Question: Please provide some help for Question 1 & Question 2 Written problems: 1. (Understanding the expectation hypothesis and the liquidity premium in yield curve) a.

Please provide some help for Question 1 & Question 2

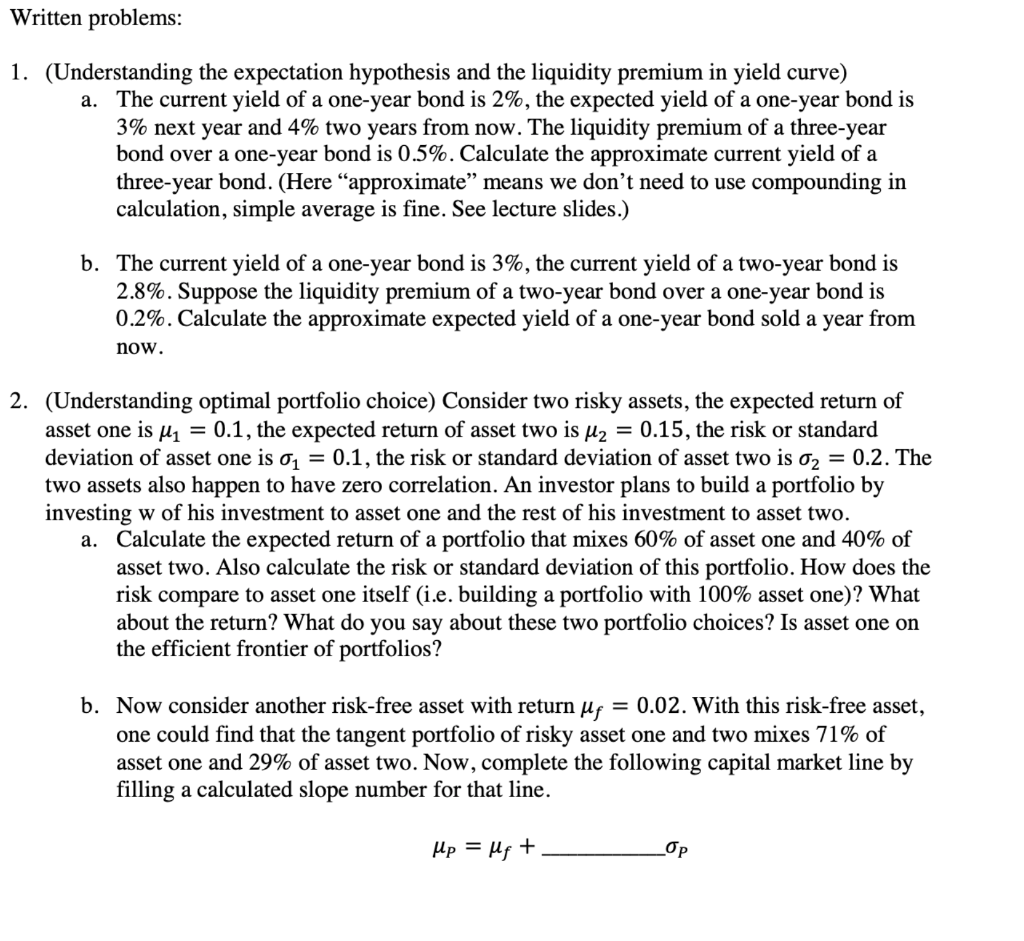

Written problems: 1. (Understanding the expectation hypothesis and the liquidity premium in yield curve) a. The current yield of a one-year bond is 2%, the expected yield of a one-year bond is 3% next year and 4% two years from now. The liquidity premium of a three-year bond over a one-year bond is 0.5%. Calculate the approximate current yield of a three-year bond. (Here approximate means we don't need to use compounding in calculation, simple average is fine. See lecture slides.) b. The current yield of a one-year bond is 3%, the current yield of a two-year bond is 2.8%. Suppose the liquidity premium of a two-year bond over a one-year bond is 0.2%. Calculate the approximate expected yield of a one-year bond sold a year from now. 2. (Understanding optimal portfolio choice) Consider two risky assets, the expected return of asset one is M = 0.1, the expected return of asset two is H2 = 0.15, the risk or standard deviation of asset one is 01 = 0.1, the risk or standard deviation of asset two is o2 = 0.2. The two assets also happen to have zero correlation. An investor plans to build a portfolio by investing w of his investment to asset one and the rest of his investment to asset two. a. Calculate the expected return of a portfolio that mixes 60% of asset one and 40% of asset two. Also calculate the risk or standard deviation of this portfolio. How does the risk compare to asset one itself (i.e. building a portfolio with 100% asset one)? What about the return? What do you say about these two portfolio choices? Is asset one on the efficient frontier of portfolios? b. Now consider another risk-free asset with return up = 0.02. With this risk-free asset, one could find that the tangent portfolio of risky asset one and two mixes 71% of asset one and 29% of asset two. Now, complete the following capital market line by filling a calculated slope number for that line. Mp = Mg + OP Written problems: 1. (Understanding the expectation hypothesis and the liquidity premium in yield curve) a. The current yield of a one-year bond is 2%, the expected yield of a one-year bond is 3% next year and 4% two years from now. The liquidity premium of a three-year bond over a one-year bond is 0.5%. Calculate the approximate current yield of a three-year bond. (Here approximate means we don't need to use compounding in calculation, simple average is fine. See lecture slides.) b. The current yield of a one-year bond is 3%, the current yield of a two-year bond is 2.8%. Suppose the liquidity premium of a two-year bond over a one-year bond is 0.2%. Calculate the approximate expected yield of a one-year bond sold a year from now. 2. (Understanding optimal portfolio choice) Consider two risky assets, the expected return of asset one is M = 0.1, the expected return of asset two is H2 = 0.15, the risk or standard deviation of asset one is 01 = 0.1, the risk or standard deviation of asset two is o2 = 0.2. The two assets also happen to have zero correlation. An investor plans to build a portfolio by investing w of his investment to asset one and the rest of his investment to asset two. a. Calculate the expected return of a portfolio that mixes 60% of asset one and 40% of asset two. Also calculate the risk or standard deviation of this portfolio. How does the risk compare to asset one itself (i.e. building a portfolio with 100% asset one)? What about the return? What do you say about these two portfolio choices? Is asset one on the efficient frontier of portfolios? b. Now consider another risk-free asset with return up = 0.02. With this risk-free asset, one could find that the tangent portfolio of risky asset one and two mixes 71% of asset one and 29% of asset two. Now, complete the following capital market line by filling a calculated slope number for that line. Mp = Mg + OP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts