Question: please provide statement of clash flow with direct method and reconciliation as well SQ 2-1 The following has been extracted from the trial balances of

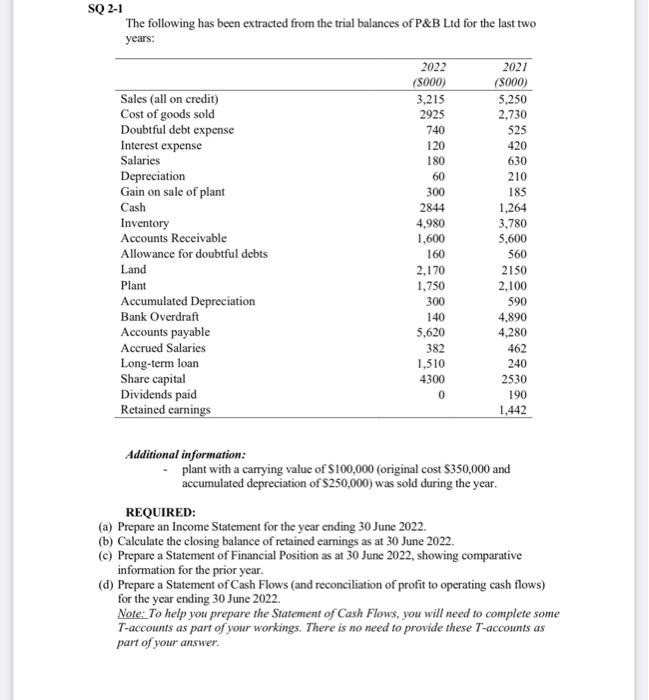

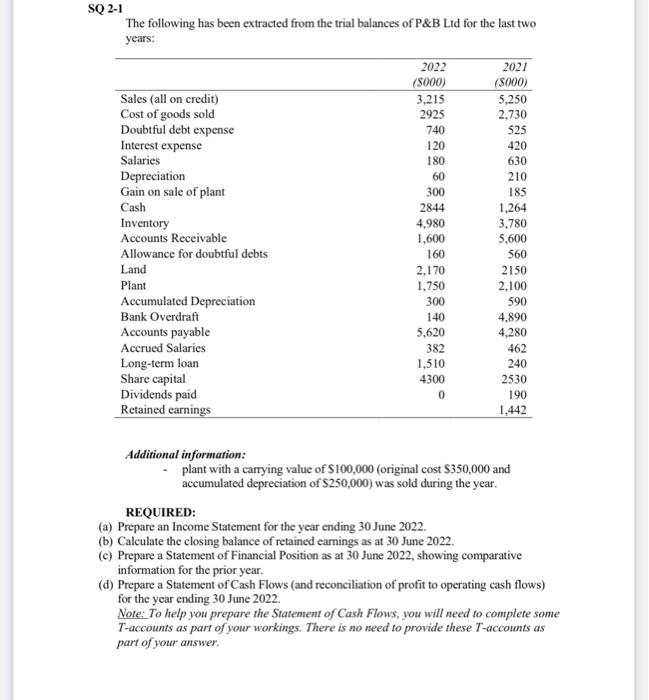

SQ 2-1 The following has been extracted from the trial balances of P&B Ltd for the last two years: Sales (all on credit) Cost of goods sold Doubtful debt expense Interest expense Salaries Depreciation Gain on sale of plant Cash Inventory Accounts Receivable Allowance for doubtful debts Land Plant Accumulated Depreciation Bank Overdraft Accounts payable Accrued Salaries Long-term loan Share capital Dividends paid Retained earnings Additional information: 2022 (8000) 3,215 2925 740 120 180 60 300 2844 4,980 1,600 160 2,170 1,750 300 140 5,620 382 1,510. 4300 0 2021 (8000) 5,250 2,730 525 420 630 210 185 1,264 3,780 5,600 560 2150 2,100 590 4,890 4,280 462 240 2530 190 1,442 plant with a carrying value of $100,000 (original cost $350,000 and accumulated depreciation of $250,000) was sold during the year. REQUIRED: (a) Prepare an Income Statement for the year ending 30 June 2022. (b) Calculate the closing balance of retained earnings as at 30 June 2022. (c) Prepare a Statement of Financial Position as at 30 June 2022, showing comparative information for the prior year. (d) Prepare a Statement of Cash Flows (and reconciliation of profit to operating cash flows) for the year ending 30 June 2022. Note: To help you prepare the Statement of Cash Flows, you will need to complete some T-accounts as part of your workings. There is no need to provide these T-accounts as part of your answer. SQ 2-1 The following has been extracted from the trial balances of P&B Ltd for the last two years: Sales (all on credit) Cost of goods sold Doubtful debt expense Interest expense Salaries Depreciation Gain on sale of plant Cash Inventory Accounts Receivable Allowance for doubtful debts Land Plant Accumulated Depreciation Bank Overdraft Accounts payable Accrued Salaries Long-term loan Share capital Dividends paid Retained earnings Additional information: 2022 (8000) 3,215 2925 740 120 180 60 300 2844 4,980 1,600 160 2,170 1,750 300 140 5,620 382 1,510. 4300 0 2021 (8000) 5,250 2,730 525 420 630 210 185 1,264 3,780 5,600 560 2150 2,100 590 4,890 4,280 462 240 2530 190 1,442 plant with a carrying value of $100,000 (original cost $350,000 and accumulated depreciation of $250,000) was sold during the year. REQUIRED: (a) Prepare an Income Statement for the year ending 30 June 2022. (b) Calculate the closing balance of retained earnings as at 30 June 2022. (c) Prepare a Statement of Financial Position as at 30 June 2022, showing comparative information for the prior year. (d) Prepare a Statement of Cash Flows (and reconciliation of profit to operating cash flows) for the year ending 30 June 2022. Note: To help you prepare the Statement of Cash Flows, you will need to complete some T-accounts as part of your workings. There is no need to provide these T-accounts as part of your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts