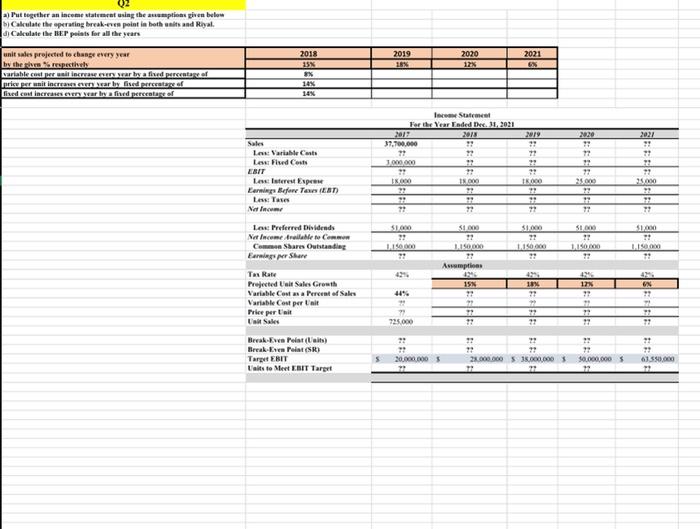

Question: please provide steps for variable cost per unit and break even a) Put together an income statement using the assumptions given below b) Calculate the

a) Put together an income statement using the assumptions given below b) Calculate the operating break-even point in both units and Riyal d) Calculate the BEP points for all the years unit sales projected to change every year by the given % respectively variable cost per unit increase every year by a fixed percentage of price per unit increases every year by fixed percentage of fixed cost increases every year by a fived percentage of 2018 15% 8% 14% 14% Sales Lev: Variable Casts Lew: Fixed Costs EBIT Less: Interest Expense Earnings Before Taxes (EBT) Less: Taxes Net Income Les: Preferred Dividends Net Income Available to Common Common Shares Outstanding Earnings per Share Tax Rate Projected Unit Sales Growth Variable Cost as a Percent of Sales Variable Cost per Unit Price per Unit Unit Sales Break-Even Point (Units) Break-Even Point (SR) Target EBIT Units to Meet EBIT Target S 2019 18% 2020 12% Income Statement For the Year Ended Dec. 31, 2021 2018 ?? 22 22 2017 37,700,000 27 3,000,000 77 18.000 77 $1,000 ?? 1.150.000 77 44% 725,000 22 77 20,000,000 $ 71 27 18.000 ?? 77 $1.000 22 1,150,000 27 Assumptions 4256 15% **** **** 27 77 27 2021 6% 22 2019 ?? 77 27 27 18:000 22 77 77 $1,000 22 1.150.000 77 477 18% ?? 77 27 22 ?? 28.000.000 $ 35,000,000 $ 27 77 2020 77 77 22 77 25.000 27 77 $1,000 SES VERECE 1,150.000 425 17% 22 22 77 50,000,000 $ 77 F ** ****** **** ******** 2021 25,000 $1,000 1.150,000 _____________ 63,550,000 17 a) Put together an income statement using the assumptions given below b) Calculate the operating break-even point in both units and Riyal d) Calculate the BEP points for all the years unit sales projected to change every year by the given % respectively variable cost per unit increase every year by a fixed percentage of price per unit increases every year by fixed percentage of fixed cost increases every year by a fived percentage of 2018 15% 8% 14% 14% Sales Lev: Variable Casts Lew: Fixed Costs EBIT Less: Interest Expense Earnings Before Taxes (EBT) Less: Taxes Net Income Les: Preferred Dividends Net Income Available to Common Common Shares Outstanding Earnings per Share Tax Rate Projected Unit Sales Growth Variable Cost as a Percent of Sales Variable Cost per Unit Price per Unit Unit Sales Break-Even Point (Units) Break-Even Point (SR) Target EBIT Units to Meet EBIT Target S 2019 18% 2020 12% Income Statement For the Year Ended Dec. 31, 2021 2018 ?? 22 22 2017 37,700,000 27 3,000,000 77 18.000 77 $1,000 ?? 1.150.000 77 44% 725,000 22 77 20,000,000 $ 71 27 18.000 ?? 77 $1.000 22 1,150,000 27 Assumptions 4256 15% **** **** 27 77 27 2021 6% 22 2019 ?? 77 27 27 18:000 22 77 77 $1,000 22 1.150.000 77 477 18% ?? 77 27 22 ?? 28.000.000 $ 35,000,000 $ 27 77 2020 77 77 22 77 25.000 27 77 $1,000 SES VERECE 1,150.000 425 17% 22 22 77 50,000,000 $ 77 F ** ****** **** ******** 2021 25,000 $1,000 1.150,000 _____________ 63,550,000 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts