Question: Please provide the answer as soon as possible. BKAF1023 INTRODUCTION TO FINANCIAL ACCOUNTING QUESTION 3 (10 MARKS: 24 MINUTES) The Nikifa, Fatihah & Wakeel partnership

Please provide the answer as soon as possible.

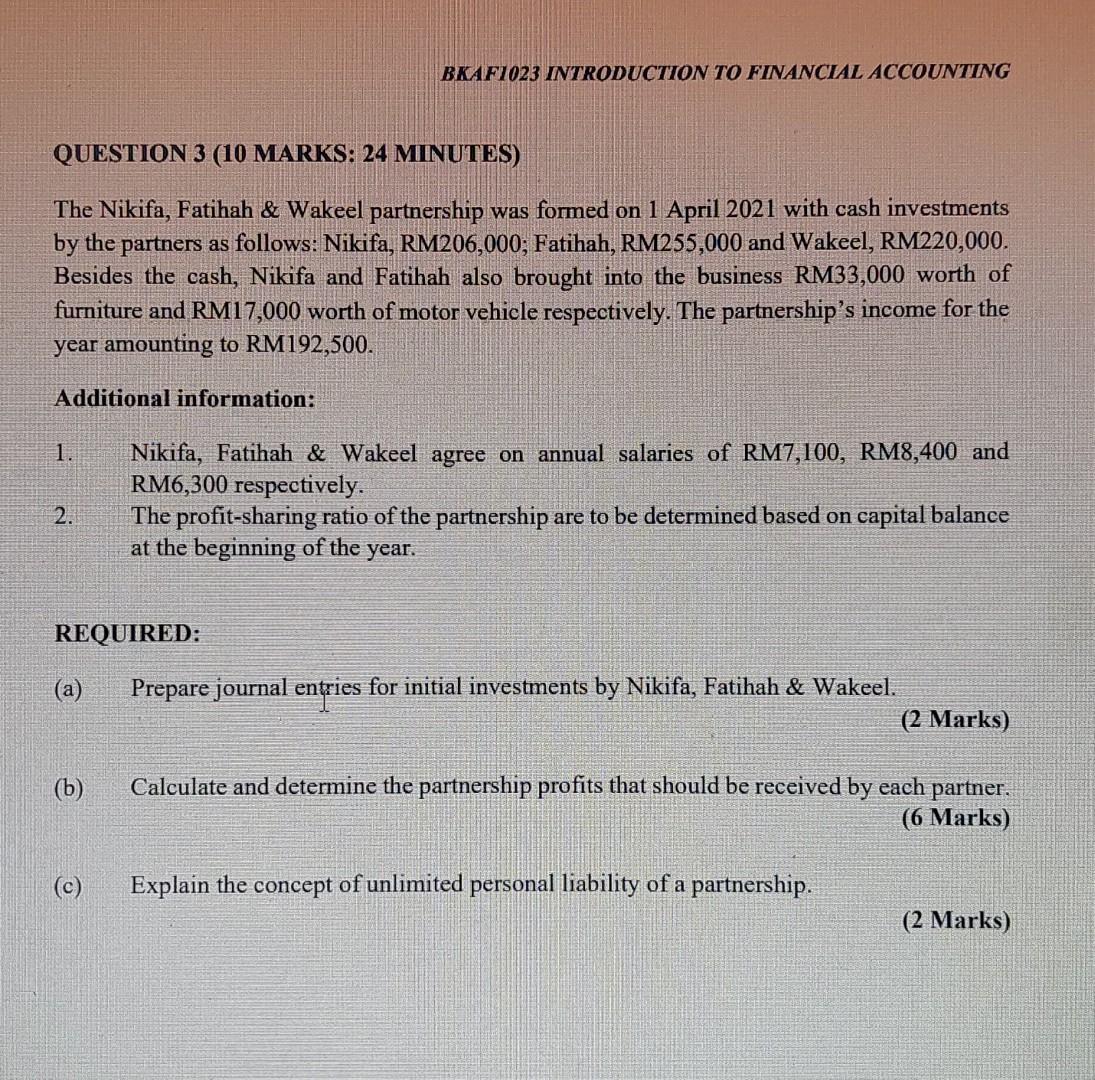

BKAF1023 INTRODUCTION TO FINANCIAL ACCOUNTING QUESTION 3 (10 MARKS: 24 MINUTES) The Nikifa, Fatihah & Wakeel partnership was formed on 1 April 2021 with cash investments by the partners as follows: Nikifa, RM206,000; Fatihah, RM255,000 and Wakeel, RM220,000. Besides the cash, Nikifa and Fatihah also brought into the business RM33,000 worth of furniture and RM17,000 worth of motor vehicle respectively. The partnership's income for the year amounting to RM192,500. Additional information: 1. Nikifa, Fatihah & Wakeel agree on annual salaries of RM7,100, RM8,400 and RM6,300 respectively. The profit-sharing ratio of the partnership are to be determined based on capital balance at the beginning of the year. 2. REQUIRED: (a) Prepare journal entries for initial investments by Nikifa, Fatihah & Wakeel. (2 Marks) (b) Calculate and determine the partnership profits that should be received by each partner. (6 Marks) (c) Explain the concept of unlimited personal liability of a partnership. (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts