Question: ***PLEASE PROVIDE STEP BY STEP AS TO HOW YOU GOT THE ANSWERS. THANK YOU!!*** 12. The management of Rockinghouse Corporation plans to issue nine-year zero-

***PLEASE PROVIDE STEP BY STEP AS TO HOW YOU GOT THE ANSWERS. THANK YOU!!***

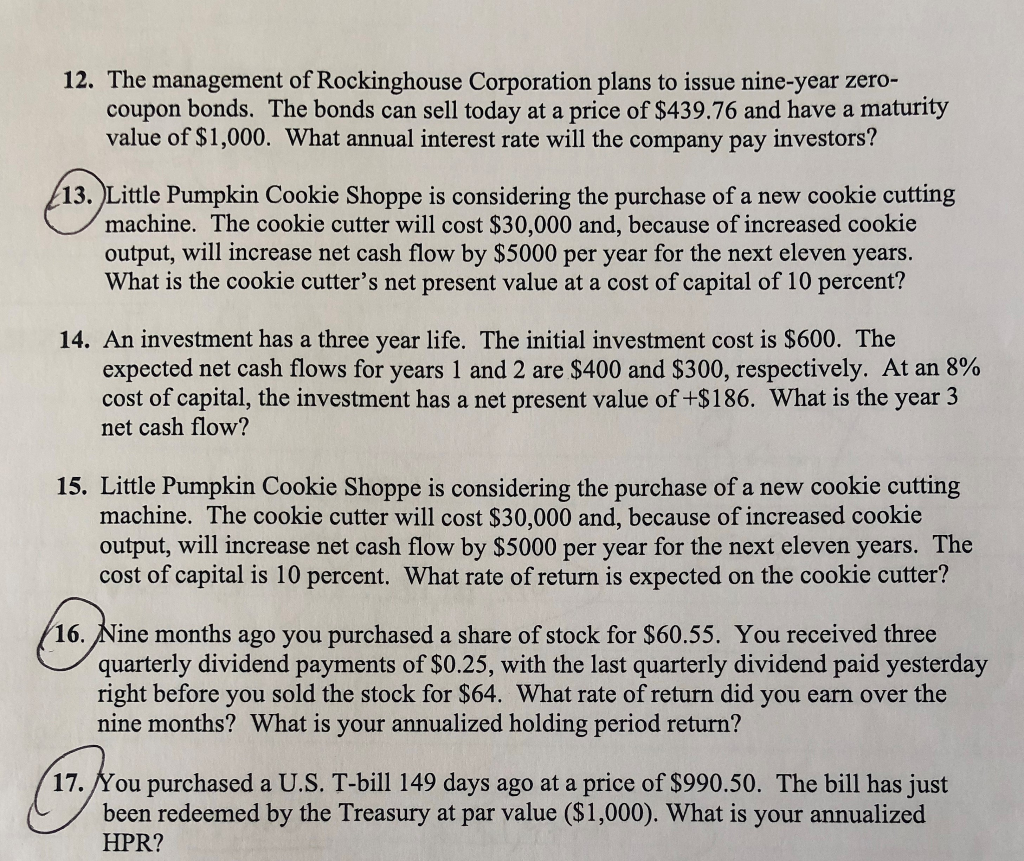

12. The management of Rockinghouse Corporation plans to issue nine-year zero- coupon bonds. The bonds can sell today at a price of $439.76 and have a maturity value of $1,000. What annual interest rate will the company pay investors? 13. Little Pumpkin Cookie Shoppe is considering the purchase of a new cookie cutting machine. The cookie cutter will cost $30,000 and, because of increased cookie output, will increase net cash flow by $5000 per year for the next eleven years. What is the cookie cutter's net present value at a cost of capital of 10 percent? 14. An investment has a three year life. The initial investment cost is $600. The expected net cash flows for years 1 and 2 are $400 and $300, respectively. At an 8% cost of capital, the investment has a net present value of +$186. What is the year 3 net cash flow? 15. Little Pumpkin Cookie Shoppe is considering the purchase of a new cookie cutting machine. The cookie cutter will cost $30,000 and, because of increased cookie output, will increase net cash flow by $5000 per year for the next eleven years. The cost of capital is 10 percent. What rate of return is expected on the cookie cutter? 16. Nine months ago you purchased a share of stock for $60.55. You received three quarterly dividend payments of $0.25, with the last quarterly dividend paid yesterday right before you sold the stock for $64. What rate of return did you earn over the nine months? What is your annualized holding period return? 17. You purchased a U.S. T-bill 149 days ago at a price of $990.50. The bill has just been redeemed by the Treasury at par value ($1,000). What is your annualized HPR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts