Question: Please provide solutions to the following problems. Thanks! 9. A firm has a receivable of 2,100,000.00. They hegdge this exposure with a put option with

Please provide solutions to the following problems. Thanks!

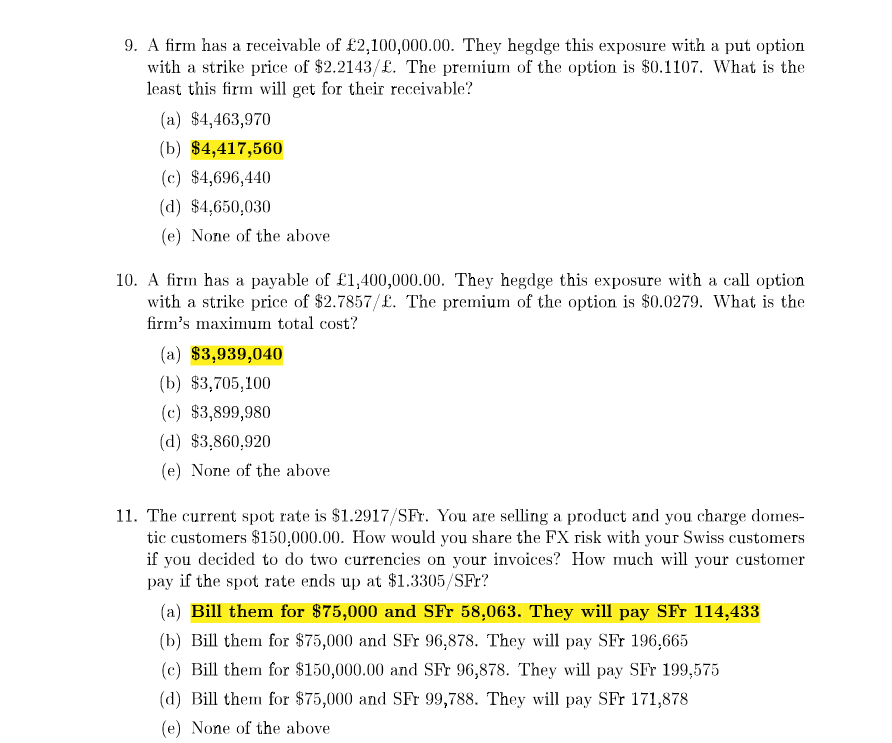

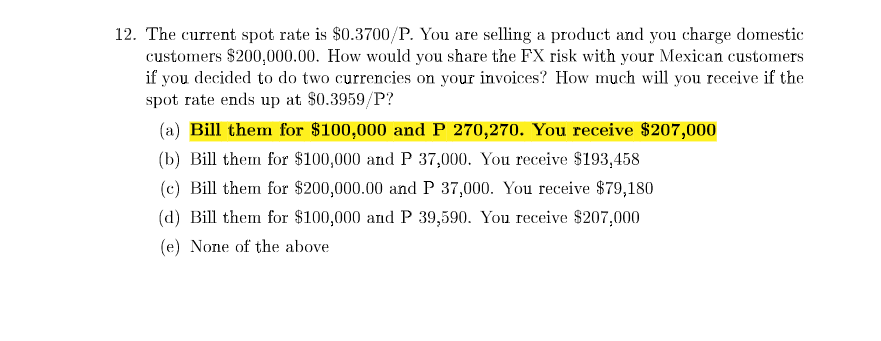

9. A firm has a receivable of 2,100,000.00. They hegdge this exposure with a put option with a strike price of $2.2143/. The premium of the option is $0.1107. What is the least this firm will get for their receivable? (a) $4,463,970 (b) $4,417,560 (c) $4,696,440 (d) $4,650,030 (e) None of the above 10. A firm has a payable of 1,400,000.00. They hegdge this exposure with a call option with a strike price of $2.7857/. The premium of the option is $0.0279. What is the firm's maximum total cost? (a) $3,939,040 (b) $3,705,100 (c) $3,899,980 (d) $3,860,920 (e) None of the above 11. The current spot rate is $1.2917/SFt. You are selling a product and you charge domes- tic customers $150,000.00. How would you share the FX risk with your Swiss customers if you decided to do two currencies on your invoices? How much will your customer pay if the spot rate ends up at $1.3305/SFr? (a) Bill them for $75,000 and SFr 58,063. They will pay SFr 114,433 (b) Bill them for $75,000 and SFr 96,878. They will pay SFr 196,665 (c) Bill them for $150,000.00 and SFr 96,878. They will pay SFr 199,575 (d) Bill them for $75,000 and SFr 99,788. They will pay SFr 171,878 (e) None of the above 12. The current spot rate is $0.3700/P. You are selling a product and you charge domestic customers $200,000.00. How would you share the FX risk with your Mexican customers if you decided to do two currencies on your invoices? How much will you receive if the spot rate ends up at $0.3959/P? (a) Bill them for $100,000 and P 270,270. You receive $207,000 (b) Bill them for $100,000 and P 37,000. You receive $193,458 (c) Bill them for $200,000.00 and P 37,000. You receive $79,180 (d) Bill them for $100,000 and P 39,590. You receive $207,000 (e) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts