Question: Please provide specific Excel functions =NPV(), =IRR(), =AVERAGE(), =YIELD() whenever applicable. Q2: Instead of Plan A, Ferengi can alternatively choose Plan B: allocate the $2,400,000

Please provide specific Excel functions =NPV(), =IRR(), =AVERAGE(), =YIELD() whenever applicable.

Q2: Instead of Plan A, Ferengi can alternatively choose Plan B: allocate the $2,400,000 capital budget to develop a new product line. The new product line will be depreciated straight-line to zero over the projects ten-year life, at the end of which the system will be worth $100,000. The new product line will not only add the firm $830,000 per year in sales, but also add $200,000 per year in pretax operating costs; and the new project line requires an initial investment in net working capital of $300,000 at the beginning year.

What would be the NPV of Plan B? What would be the IRR of Plan B? If these two plans are mutually exclusive, shall Ferengi finally choose Plan A or B?

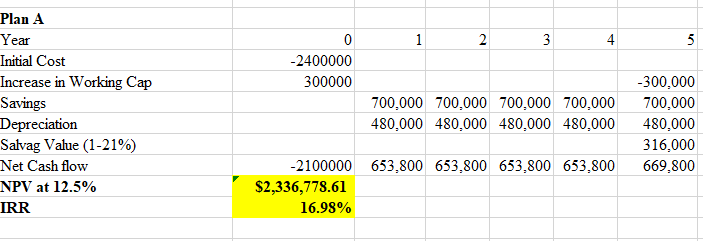

23 -2400000 300000 Plan A Year Initial Cost Increase in Working Cap Savings Depreciation Salvag Value (1-21%) Net Cash flow NPV at 12.5% IRR 700,000 700.000 700.000 700.000 480.000 480.000 480,000 480,000 -300.000 700.000 480.000 316,000 669.800 653,800 653,800 653,800 653,800 -2100000 $2,336,778.61 16.98%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts