Question: Please provide step by step solution ASAP its urgent OP purchased a piece of development land on 31 October 20 XO for $800,000. OP revalued

Please provide step by step solution ASAP its urgent

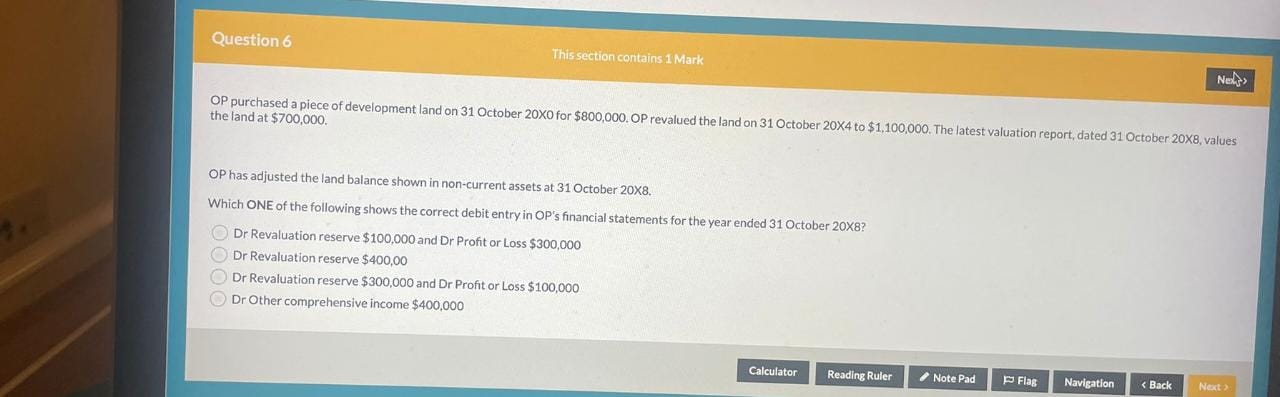

OP purchased a piece of development land on 31 October 20 XO for $800,000. OP revalued the land on 31 October 204 to $1,100,000. The latest valuation report, dated 31 October 208, values the land at $700,000. OP has adjusted the land balance shown in non-current assets at 31 October 208. Which ONE of the following shows the correct debit entry in OP's financial statements for the year ended 31 October 208 ? Dr Revaluation reserve $100,000 and Dr Profit or Loss $300,000 Dr Revaluation reserve $400,00 Dr Revaluation reserve $300,000 and Dr Profit or Loss $100,000 Dr Other comprehensive income $400,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts