Question: PLEASE PROVIDE STEPS / EXPLAIN HOW TO SOLVE THIS QUESTION You have just a sold a ONE-PERIOD call option on 100 shares of a $20

PLEASE PROVIDE STEPS / EXPLAIN HOW TO SOLVE THIS QUESTION

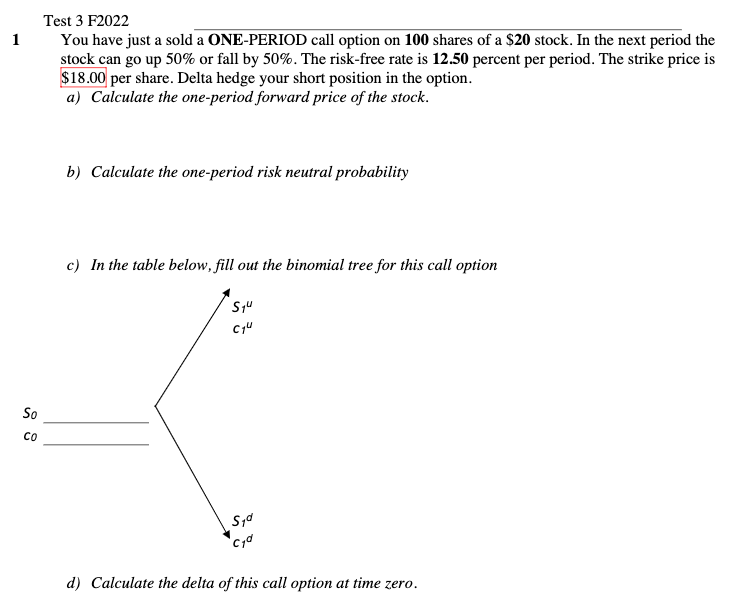

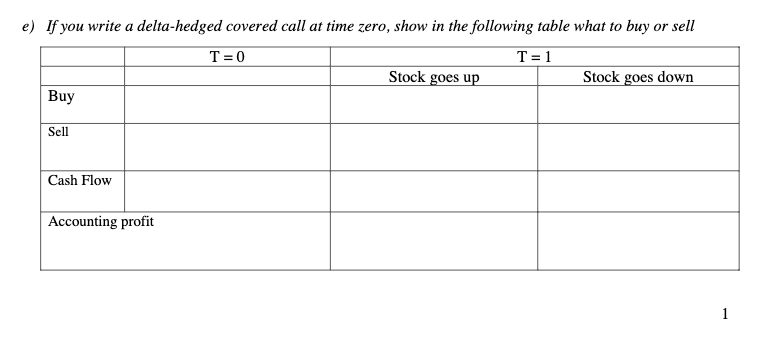

You have just a sold a ONE-PERIOD call option on 100 shares of a $20 stock. In the next period the stock can go up 50% or fall by 50%. The risk-free rate is 12.50 percent per period. The strike price is $18.00 per share. Delta hedge your short position in the option. a) Calculate the one-period forward price of the stock. b) Calculate the one-period risk neutral probability c) In the table below, fill out the binomial tree for this call option d) Calculate the delta of this call option at time zero. If you write a delta-hedged covered call at time zero, show in the following table what to buy or sell You have just a sold a ONE-PERIOD call option on 100 shares of a $20 stock. In the next period the stock can go up 50% or fall by 50%. The risk-free rate is 12.50 percent per period. The strike price is $18.00 per share. Delta hedge your short position in the option. a) Calculate the one-period forward price of the stock. b) Calculate the one-period risk neutral probability c) In the table below, fill out the binomial tree for this call option d) Calculate the delta of this call option at time zero. If you write a delta-hedged covered call at time zero, show in the following table what to buy or sell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts