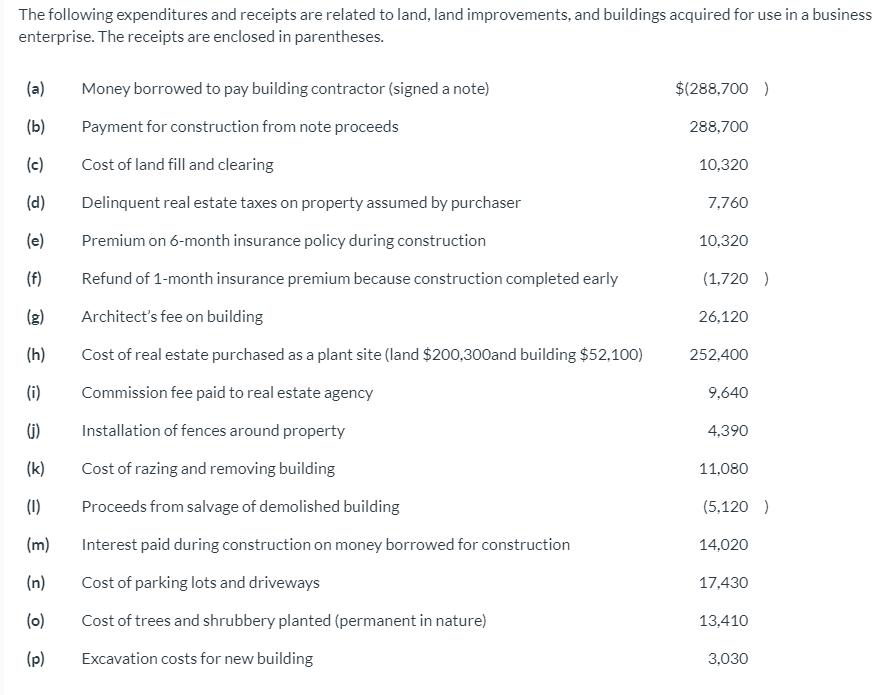

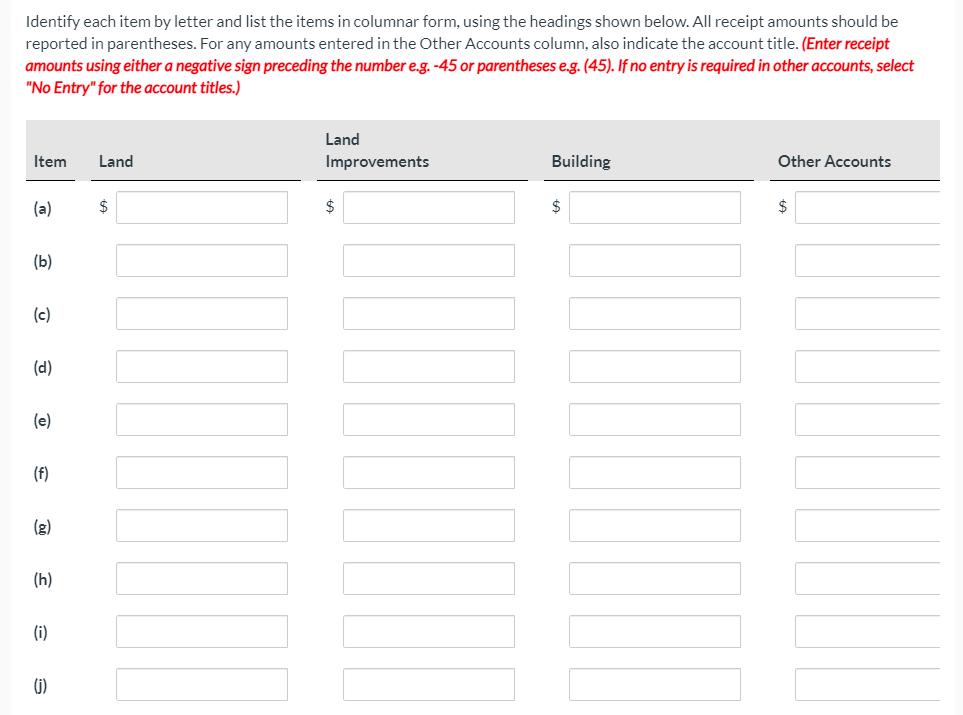

The following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. The receipts are enclosed in parentheses. (a) Money borrowed to pay building contractor (signed a note) $(288,700 ) (b) Payment for construction from note proceeds 288,700 (c) Cost of land fill and clearing 10,320 (d) Delinquent real estate taxes on property assumed by purchaser 7,760 (e) Premium on 6-month insurance policy during construction 10,320 (f) Refund of 1-month insurance premium because construction completed early (1,720 ) (g) Architect's fee on building 26,120 (h) Cost of real estate purchased as a plant site (land $200,300and building $52,100) 252,400 (i) Commission fee paid to real estate agency 9,640 (j) Installation of fences around property 4,390 (k) Cost of razing and removing building 11,080 (1) Proceeds from salvage of demolished building (5,120 ) (m) (n) Interest paid during construction on money borrowed for construction 14,020 Cost of parking lots and driveways 17,430 (0) Cost of trees and shrubbery planted (permanent in nature) 13,410 (p) Excavation costs for new building 3,030 Identify each item by letter and list the items in columnar form, using the headings shown below. All receipt amounts should be reported in parentheses. For any amounts entered in the Other Accounts column, also indicate the account title. (Enter receipt amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). If no entry is required in other accounts, select "No Entry" for the account titles.) Item Land (a) $ (b) (c) (d) (e) (f) (g) (h) (i) (j) Land Improvements $ Building $ Other Accounts $

Step by Step Solution

There are 3 Steps involved in it

To provide a detailed answer we need to allocate the expenditures and receipts into the appropriate categories Land Land Improvements Building and Oth... View full answer

Get step-by-step solutions from verified subject matter experts