Question: Please provide solutions for all problems Problems 7-14 are based on the following information: You have the following information about the firm: 2,000,000 shares outstanding

Please provide solutions for all problems

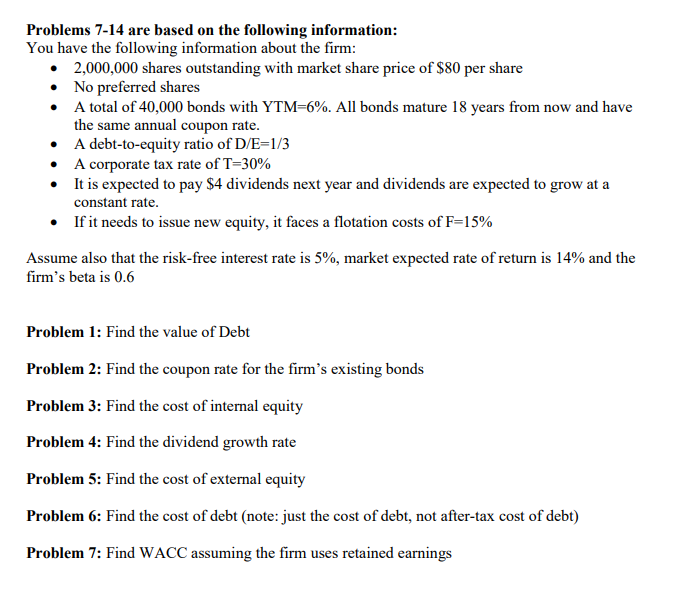

Problems 7-14 are based on the following information: You have the following information about the firm: 2,000,000 shares outstanding with market share price of $80 per share No preferred shares A total of 40,000 bonds with YTM=6%. All bonds mature 18 years from now and have the same annual coupon rate. A debt-to-equity ratio of D/E=1/3 A corporate tax rate of T=30% It is expected to pay $4 dividends next year and dividends are expected to grow at a constant rate. If it needs to issue new equity, it faces a flotation costs of F=15% Assume also that the risk-free interest rate is 5%, market expected rate of return is 14% and the firm's beta is 0.6 Problem 1: Find the value of Debt Problem 2: Find the coupon rate for the firm's existing bonds Problem 3: Find the cost of internal equity Problem 4: Find the dividend growth rate Problem 5: Find the cost of external equity Problem 6: Find the cost of debt (note: just the cost of debt, not after-tax cost of debt) Problem 7: Find WACC assuming the firm uses retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts