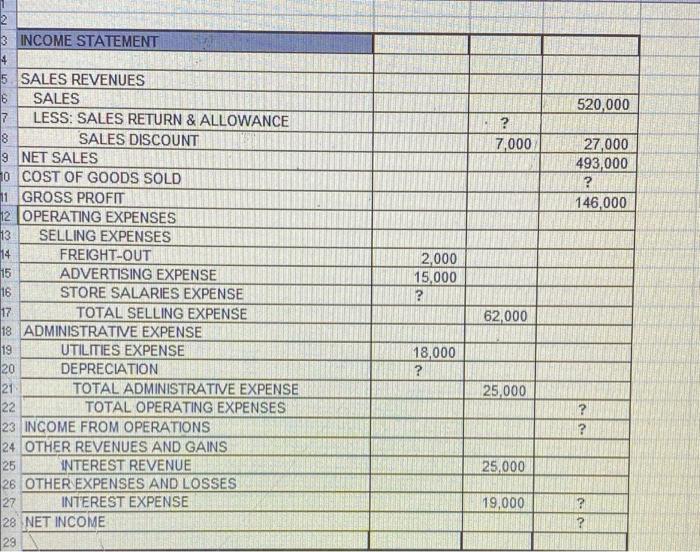

Question: please provide the abswers for the missing line items indicated with Quesion marks (?) compute the following 2 3 INCOME STATEMENT 520,000 ? 7,000 27,000

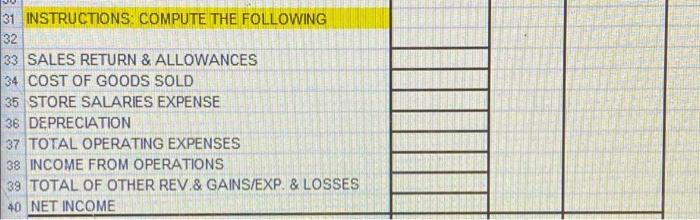

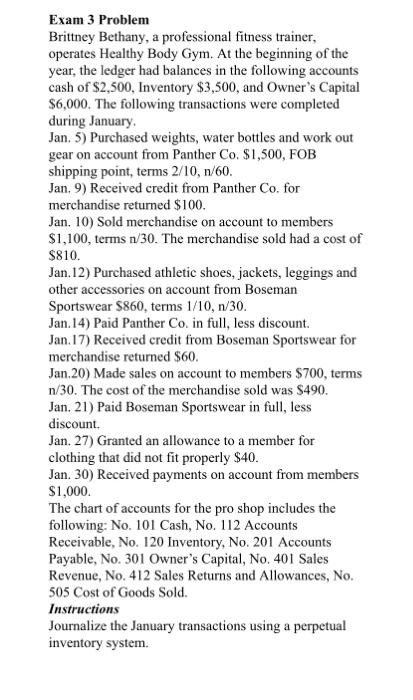

2 3 INCOME STATEMENT 520,000 ? 7,000 27,000 493,000 ? 146,000 2,000 15,000 ? 5 SALES REVENUES 6 SALES 7 LESS: SALES RETURN & ALLOWANCE 18 SALES DISCOUNT 9 NET SALES 0 COST OF GOODS SOLD 11 GROSS PROFIT 12 OPERATING EXPENSES 113 SELLING EXPENSES 14 FREIGHT-OUT 15 ADVERTISING EXPENSE 16 STORE SALARIES EXPENSE 17 TOTAL SELLING EXPENSE 18 ADMINISTRATIVE EXPENSE 19 UTILITIES EXPENSE 20 DEPRECIATION 21 TOTAL ADMINISTRATIVE EXPENSE 22 TOTAL OPERATING EXPENSES 23 INCOME FROM OPERATIONS 24 OTHER REVENUES AND GAINS 25 INTEREST REVENUE 26 OTHER EXPENSES AND LOSSES 27 INTEREST EXPENSE 28 NET INCOME 29 62,000 18,000 ? 25,000 ? ? 25,000 19,000 ? 31 INSTRUCTIONS COMPUTE THE FOLLOWING 32 33 SALES RETURN & ALLOWANCES 34 COST OF GOODS SOLD 35 STORE SALARIES EXPENSE 36 DEPRECIATION 37 TOTAL OPERATING EXPENSES 38 INCOME FROM OPERATIONS 39 TOTAL OF OTHER REV. & GAINS/EXP. & LOSSES 40 NET INCOME Exam 3 Problem Brittney Bethany, a professional fitness trainer, operates Healthy Body Gym. At the beginning of the year, the ledger had balances in the following accounts cash of $2,500, Inventory $3,500, and Owner's Capital $6,000. The following transactions were completed during January. Jan. 5) Purchased weights, water bottles and work out gear on account from Panther Co. $1,500, FOB shipping point, terms 2/10, n/60. Jan. 9) Received credit from Panther Co. for merchandise returned $100. Jan. 10) Sold merchandise on account to members $1,100, terms n/30. The merchandise sold had a cost of $810. Jan.12) Purchased athletic shoes, jackets, leggings and other accessories on account from Boseman Sportswear $860, terms 1/10, n/30. Jan. 14) Paid Panther Co. in full, less discount. Jan. 17) Received credit from Boseman Sportswear for merchandise returned $60. Jan.20) Made sales on account to members $700, terms n/30. The cost of the merchandise sold was $490. Jan. 21) Paid Boseman Sportswear in full, less discount. Jan. 27) Granted an allowance to a member for clothing that did not fit properly $40. Jan. 30) Received payments on account from members $1,000. The chart of accounts for the pro shop includes the following: No. 101 Cash, No. 112 Accounts Receivable, No. 120 Inventory, No. 201 Accounts Payable, No. 301 Owner's Capital, No. 401 Sales Revenue, No. 412 Sales Returns and Allowances, No. 505 Cost of Goods Sold. Instructions Journalize the January transactions using a perpetual inventory system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts