Question: Please provide steps and it must be the right answer. Suppose you have $60,000 to invest. You're considering Miller-Moore Equine Enterprises (MMEE), which is currently

Please provide steps and it must be the right answer.

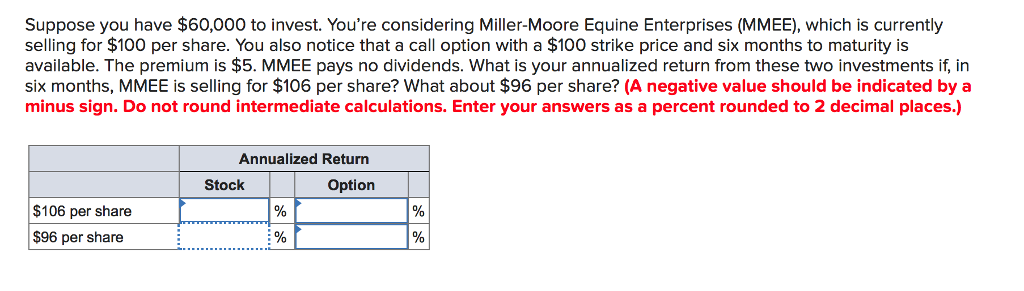

Suppose you have $60,000 to invest. You're considering Miller-Moore Equine Enterprises (MMEE), which is currently selling for $100 per share. You also notice that a call option with a $100 strike price and six months to maturity is available. The premium is $5. MMEE pays no dividends. What is your annualized return from these two investments if, in six months, MMEE is selling for $106 per share? What about $96 per share? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Annualized Return Stock Option $106 per share $96 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts