Question: Please provide solutions Problem 2. In connection with the audit of Tild company for the year ended December 31, 2018, you are called upon to

Please provide solutions

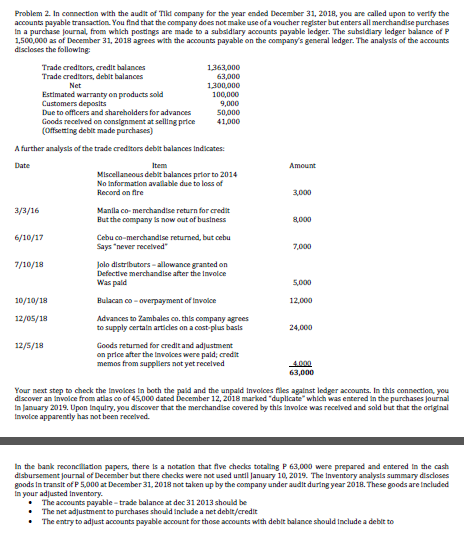

Problem 2. In connection with the audit of Tild company for the year ended December 31, 2018, you are called upon to verify the accounts payable transaction. You find that the company does not make use of a voucher register but enters all merchandise purchases in a purchase journal, from which postings are made to a subsidiary accounts payable ledger. The subsidiary ledger balance of P 1,500,000 as of December 31, 2018 agrees with the accounts payable on the company's general ledger. The analysis of the accounts discloses the following: Trade creditors, credit balances 1,363,000 Trade creditors, debit balances 63,000 Net 1,300,000 Estimated warranty on products sold 100 000 Customers deposits 9,000 Due to officers and shareholders for advances 50,000 Goods received on consignment at selling price 41,000 (Offsetting debit made purchases) A further analysis of the trade creditors debit balances Indicates. Date Item Amount Miscellaneous debit balances prior to 2014 No information available due to loss of Record on fire 3.000 3/3/16 Manila co- merchandise return for credit Hut the company is now out of business 8,000 6/10/17 Cebu co-merchandise returned, but cebu Says "never received" 7,000 7/10/18 Jolo distributors = allowance granted on Defective merchandise after the Involce Was paid 5,000 10/10/18 Bulacan co = overpayment of Invoke 12,000 12/05/18 Advances to Zambales co. this company agrees to supply certain articles on a cost plus basis 24,000 12/5/18 Goods returned for credit and adjustment on price after the Invokes were pald; credit memos from suppliers not yet received 63,000 Your next step to check the Invoker In both the paid and the unpaid Involces files against ledger accounts. In this connection, you discover an invoice from atlas on of 45,000 dated December 12, 2018 marked "duplicate" which was entered in the purchases journal In January 2019. Upon Inquiry, you discover that the merchandise covered by this involce was received and sold but that the original Invoice apparently has not been received. In the bank reconciliation papers, there Is a notation that five checks totaling P 63,000 were prepared and entered In the cash disbursement journal of December but there checks were not used until January 10, 2019. The Inventory analysis summary discloses goods In transit of P 5,000 at December 31, 2018 not taken up by the company under audit during year 2018. These goods are Included In your adjusted Inventory. The accounts payable = trade balance at dec 31 2013 should be The net adjustment to purchases should include a net debit/credit The entry to adjust accounts payable account for those accounts with debit balance should Include a debit to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts