Question: please provide step by step solutions 2. Bond Question: 1. The Rio Tinto Corporation is planning a capital project that would involve the construction of

please provide step by step solutions

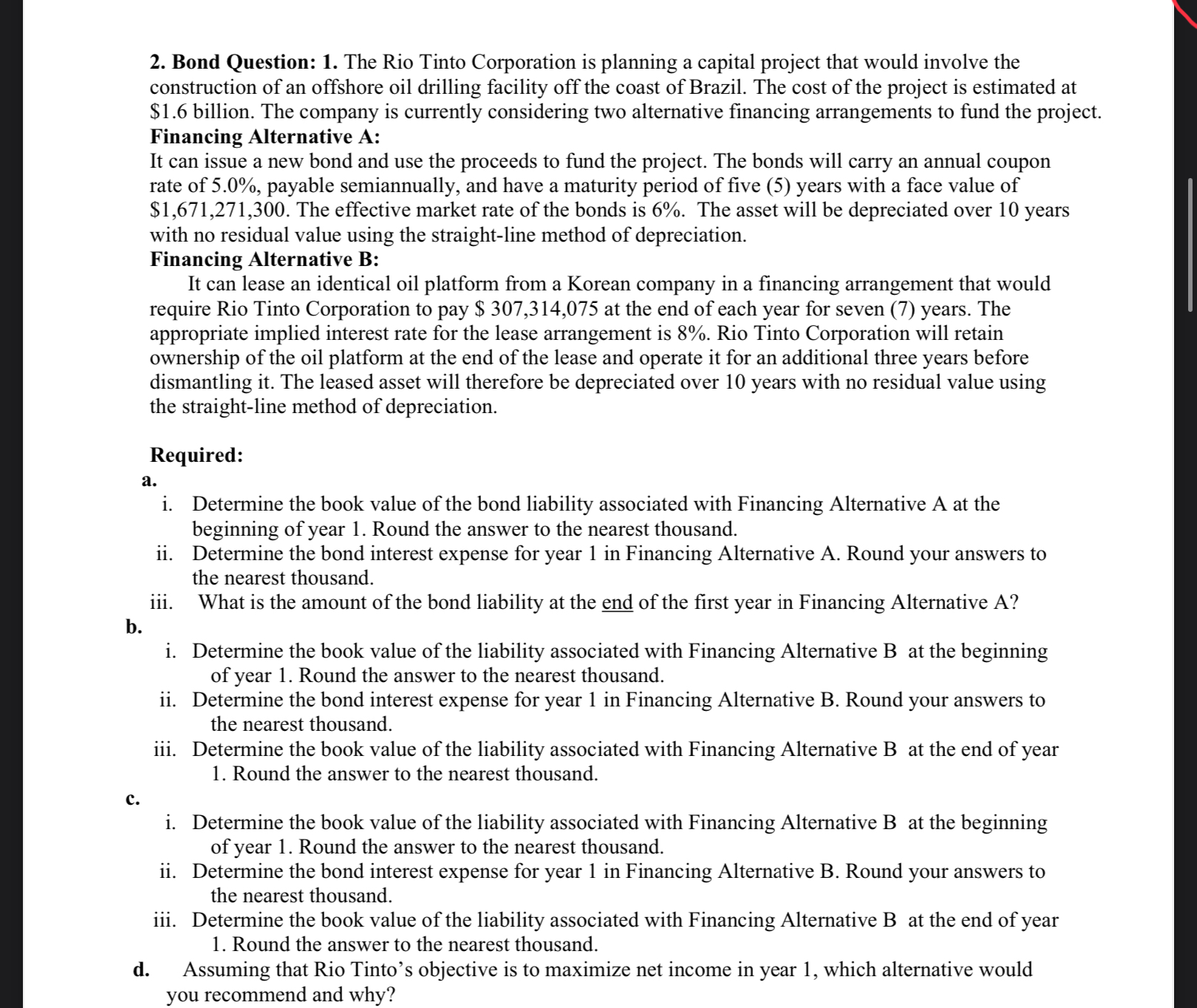

2. Bond Question: 1. The Rio Tinto Corporation is planning a capital project that would involve the construction of an offshore oil drilling facility off the coast of Brazil. The cost of the project is estimated at $1.6 billion. The company is currently considering two alternative financing arrangements to fund the project. Financing Alternative A: It can issue a new bond and use the proceeds to fund the project. The bonds will carry an annual coupon rate of 5.0%, payable semiannually, and have a maturity period of five (5) years with a face value of $1,671,271,300. The effective market rate of the bonds is 6%. The asset will be depreciated over 10 years with no residual value using the straight-line method of depreciation. Financing Alternative B: It can lease an identical oil platform from a Korean company in a financing arrangement that would require Rio Tinto Corporation to pay $307,314,075 at the end of each year for seven (7) years. The appropriate implied interest rate for the lease arrangement is 8%. Rio Tinto Corporation will retain ownership of the oil platform at the end of the lease and operate it for an additional three years before dismantling it. The leased asset will therefore be depreciated over 10 years with no residual value using the straight-line method of depreciation. Required: a. i. Determine the book value of the bond liability associated with Financing Alternative A at the beginning of year 1 . Round the answer to the nearest thousand. ii. Determine the bond interest expense for year 1 in Financing Alternative A. Round your answers to the nearest thousand. iii. What is the amount of the bond liability at the end of the first year in Financing Alternative A? b. i. Determine the book value of the liability associated with Financing Alternative B at the beginning of year 1 . Round the answer to the nearest thousand. ii. Determine the bond interest expense for year 1 in Financing Alternative B. Round your answers to the nearest thousand. iii. Determine the book value of the liability associated with Financing Alternative B at the end of year 1. Round the answer to the nearest thousand. c. i. Determine the book value of the liability associated with Financing Alternative B at the beginning of year 1. Round the answer to the nearest thousand. ii. Determine the bond interest expense for year 1 in Financing Alternative B. Round your answers to the nearest thousand. iii. Determine the book value of the liability associated with Financing Alternative B at the end of year 1. Round the answer to the nearest thousand. d. Assuming that Rio Tinto's objective is to maximize net income in year 1, which alternative would

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts